Stock splits and capital gains taxes

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

Dear Tax Talk,

I have a few stocks that I bought some time ago. Over the years, the stocks have split. I believe I would owe tax on this amount. My intent is to sell these stocks and gift the proceeds to my son and his wife. How do I account for stock splits, and would I still owe capital gains tax on the gift?

— Carol

Dear Carol,

In order to determine whether you are going to be taxed on the sale of your stock that has split over the years, you are going to need to calculate your “adjusted basis” and then deduct that amount from your sales price to see if you have a taxable gain or loss to report on your tax return.

Basically, a stock split occurs when a company’s board of directors decides, for various reasons, to increase the number of shares in the stock. One reason may be that the stock has gone up so much in price that it becomes unaffordable for many investors. The market price of the stock after the split depends on how many new shares are issued. If it was previously selling for $100 and there is a two-for-one split, the new market price of the stock will be $50.

But what happens to your basis at this point? Let’s say you own 10 shares of stock that cost you $25 dollars a share to purchase and the stock is now up to $100 dollars a share when the company determines that it will split the stock two for one. This means that for every share you owned prior to the split, you now own twice as many. In this case, you would own 20 shares of stock. To calculate your adjusted basis in the 20 shares you now own, you will take your original purchase price of $250 (10 shares x $25 per share) and divide it by 20 (the number of shares you own after the split) to come up with an adjusted basis of $12.50 per share.

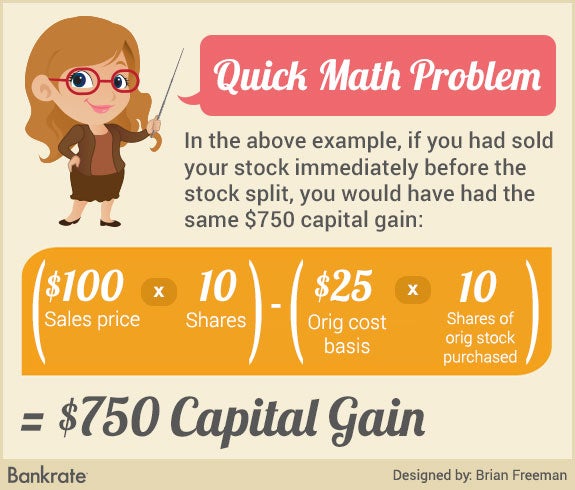

If you sell the 20 shares of stock for $50 per share, you will have a capital gain of $750 ($50 selling price x 20 shares less $12.50 adjusted cost basis x 20 shares).

So you pretty much end up in the same place with minor differences for price fluctuations in the real world marketplace. If you sell the stock, then the gain is reported on your tax return and you pay the taxes accordingly.

Moving on to your next question about giving the proceeds to your son and his wife: There is an annual gift exclusion of $14,000 per person per year. This means you can give your son and his wife a total of $28,000 per year. If you have a spouse who also wishes to give a gift to your son and his wife, the gift amount can be doubled to $56,000 in an estate planning maneuver called “gift splitting.”

If you give more than the annual gift exclusion amount, you will probably be required to file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

Thanks for the great questions and all the best to you.

Ask the adviser

To ask a question on Tax Talk, go to the “Ask the Experts” page and select “Taxes” as the topic. Read more Tax Talk columns.

To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. Taxpayers should seek professional advice based on their particular circumstances.

Bankrate’s content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. The content is broad in scope and does not consider your personal financial situation. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Please remember that your use of this website is governed by Bankrate’s Terms of Use.

Related Articles

Cryptocurrency taxes: A guide to tax rules for Bitcoin, Ethereum and more

Need to report cryptocurrency on your taxes? Here’s how to use Form 8949 to do it