Is car insurance tax deductible?

Key takeaways

- Drivers who use their vehicles for business purposes may be eligible for a tax deduction on their car insurance and other vehicle-related expenses.

- Drivers have two options when filing for vehicle-related tax deductions — actual expenses method or standard mileage method.

- If you use your vehicle for both business and personal use, you can only deduct the costs associated with business use, not the full expense of owning a car.

During tax season, most of us are scrambling and looking around for every possible tax deduction — who doesn’t want to maximize their refund, right? For drivers who are self-employed or use their vehicles for business use (gig workers and realtors, this means you), you may be able to include car insurance as part of your deductions. Keep in mind that tax laws change frequently. While Bankrate can provide you with an overview of when car insurance is tax-deductible, you may want to speak to a tax professional to stay on the IRS’s good side and get back every penny you deserve.

Is my auto insurance tax-deductible?

Drivers who use their vehicle for business purposes may be able to claim their car insurance as a tax deduction, but it depends on which filing method you choose. Insurance is considered when you use the actual expense method during filing, much like gas or the cost of repairs. However, the standard mileage rate method does not factor in the cost of auto insurance.

Taxpayers who operate their cars for business and personal uses should calculate the deduction for both the actual and standard mileage rates to see which one yields the highest deduction.— Kemberley Washington, CPA, Tax Reporter

What is business use?

Examples of business use that may qualify for a business mileage deduction are:

- Driving to meet a client

- Driving to check on various work sites

- Driving to purchase supplies or have meetings that relate to business matters

Car insurance companies use rating factors such as usage and annual mileage to evaluate risk and calculate your policy premium. Usage refers to how you choose to operate your vehicle and most drivers fall into either pleasure or commuter use. The pleasure use designation is for when the car is driven occasionally — appropriate for drivers with similar driving needs as remote workers or those who are retired. Commuting use is for drivers whose daily routine includes driving to locations like work or school.

However, business use is a designation commonly used for realtors, contract workers and salespeople. Instead of commuting to the same office every day, some occupations require drivers to visit various locations throughout the day. This is the type of business use that may qualify for tax deductions.

While business use is a designation on your insurance policy, drivers who carry clients with them, such as realtors, may also purchase a business endorsement for their policy.

How to deduct your car insurance when filing taxes

When filing taxes, you may be able to add some or all of the cost of your auto insurance into your business expenses. For self-employed individuals and rideshare drivers (such as Uber and Lyft), you can fill out tax form Schedule C (form 1040), which can be found on the IRS website.

Keep in mind that commutes to and from work generally do not qualify as business use. Even if you only use your car to commute between work and home and nothing else, it is unlikely to be eligible for tax deductions. In general, only driving done during your business hours and for business purposes is eligible.

Writing off your car insurance deductible

If your car insurance is tax-deductible, you may be able to write your car insurance deductible off as well. This write-off is only possible if you have had to pay that deductible during that tax year and only applies under certain circumstances. If you have not filed a claim or paid your deductible, there is nothing to report beyond the regular premium payments.

All tax filers need to remember the standard deduction when filing taxes. If your write-offs do not add up to more than the standard deduction, then they will not save you money on taxes. If your totaled deductions exceed the standard deduction, you can replace the standard deduction with your calculated deductions.

What if my car is used for both business and pleasure?

If you use your vehicle for business purposes only, you may have an easier time filing your taxes since you won’t have to figure out the split between your business and personal use. Using your car for both business and pleasure use can make things a bit trickier.

If your car is used for both business and personal purposes, you will have the option to use the actual expense method or the standard mileage rate to calculate how much you can write off. The actual expense method allows you to calculate your total expenses and apply the business percentage to determine your deduction. Whereas, the standard mileage rate is an approved cents-per-mile expense for different uses of vehicles, like driving for business or medical purposes. The standard mileage may be updated each year, so make sure to check the current rates before filing.

For part-time rideshare drivers, such as drivers for Uber or Lyft, you may have purchased an insurance endorsement. Rideshare endorsements generally provide coverage while your app is on and you are waiting for a ride request. Once you accept a request, the commercial insurance provided by Uber or Lyft takes over responsibility. In those cases, the rideshare insurance add-on may be considered a business expense, and the associated cost could be tax-deductible.

Other car-related deductions you may be able to claim

Depending on whether you choose the actual expenses method or the standard mileage method, there are additional car-related expenses that may be tax-deductible beyond car insurance. Below are a few examples:

- Maintenance and repairs

- Registration fees and car sales tax

- Car loan interest

- Depreciation

- Tolls and parking fees

- Garage rent

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

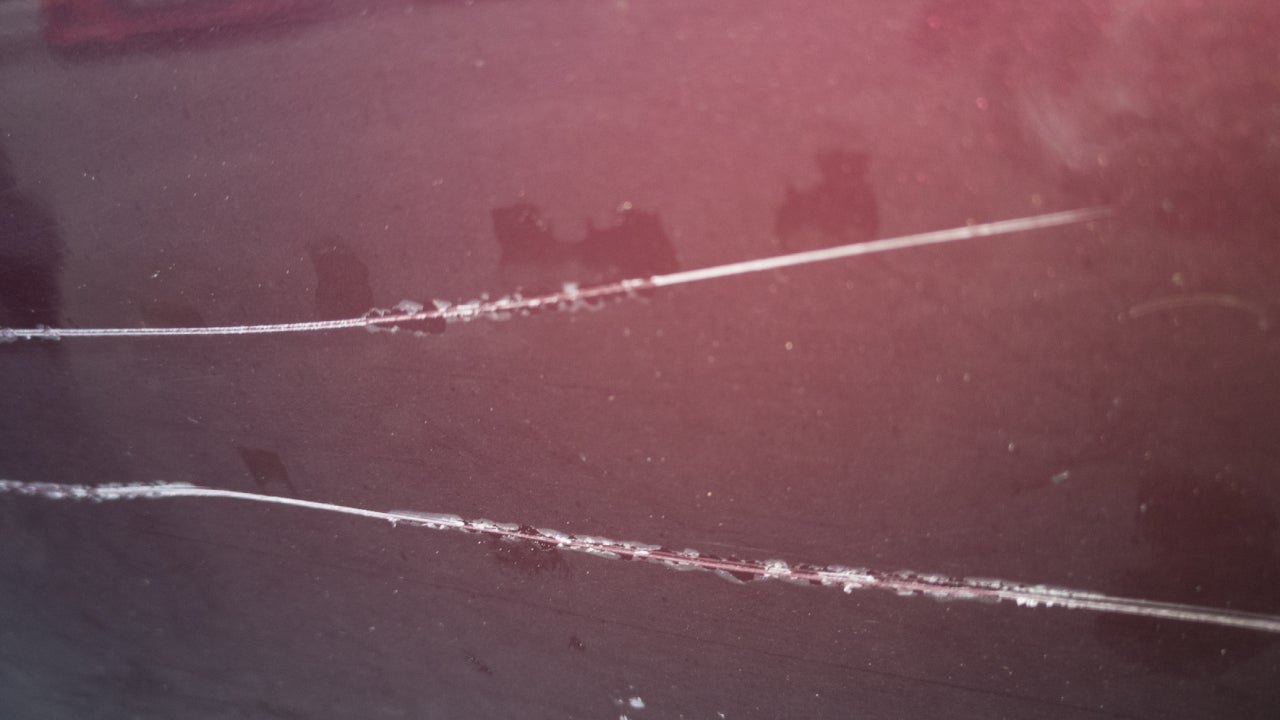

Does car insurance cover keyed cars?

Is homeowners insurance tax-deductible?

Does car insurance cover your parked car?

What is a car insurance deductible?