A new wave of coronavirus-driven layoffs are looming — here’s who is most at risk

First, the layoffs came for the restaurant, retail, hotel and tourism workers — the ones on the front lines of nationwide stay-at-home orders meant to stop the novel coronavirus from spreading.

Now, experts say the once immune white-collar positions that have so far been able to weather the storm by working from home could be at risk in a second round of layoffs, as virus cases surge again almost eight months into the global health crisis while demand is still far from its pre-pandemic levels.

That picture isn’t looking any better with economic momentum slowing from its earlier pace in the summer and lawmakers remaining far apart in negotiations over the next round of fiscal relief.

“Many industries are facing a reckoning,” says Julia Pollak, labor economist at ZipRecruiter. “This is a critical time when companies are sort of looking back on 2020 and surveying the damage and planning accordingly for the new year — and it’s increasingly clear this pandemic is not going away very quickly, so employment has to give in some places.”

Here’s who could be most at risk in a second wave of coronavirus pandemic-induced layoffs and how to prepare your wallet.

Second round of layoffs: Who’s most at risk for job loss?

Economists say the second wave of layoffs risks repeating old stories and creating new ones.

Another round similar to what Americans witnessed back in March could be poised to wreak havoc on the labor market, as the colder winter months weigh on sales and cause an uptick in the virus — what’s known to cause apprehension among the economy’s consumer powerhouse even without an official lockdown. That means some Americans who were laid off once could potentially face job loss again.

Separately, a prolonged slump in the economy risks spilling over into the higher-paying industries first left mostly untouched. Businesses might be inclined to let go of employees as revenues plummet, even though those individuals are working from home. Already, a wave of white-collar layoffs across firms including ExxonMobil, Chevron, Charles Schwab, Goldman Sachs, Wells Fargo, Salesforce and Allstate has hit the market.

“What we’re seeing is a continuation of that first wave of layoffs that never really stopped,” Pollak says. “Just in the past two weeks, we’ve had mass layoffs announced at banks and law firms, sports teams, paper mills, major event venues, and aerospace companies. That’s entirely to be expected when you look at the level of economic volatility occurring right now.”

1. Restaurant and retail positions still hang in the balance with path of virus, economy uncertain

The U.S. economy lost some 15 percent of all jobs between February and April, a level as high as 22.2 million. Bearing the brunt of the pain were the lower-paying, blue-collar hospitality and service sector workers subject to most of the lockdowns. A Federal Reserve survey from May found that nearly 40 percent of all households earning less than $40,000 had been hit with a job loss.

Retail positions shrank by some 2.4 million positions between February and April, with clothing and clothing accessory stores bearing the brunt of the job loss (losing almost 62 percent of all positions) along with sporting goods, hobby, book and music stores (38 percent) as well as other miscellaneous store retailers (34 percent), according to a Bankrate analysis of Labor Department data. Also losing a substantial share of positions were food and drinking places, which saw payrolls shrink by nearly 50 percent in the three-month period.

Clothing and clothing accessory stores, as well as food and drinking places, have since recovered nearly two-thirds of those cut positions, but they’re still down nearly 25 percent and 18 percent from a year ago, respectively. All of that suggests the industry might still be in a fragile position, especially during the colder months when some economists worry about a second wave of infections.

The expiration of federal support could also weigh on many of the industries. Receipts at restaurants and retailers have already rebounded past pre-pandemic levels, bolstered by federal support from direct $1,200 (or more) stimulus checks, an extra 39 weeks of unemployment benefits and a $600 supplemental weekly boost to those weekly checks. All of those efforts combined helped send U.S. personal income to its highest level ever, but the extra unemployment insurance (UI) money expired back in July, while the other near 21.5 million jobless Americans might soon face a fiscal cliff when their UI benefits expire at the end of the year.

“There’s no expectation among economists that we’ll see anything like that downturn in March and April again in the near-term,” says Mark Hamrick, Bankrate’s senior economic analyst. “Still, with safe and effective vaccines not yet available, there will be a persistent cost to the economy as consumers avoid certain behaviors and purchases and employers adjust as needed.”

2. State and local government employment, along with health care and travel are still facing jobs deficits

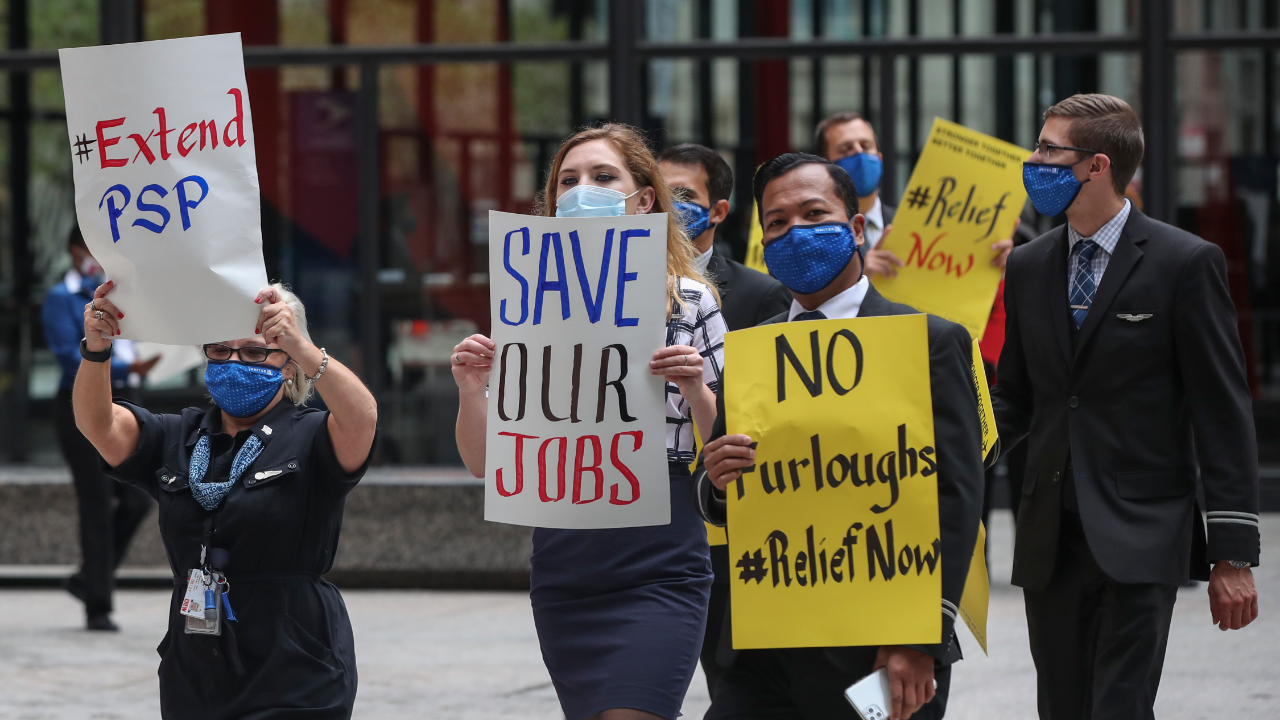

Industries that haven’t seen enough demand to bring back workers include those in the transportation industry, including air and rail transportation workers. Travel and tourism has also been hit hard, with travel arrangement services down nearly 29 percent from a year ago and shrinking by 45 percent between May and September, when most sectors started adding positions again, according to Bankrate’s analysis.

Air travel is down by more than 80 percent in 2020, according to the Bureau of Transportation Statistics, and industry analysts say it’s unlikely to experience a full return to pre-pandemic levels until at least after a vaccine arrives.

State and local government employment has also continued to decline. With the industry hit by slumping tax revenues and soaring health care and unemployment costs, some economists warn that they could choose to furlough more workers if the crisis goes on long enough.

Health care workers whose jobs weren’t directly tied to treating patients from coronavirus-related illnesses are at risk. Hospital employment is down nearly 2 percent from a year ago and shrank by nearly 4 percent between May and September. Nursing and residential care facilities employment fell by nearly 88 percent in the same four-month period.

“It remains the case that leisure and hospitality sector jobs, such as bars and restaurants, retailing, as well as those related to travel including airlines, will continue to be at risk,” Hamrick says. “Additionally, sectors including health care, energy and utilities have suffered during this downturn. Consumers have favored consumption of goods, while purchases of services more broadly have suffered. With many state and local government budgets hemorrhaging, we can expect some job losses there as well.”

3. Construction, trucking and administrative and support services could see a hit given contagious nature of recessions

Recessions are contagious and tend to have domino effects on other industries. For instance, restaurant establishments and retailers that close down might not bode well for the suppliers or for the trucking industry if their main job is to transport goods back and forth between food establishments. Meanwhile, administrative and support services, which include clerical workers and cleaning activities, might see more cutbacks with offices closed. Waste management services could also take a hit, with concert venues, conference centers and sports stadiums closed, says Constance Hunter, chief economist at KPMG.

Commercial construction employment, which might include opportunities in construction of buildings and nonresidential buildings, might also take a hit, with the stay-at-home nature of the current pandemic environment.

“While residential construction is faring well amid low interest rates and strong demand for single-family homes, commercial construction is suffering amid a glut of office space in some markets,” Hamrick says.

Job postings in banking and finance and software development are down by nearly a quarter (21 percent and 26.8 percent, respectively), according to data through Oct. 30 from job-search engine Indeed. Food preparation and service job postings are down 16.3 percent from a year ago, while child care is down 16.6 percent, customer service 13.6 percent and installation and maintenance down 11.9 percent, according to the report. While those aren’t exactly layoffs, they could signify where employers may turn for cuts at the end of the year when many reassess and reevaluate their plans for the next 12 months.

4. Employees in higher-wage positions might have a harder time finding a position

Data from Indeed also shows that job postings for higher-wage occupations have fallen the most at this point in the crisis and are 18 percent below trend, a steeper decline than middle- and bottom-tier opportunities, according to figures collected through Oct. 30.

Higher-wage positions are the opposite of rank-and-file jobs, where they take longer to both hire and fire, according to Nick Bunker, Indeed’s economic research director. Current job-seeking opportunities almost have an inverse relationship with where the jobs were taken away, he says. High-wage employment took a smaller hit, but the trend in postings is lower; low-wage employment was slammed, but the trend in postings is much higher.

“It’s really the cost of hires as a big part of this,” he says. “With all this uncertainty, employers are seemingly more hesitant to add more high-wage workers to their payrolls.”

5. Pay attention to which industries are seeing their hours cut

Some economists also track the average weekly hours worked within an industry as a leading indicator, with the idea that employers might reduce someone’s hours before ultimately deciding to let them go.

Employees in mining and logging might be the most at risk, given that their hours have been cut the most, and Labor Department data would agree. The industry saw more cuts between May and September than it did during the first wave of layoffs from February to April.

Second round of layoffs: How to prepare your wallet

Regardless of whether you’re afraid you could face a layoff, Americans should prioritize cutting back on spending as much as possible while ramping up saving for emergencies. If you’ve faced unexpected job loss, individuals will want to apply for UI as soon as possible. In the meantime, they might be able to arrange a forbearance program with any lenders and utility companies that they regularly pay a bill to. Take a close glance at your finances to also see if there are places where you can reduce your monthly bills, thereby limiting your expenses even more.

“For Americans making decisions about their personal finances, strategies which have stood the test of time should remain front-and-center,” Hamrick says. “That means focus on paying down debt, having a budget and saving for retirement and emergencies.”

When it comes to individuals’ careers, networking will be a valuable asset, Hamrick says. If possible, your job search shouldn’t be limited to any specific geographic location.

Some of the hardest-hit areas include major metropolitan areas where lockdowns were steeper and cases were higher, according to Indeed. Jobseekers might also want to consider looking beyond major metropolitan areas where large portions of the workforce are working remotely. Jobs in retail, restaurants and personal-service jobs have suffered the most in predominantly work-from-home metro areas, Indeed found.

If you’re looking for a job, use technology to your advantage and register for multiple job-search sites. Digitize your resume, make sure your application is free from mistakes and pay attention to the skills required in each listing. That might give you some helpful ideas for how you can bolster your resume and skills to be a more competitive candidate.

“It’s a good idea to always be a job seeker and to be looking at the labor market for which kinds of roles people are hiring for and what kinds of skills are valuable,” Pollak says. “This is the time to be creative and innovative, to pay attention to what’s happening in the news and be on the lookout for new opportunities.”

Learn more:

- Overpaid unemployment benefits: What to do when your state wants the money back

- Unemployment benefits: 8 possible reasons your payment is late — and what to do about it

- How much money could you get on the next stimulus check?

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like