Guide to American Express transfer partners

Key takeaways

- The American Express Membership Rewards program has 17 airline partners and three hotel partners to choose from.

- Transfer ratios for Amex travel partners vary, yet most of them can be transferred at a rate of 1:1.

- Remember that not all American Express credit cards earn Membership Rewards, and that some earn cash back instead.

One of the most mysterious aspects of credit card award travel is figuring out how to boost rewards value with airline and hotel transfer partners. In most cases, transferring your rewards to travel partners provides a higher redemption value than redeeming rewards for statement credits, cash or gift cards. This is especially true for cardholders who can make a high-value redemption, such as airfare in a premium cabin or a luxurious hotel stay in a far-flung corner of the world.

The American Express Membership Rewards program is one of the most popular award travel ecosystems. It offers a large variety of transfer partners, and its network includes many popular airlines and hotels. If you have an eligible Amex credit card and want to stretch your points value further, redeeming your points through the Amex travel portal or for partner travel should be top of mind.

In this guide, we’ll go over all Amex transfer partners, some pros and cons of transferring points and how to maximize your rewards.

American Express airline partners

Amex’s airline partners typically offer transfers at a 1,000-point:1,000-point (or 1:1) rate. Many Amex airline partners also have alliances that allow you to expand your flight options and, at times, boost the value of your points even more.

Here’s the chart of Amex airline partners, along with their transfer ratios and estimated transfer times:

|

Airline partner |

Transfer ratio |

Transfer time |

|---|---|---|

| Aer Lingus | 1,000:1,000 | Instant |

| AeroMexico | 1,000:1,600 | Instant |

| Aeroplan | 1,000:1,000 | Instant |

| Air France/KLM Flying Blue | 1,000:1,000 | Instant |

| ANA Mileage Club | 1,000:1,000 | Up to 48 hours |

| Avianca LifeMiles | 1,000:1,000 | Instant |

| British Airways Executive Club | 1,000:1,000 | Instant |

| Cathay Pacific Asia Miles | 1,000:1,000 | Instant |

| Delta SkyMiles | 1,000:1,000 | Instant |

| Emirates Skywards | 1,000:1,000 | Instant |

| Etihad Guest | 1,000:1,000 | Instant |

| Iberia Plus | 1,000:1,000 | Instant |

| JetBlue TrueBlue | 250:200 | Instant |

| Qantas Frequent Flyer | 500:500 | Instant |

| Qatar Airways Privilege Club | 1,000:1,000 | Instant |

| Singapore Airlines KrisFlyer | 1,000:1,000 | Instant |

| Virgin Atlantic Flying Club | 1,000:1,000 | Instant |

It may take some time to learn how to discover the best deals with Amex airline partners, but if you’re flexible with your dates and destinations, there are plenty of ways to get outsized rewards value. And if you’re strategic about your redemptions, your Amex Membership Rewards points value could be worth around 2.0 cents per point or more, according to Bankrate’s points and miles valuations guide.

For example, you may not think you’d get much use out of transferring points to an airline like British Airways. However, you can use the British Airways Executive Club currency, called Avios, to book flights on all oneworld Alliance carriers including American Airlines and Alaska Airlines. Unfortunately, using Avios on British Airways flights carries substantial fuel surcharges, making your points much less valuable with those flights.

However, if you focus on British Airways partner flights, you can score significant value due to the airline’s distance-based award chart.

There are a number of U.S.-based short-haul flights where you may be able to get economy fares starting at just 6,000 points — whereas these same award flights on another airline could cost 20,000 points or more for the same destinations and dates. When you start looking at aspirational travel options like international flights in first or business class, you stand to earn even more value for your points.

You’ll have to research these connections and understand exactly how the alliances work, but you can garner significant discounts for flights once you get the hang of it.

Should you transfer Amex points to an airline partner?

For the most part, transferring Amex points to an airline partner will offer you more value. Here are some pros and cons to consider when transferring points:

Pros

- You can get higher redemption values for your points.

- Some alliance partners can expand your route options and potentially boost your points value even more.

- You may be able to score excellent deals on first and business class award fares.

Cons

- Blackout dates and limited availability apply.

- There’s more research required versus booking travel through AmexTravel.com.

- Transferring points from your Amex card to an airline loyalty program is not reversible.

American Express hotel partners

Transferring your Amex rewards to hotel partners may not offer as much value as transferring rewards to airline partners, but it can still be a good use of your points under the right circumstances. Plus, you may find better deals and value for off-peak accommodations.

Here’s a look at Amex’s hotel partners:

|

Hotel partner |

Transfer ratio |

Transfer time |

|---|---|---|

| Hilton Honors | 1,000:2,000 | Instant |

| Choice Privileges | 1,000:1,000 | Instant |

| Marriott Bonvoy | 1,000:1,000 | Instant |

Should you transfer Amex points to a hotel partner?

Situations where transfers to a hotel partner can help you get more value for your Amex rewards aren’t as plentiful as you’ll find with airline partners. Consider the pros and cons of transferring Amex points to hotels before you make this move.

Pros

- You can find good deals on hotel bookings depending on your destination and travel dates.

- You can use fewer points on a five-night stay since Hilton and Mariott offer the fifth night free on five-night stays (terms apply).

- You could find additional perks and free stays to complement your points if you have hotel elite status.

Cons

- You may not get a great redemption ratio by transferring points to Amex hotel partners.

- There may be blackout dates or high prices in peak season that further decrease the value of your points.

- Transferring points from your Amex card to a hotel loyalty program can’t be reversed.

How to earn Amex points

To benefit from Amex airline and hotel partners, you have to earn points that live within the American Express Membership Rewards program. While there are a few ways to do this, they all require you to have a card that earns Amex points instead of cash back.

Some popular American Express credit cards that earn Membership Rewards points include:

- American Express Platinum Card®

- The Business Platinum Card® from American Express

- American Express® Gold Card

- American Express® Business Gold Card

- American Express Green Card®*

- The Blue Business® Plus Credit Card from American Express

Once you have at least one of these cards, you can earn Amex Membership Rewards for each dollar you spend.

A few additional ways to earn Amex points as a cardholder include:

- Booking travel through Amex Travel: While cardholders earn points on all their charges, some Amex credit cards offer additional points for travel bookings made through the Amex Travel portal.

- Referring friends: Many Amex credit cards let you earn a referral bonus if a friend or acquaintance signs up for one of their cards through your referral link.

- Shopping with Rakuten: The Rakuten shopping portal lets users earn Amex points for eligible purchases after they link their account.

- Signing up for Amex Rewards Checking: Amex Rewards Checking comes without any monthly fees, and users can earn Amex Membership Rewards points for eligible debit card purchases.

- Taking advantage of Amex Offers: Amex Offers lets users earn additional Amex points (or cash back) for eligible purchases after they add an offer to their card and meet the specified requirements. These offers are available in your online Amex account or in your account on the Amex mobile app.

How to transfer Amex Membership Rewards points

First off, remember that only certain Amex credit cards earn Membership Rewards. This includes the brand’s travel credit cards, but not its range of cash back credit cards.

Before making any transfers, you must connect your hotel or airline loyalty account to your Amex account. Note that the name on your loyalty account must match either your name or the name of an authorized user on your credit card account. Once your loyalty program account is linked, you can transfer your Amex points with the following steps.

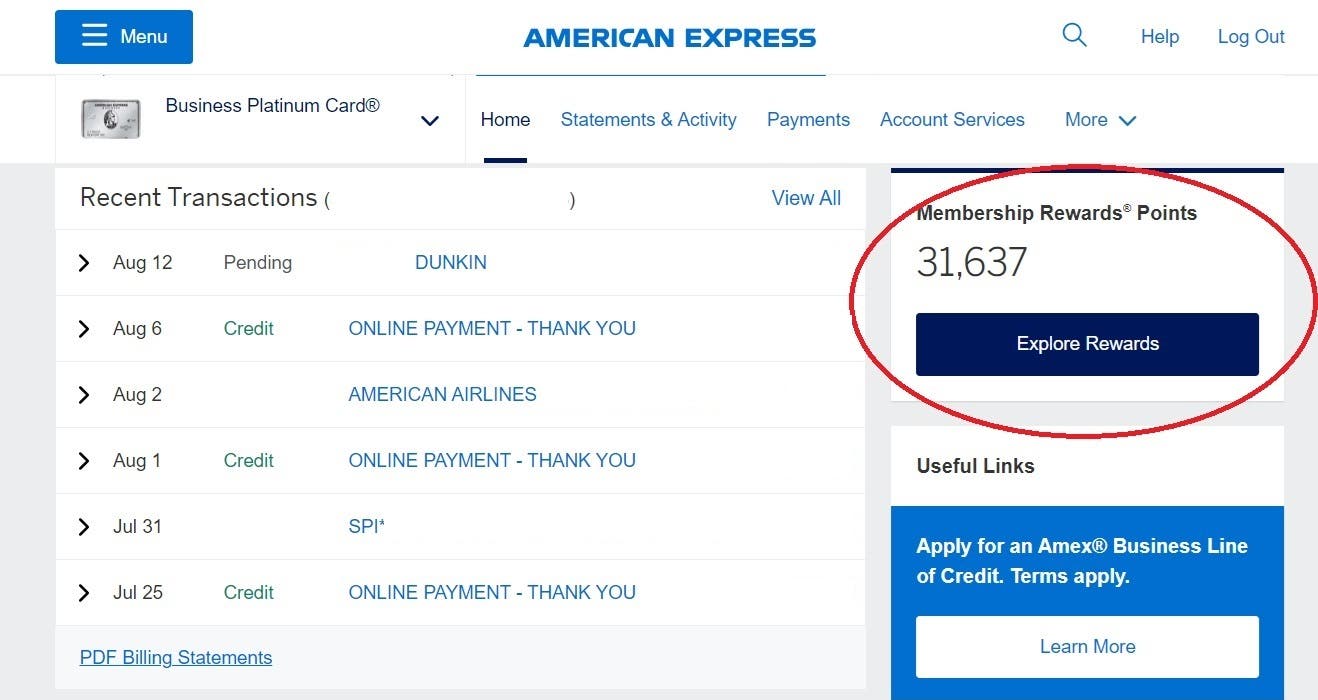

1. Log into your American Express account and click on “Explore Rewards”

Head to your American Express online account management page and log in. From there, you’ll click on the rewards section of your account to move onto the next step.

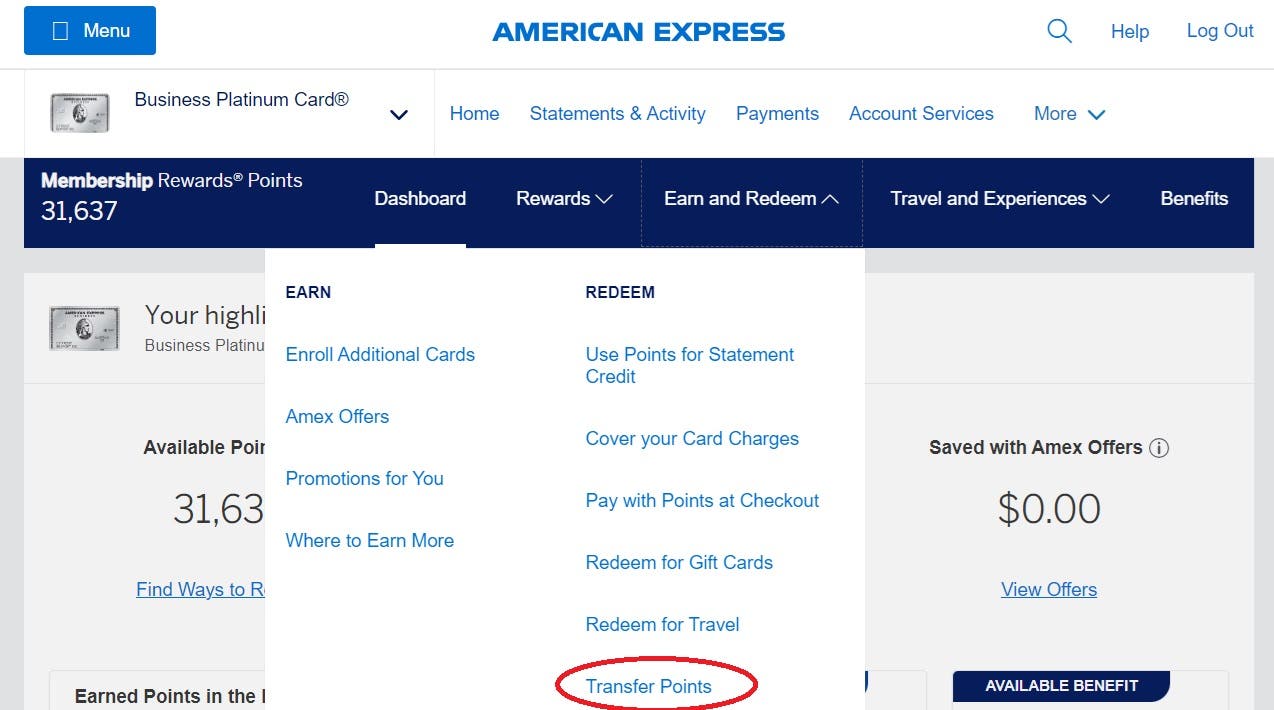

2. Choose the option to transfer rewards

Once you’re in the rewards section of your account, you’ll go to the dropdown menu under “Earn and Redeem” and select “Transfer Points” to see a list of all available American Express transfer partners.

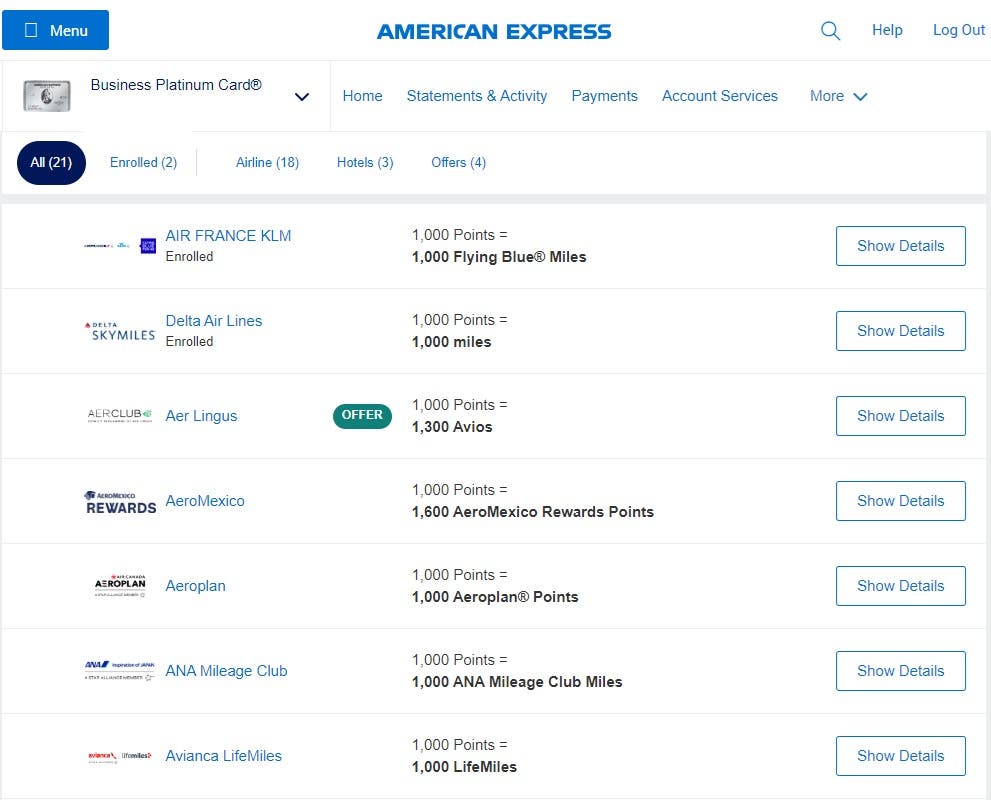

3. Choose an airline or hotel partner

From here, you can browse available airline and hotel partners. Note that all partners have a set minimum and maximum number of points you can transfer. Typically, you must transfer at least 1,000 points.

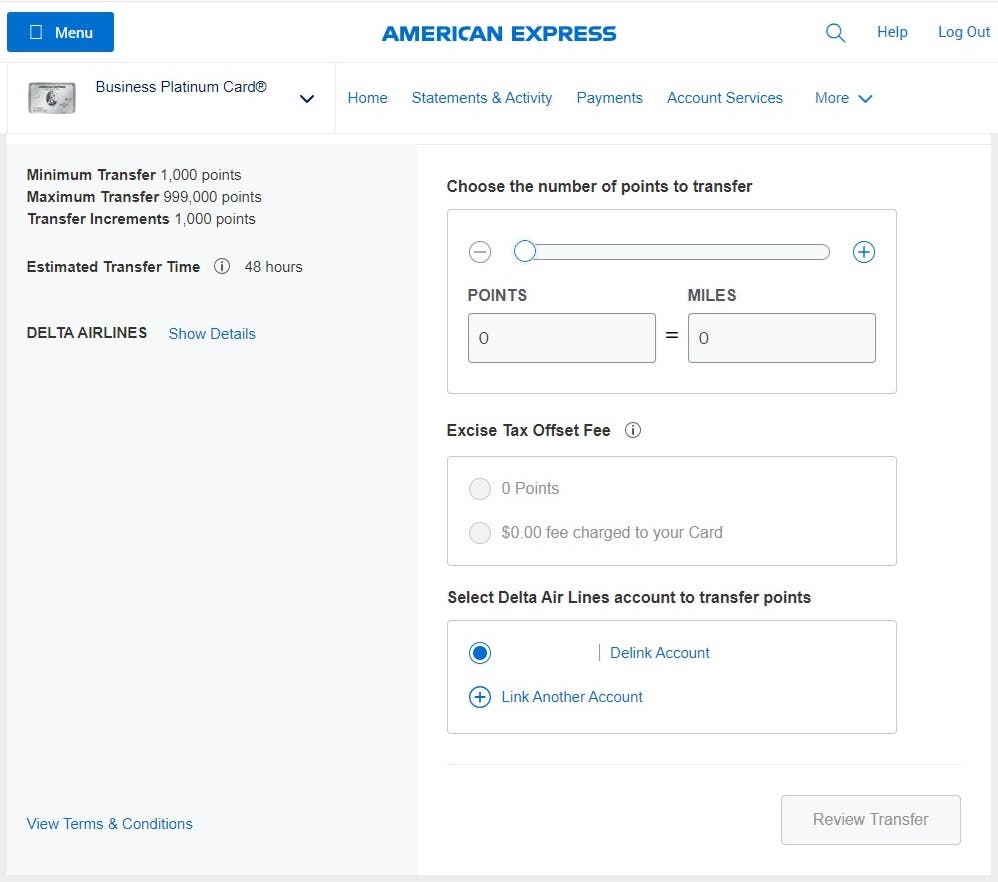

4. Initiate the transfer

Choose a transfer partner and begin the transfer. This step is easy to take care of completely online.

While it may take up to 48 hours for a point transfer to go through with certain transfer partners, anecdotal evidence suggests most transfers are instant. Either way, you can log into your account once the transfer is complete and use your new loyalty points for airfare or hotel stays.

How to maximize value when transferring points

If you want to get the most out of your Membership Rewards points, here are a few tips that can help:

- Consider being flexible with your travel destinations and dates to score the best deals.

- Watch out for transfer bonuses through Amex that boost your points value by 20 to 50 percent.

- Make sure to verify that award reservations are available for the dates you’d like to travel before you transfer points.

- Check for alternative booking options, like alliances that have distance-based award charts versus dynamic award flight pricing.

- Check award pricing for business and first-class fares for more luxurious travel options at lower rates.

- Be mindful of additional costs, like fuel surcharges (British Airways) and federal excise taxes for transfers to U.S.-based airline programs (Delta SkyMiles, JetBlue TrueBlue).

The bottom line

Amex transfer partners can help you get more value for each point you earn, but you’ll want to be sure this is the case before you move your points. You can do this by comparing the cash rate for travel bookings you want to make, and by checking how much flights and hotels cost (in cash or points) in the Amex travel portal.

Whatever you do, don’t transfer your points to a partner until you know you can use them. Since Amex point transfers are a one-way deal, you can’t change your mind and move your points back to the card issuer.

*Information about the American Express Green Card® has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.