Is a recession on the horizon? See what top economists say

When it comes to managing their financial lives, Americans should make hay while the sun shines.

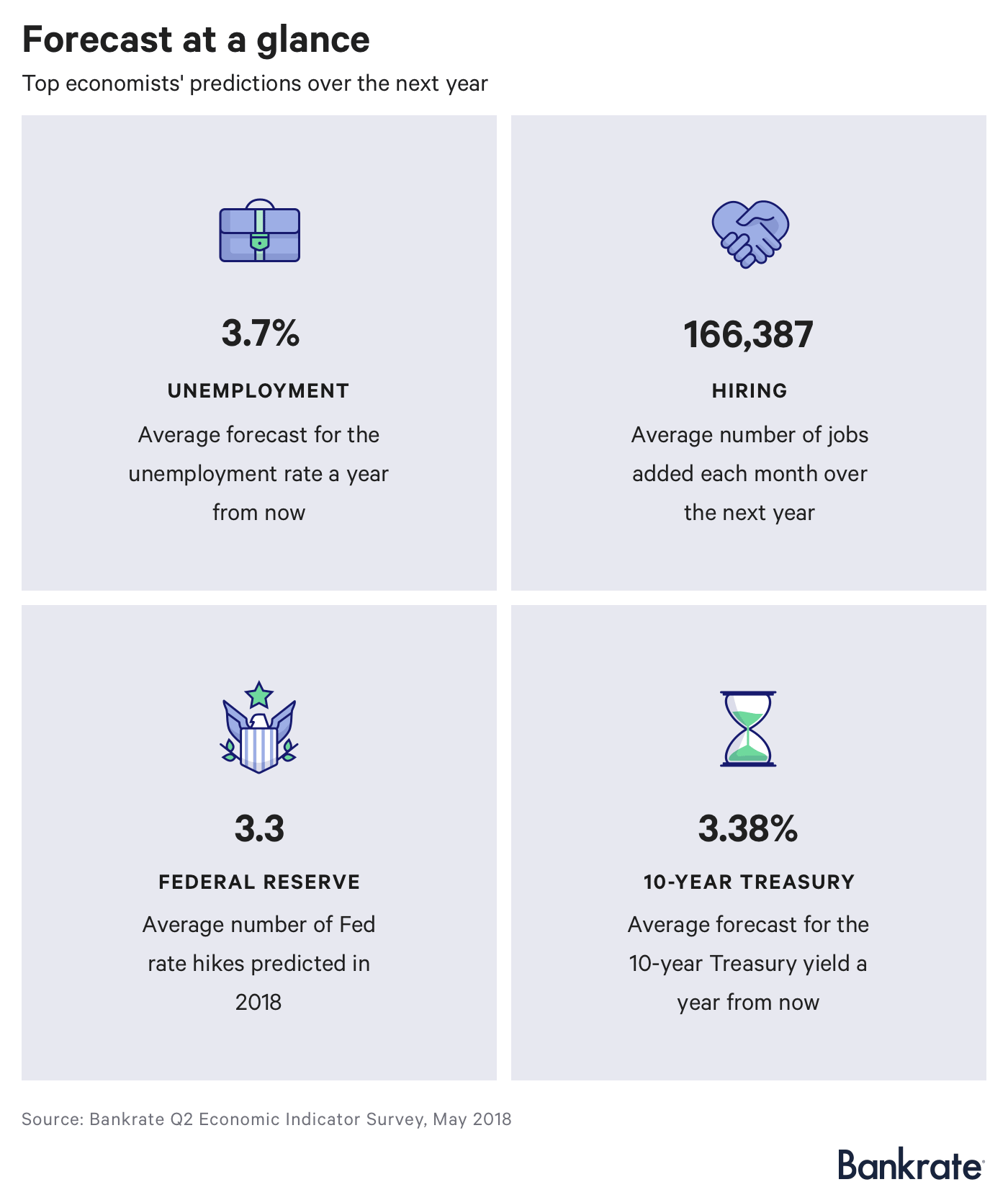

Experts say the economic outlook is bright, at least in the short term, according to Bankrate’s Second-Quarter Economic Indicator survey of 18 top economists. Additional job growth is expected and the unemployment rate is predicted to keep falling.

“Strong economic growth, with real GDP growth close to 3 percent, should absorb most of any slack left in the labor market,” says Lynn Reaser, chief economist at Point Loma Nazarene University. “Only those primarily between jobs or lacking critical skills will be remain in the jobless count.”

But all good things must come to an end. Analysts surveyed by Bankrate predict we’ll see an economic downturn sooner rather than later. Mortgage rates will continue to tick up, and there’s a good chance that we’ll see at least two more Federal Reserve interest rate hikes before the end of the year.

Consumers should aim to get their finances on track before the economy starts to lag. Don’t wait to start chipping away at a mountain of debt or padding the emergency fund in your savings account.

Is a recession around the corner?

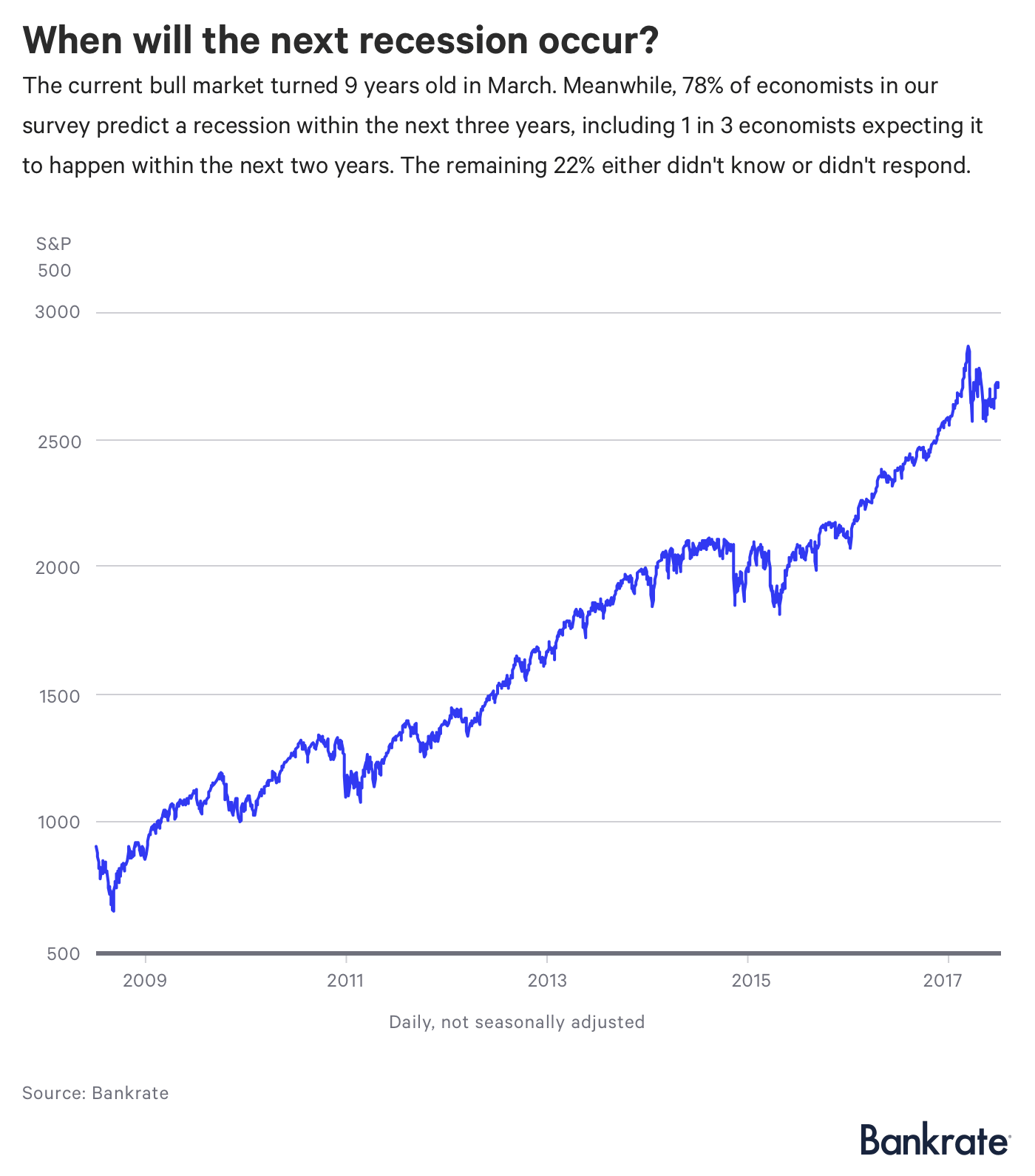

The current bull market celebrated its ninth birthday in March. But the next economic slowdown could be closer than you think.

In all, more than three-quarters (78 percent) of the economists who were surveyed think a recession will rear its ugly head within three years:

- 44 percent expect a recession between the next two and three years.

- 33 percent expect a recession within the next two years.

- 22 percent said that they don’t know when the next recession will occur or gave no answer.

“This business cycle is shaping up to end in a traditional way, where the economy and inflation heats up, and the Fed must raise rates to cool it off,” says Robert Frick, corporate economist at Navy Federal Credit Union. “Given wage and inflation pressures seem subdued, and the pace of the expansion has been slow, a recession may not occur until late 2020.”

Four in 10 U.S. adults can’t cover a $400 emergency expense, according to the latest report from the Fed. If you’re unprepared to face the unexpected — or survive a potential economic downturn — now’s a good time to open a new savings account. The best ones pay around 2 percent APY.

Job growth to continue, but at a slower pace

The economy has been steadily adding jobs month to month as employers scramble to find top candidates to fill open positions. Overall employment growth, however, will probably slow over time.

Two-thirds of the experts predict monthly payrolls to add 175,000 jobs or fewer per month over the next 12 months. Their forecast for the average number of jobs added each month over the next year is 166,387, higher than it was at the tail end of 2017 (162,247) but lower than it was in the first quarter of this year (176,361).

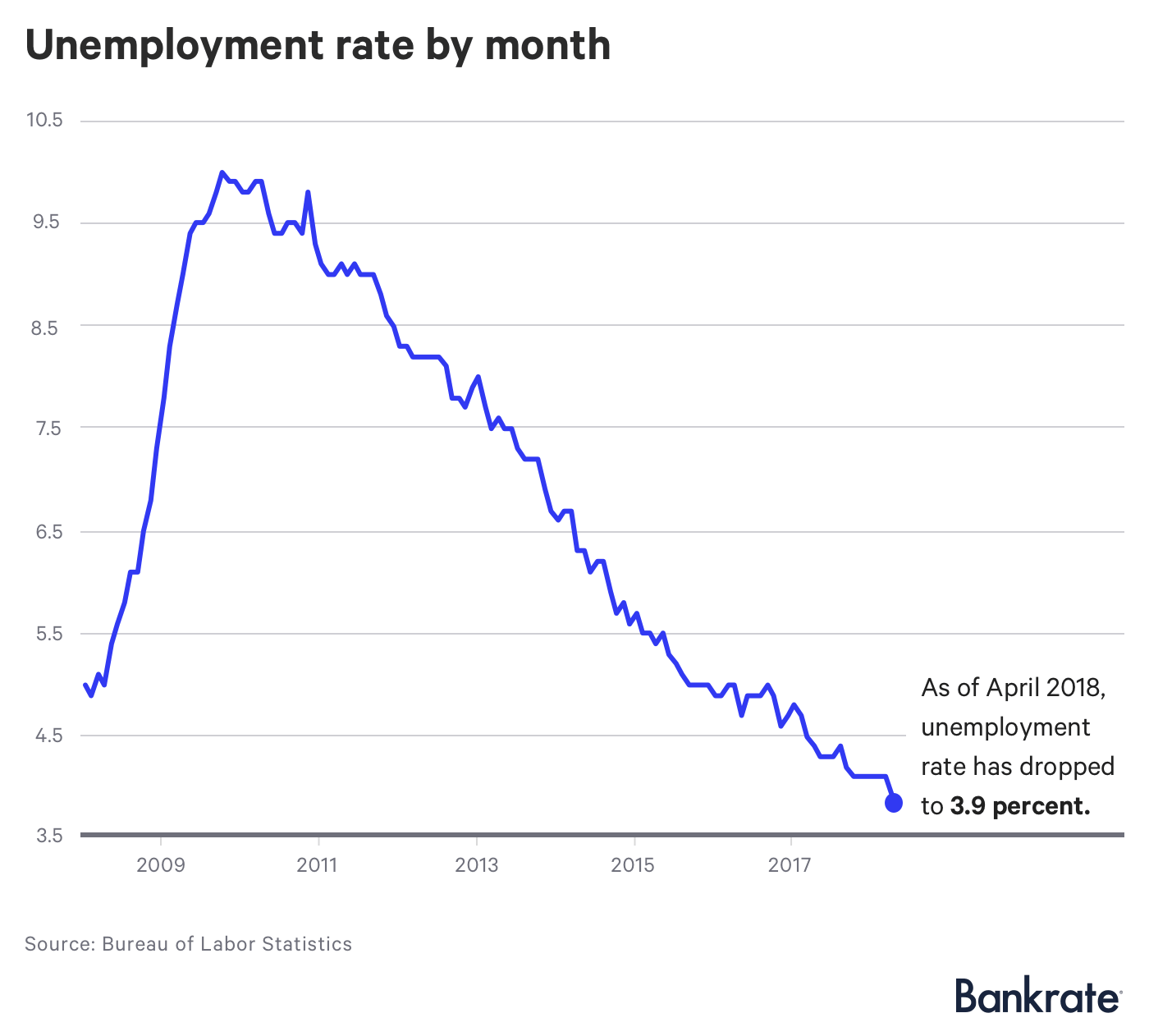

Meanwhile, the percentage of jobless Americans actively seeking work continues to decline. Some 89 percent of the economists told Bankrate they expect the unemployment rate to remain below 4 percent a year from now. It’s currently 3.9 percent.

“Shortfall in (the) employment rate of prime workers and lack of wage inflation suggests (the) unemployment rate could fall further,” says Satyam Panday, senior economist at S&P Global.

Interest rates to rise

Inflation is finally starting to pick up, and monetary policymakers haven’t been shy about their plans to keep the economy from getting too hot.

Most of the market is prepared for an interest rate hike at the next Fed meeting in June. And 83 percent of survey respondents anticipate that we’ll see a total of three or more increases in short-term interest rates in 2018. Half of them expect the Fed to hike rates at least four times in 2018.

Don’t be surprised to see mortgage rates rising as well, particularly as the Fed unwinds its trillion-dollar balance sheet. The forecast for the 10-year Treasury note — the benchmark for 30-year fixed mortgage rates — is slightly higher than it was in the first quarter. Two out of three economic experts predict a yield between 3 percent and 3.49 percent.

Borrowers struggling to get their debt under control should get ready to face the music. Higher interest rates in the coming months means you’ll be paying more out of pocket.

“Continue to pay down variable-rate debt such as credit cards, home equity lines of credit and get out of adjustable-rate mortgages to evade further payment increases,” says Greg McBride, CFA, Bankrate’s chief financial analyst.

The Second-Quarter 2018 Bankrate Economic Indicator survey of economists was conducted May 8-16. Survey requests were emailed to economists nationwide, and responses were submitted voluntarily online. Responding were: Scott Anderson, Bank of the West, chief economist and executive vice president; Bob Baur, Principal Global Investors, chief global economist; Scott Brown, Raymond James, chief economist; Robert A. Brusca, Fact and Opinion Economics, chief economist; Gregory Daco, Oxford Economics, chief U.S. economist; Bill Dunkelberg, NFIB, chief economist; Robert Frick, Navy Federal Credit Union, corporate economist; Robert Hughes, American Institute for Economic Research, senior research fellow; Sam Khater, Freddie Mac, chief economist; Bernard Markstein, Markstein Advisors, president and chief economist; Ward McCarthy, Jefferies, chief economist; Joel L. Naroff, Naroff Economic Advisors, president; Michael Neal, National Association of Home Builders, senior economist; Satyam Panday, S&P Global, senior economist; Lynn Reaser, Point Loma Nazarene University, chief economist; Phillip Swagel, University of Maryland, professor; Ryan Sweet, Moody’s Analytics, director of real time economics; Diane Swonk, Grant Thorton, chief economist.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.