Do you use a strategy for wedding gift-giving? Most people do

You’re saving the date: Your friends are throwing the wedding of the century in eight months, and you’re invited! It’s gonna be epic, on an island you’ve never heard of, and everyone will be there.

But there are those little matters you have to think about: making your travel arrangements, finding something great to wear, and — most important of all — buying the perfect gift at the appropriate price point. You won’t want to seem cheap.

It’s no wonder Leigh Mosby, an interior designer in Raleigh, North Carolina, estimates an upcoming wedding will cost her up to $2,000. “I love (the bride), I’m happy to support her, but financially speaking, it is a big commitment,” she says.

Many Americans use strategies so they’re not kissing too much of their money goodbye in the wedding receiving line. Most base their wedding gift spending on how well they know the couple, a Bankrate survey finds. Some even turn down invitations because of the costs.

Wedding season is a great reason to have some savings handy – or a travel rewards credit card, in case of destination weddings.

How much to spend on a gift? It depends

Overall, nearly half of Americans — 47 percent — say they typically spend $100 or more on wedding gifts for close friends and family. For distant relatives, acquaintances and colleagues, they tend to spend less: — only 28 percent say they typically spend $100 or more.

Delia Sequeira, a behavior analyst in Edison, New Jersey, says she’s more likely to feel obligated to lay out serious cash for closer friends and family.

“If you’re bridesmaid or a really good friend, you can’t really get away with giving a gift that is not that great,” she says.

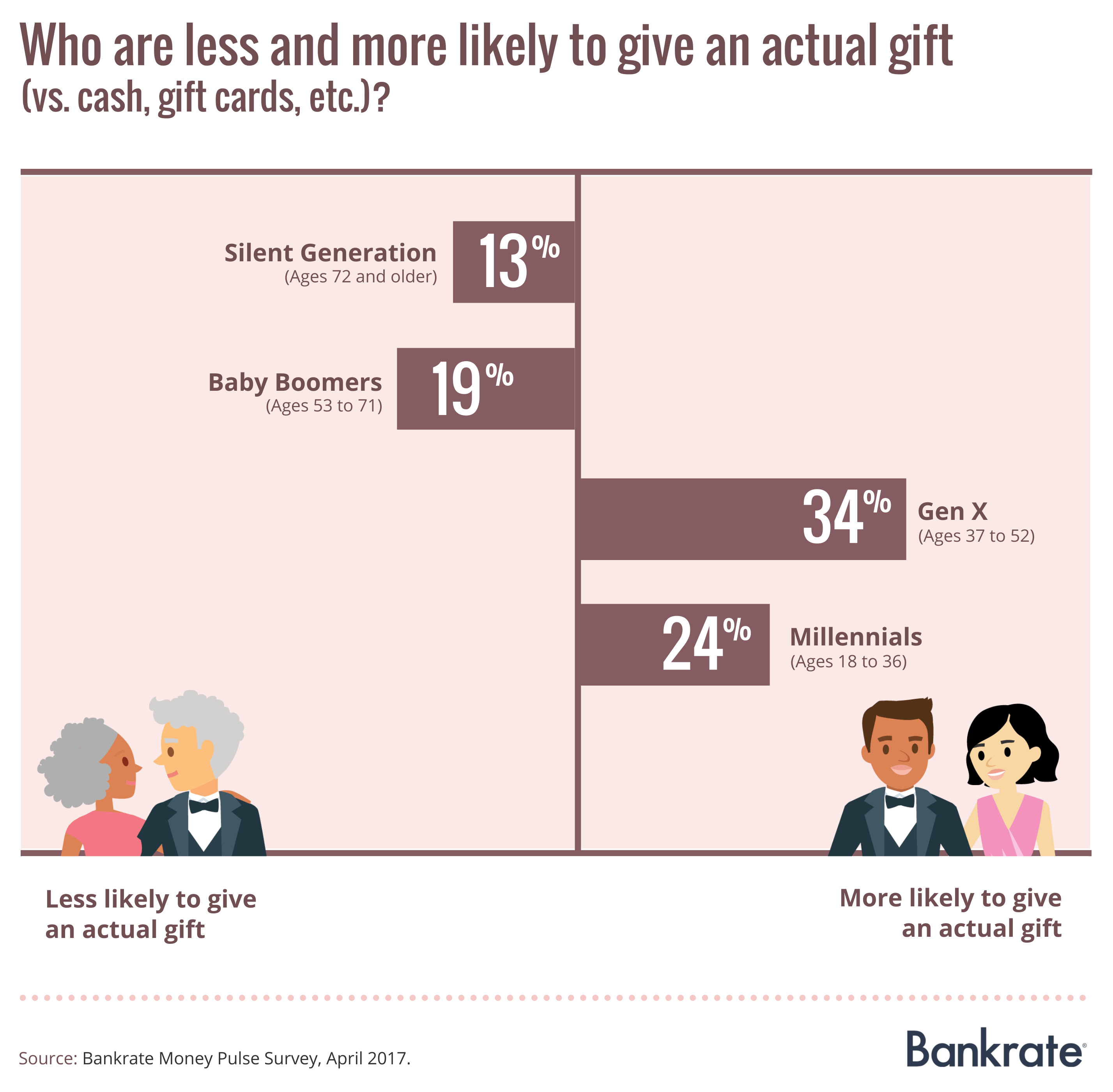

Cash or checks are the most popular type of gift to give, particularly among people in the Northeast. There, 45 percent choose to give cash or checks, compared to 29 percent nationwide. Gifts off the registry were the overall No. 2 choice in the survey, followed by gift cards that must be used at a specific store or chain.

Some give only regrets

About 1 in 5 Americans has declined a wedding invitation because they couldn’t afford to go. Parents, older millennials and Generation Xers are among the groups most likely to say no.

Sequeira says she’s more focused on reining in those expenses now that she’s gone back to school.

“Before when I was younger making the same amount of money, going to these weddings and to all these events didn’t feel like it was a strain on my budget. I was also a little more reckless with the way I budgeted and not as well-versed in what I should be doing financially,” she says.

Mosby, the designer, estimates she has spent more than $10,000 attending weddings over the last 10 years, including one summer where she went to six weddings in three months. While spending a few hundred dollars to attend a typical wedding close to home isn’t usually an issue for her, she says destination weddings can easily multiply the cost by a factor of 10.

At times, Mosby says, she has had to take on side work, in addition to her full-time job, to meet wedding expenses.

How to cope

High wedding costs are very familiar to Liz Landau, a financial planner in White Plains, New York, who tries to advise clients on how to handle a busy wedding season.

“I try to alert them to the cost, and that as they get into their late 20s and early 30s, there’s going to be a slew of weddings and we talk about the different components of the cost,” she says.

It’s important to decide ahead of time how the expenses will be covered.

“We go through the math,” she says. “Where are you coming up with the extra $5,000? Are you OK not going on a vacation for two years, or putting off buying a new car?”

If you have a few wedding invitations or save-the-dates on your calendar, shop for a savings account before you start shopping for a gift or your outfit. If you have to put some of your expenses on plastic, use a credit card that will give you cash back or other rewards.

Methodology: Bankrate’s poll was conducted by Princeton Survey Research Associates International, which obtained the data via telephone interviews with a nationally representative sample of 1,000 adults living in the continental U.S. Telephone interviews were conducted by landline (500) and cellphone (500, including 308 without a landline phone) in English and Spanish from April 6-9, 2017.

Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error is plus or minus 3.8 percentage points.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.