Millennials prefer cash over stocks — and it could cost them millions

Millennials profess a love for cash that shows their economic skittishness, while demonstrating a risk intolerance that could cost them big-time when they stop working.

A decade removed from the most devastating financial crisis in almost a century, millennials’ propensity for cash’s safety belies their need to create wealth over the long term, which is best done with a combination of stocks and bonds.

Nevertheless, when it comes to how millennials actually invest their retirement savings, they are as accepting of stocks as earlier generations, despite what they might tell a pollster.

The question, then, is why do millennials claim cash is their favorite asset when it isn’t?

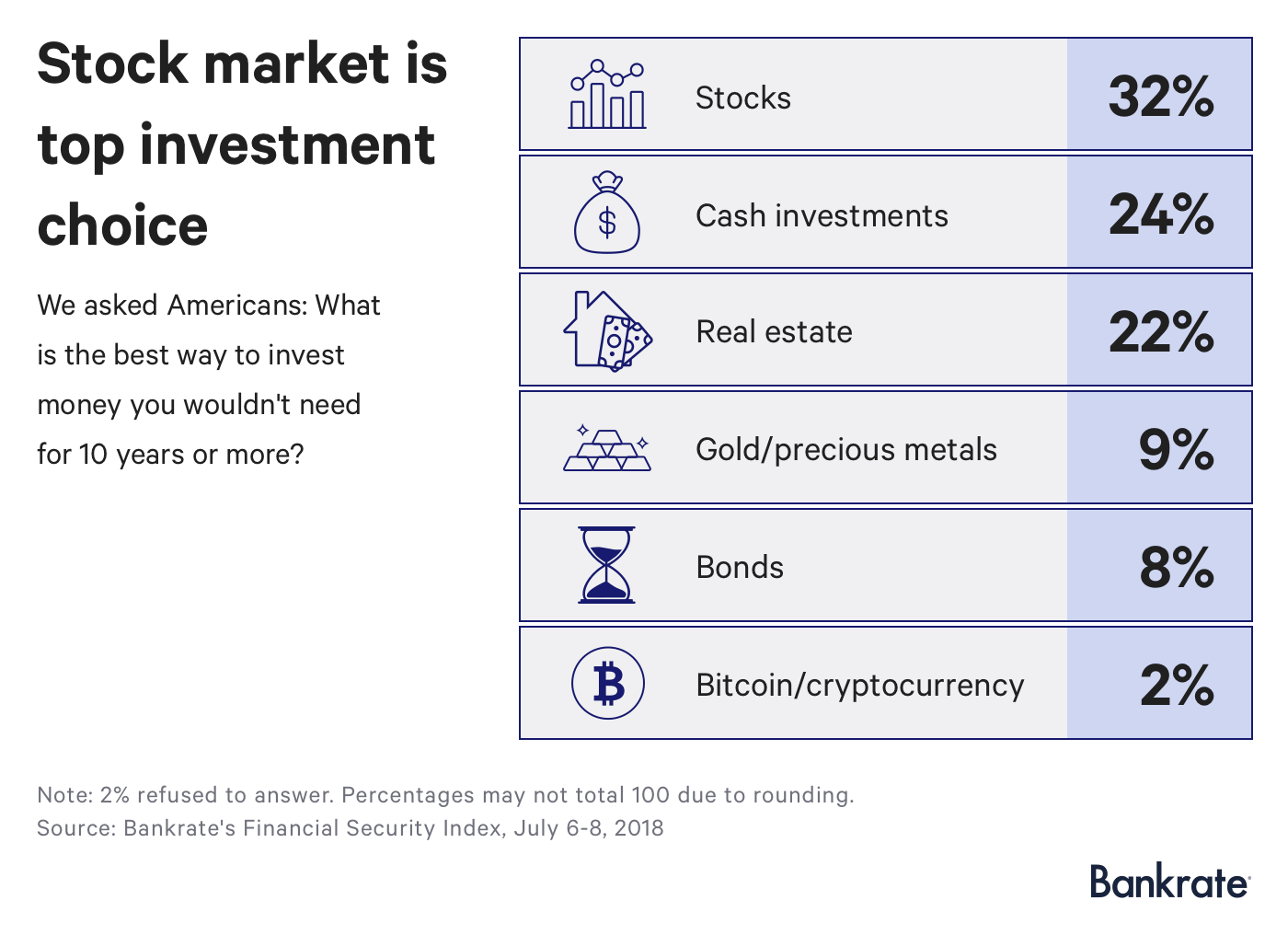

The stock market is the top investment choice

A third of Americans (32 percent) say the stock market is the best investment for money they won’t need for a decade, according to a new Bankrate survey, while less than a quarter (24 percent) say no-risk cash is their top preference.

“For investment horizons of longer than 10 years, the stock market is an entirely appropriate investment,” says Greg McBride, CFA, Bankrate chief financial analyst. “Cash is not, and especially if you’re not seeking out the most competitive returns.”

This is the first time in four years respondents didn’t favor real estate, which registered 22 percent in this survey. Gold, bonds and bitcoin rounded out the top six, with cryptocurrencies receiving just 2 percent.

Real estate is in a bit of a slump. Sales of previously owned homes declined 2.2 percent in June compared with a year prior, according to the National Association of Realtors, despite an improving economy. New home constructions and mortgage applications have also fallen, as prices have risen.

That’s because homes have risen a lot.

The median existing-home price was $276,000 in June, according to NAR, up 5.2 percent over the past 12 months. Home values have increased on a year-over-year basis for 76 straight months. Meanwhile, the average 30-year fixed-rate mortgage sits at 4.68 percent as of July 18, according to Bankrate, up from 4.11 percent a year ago.

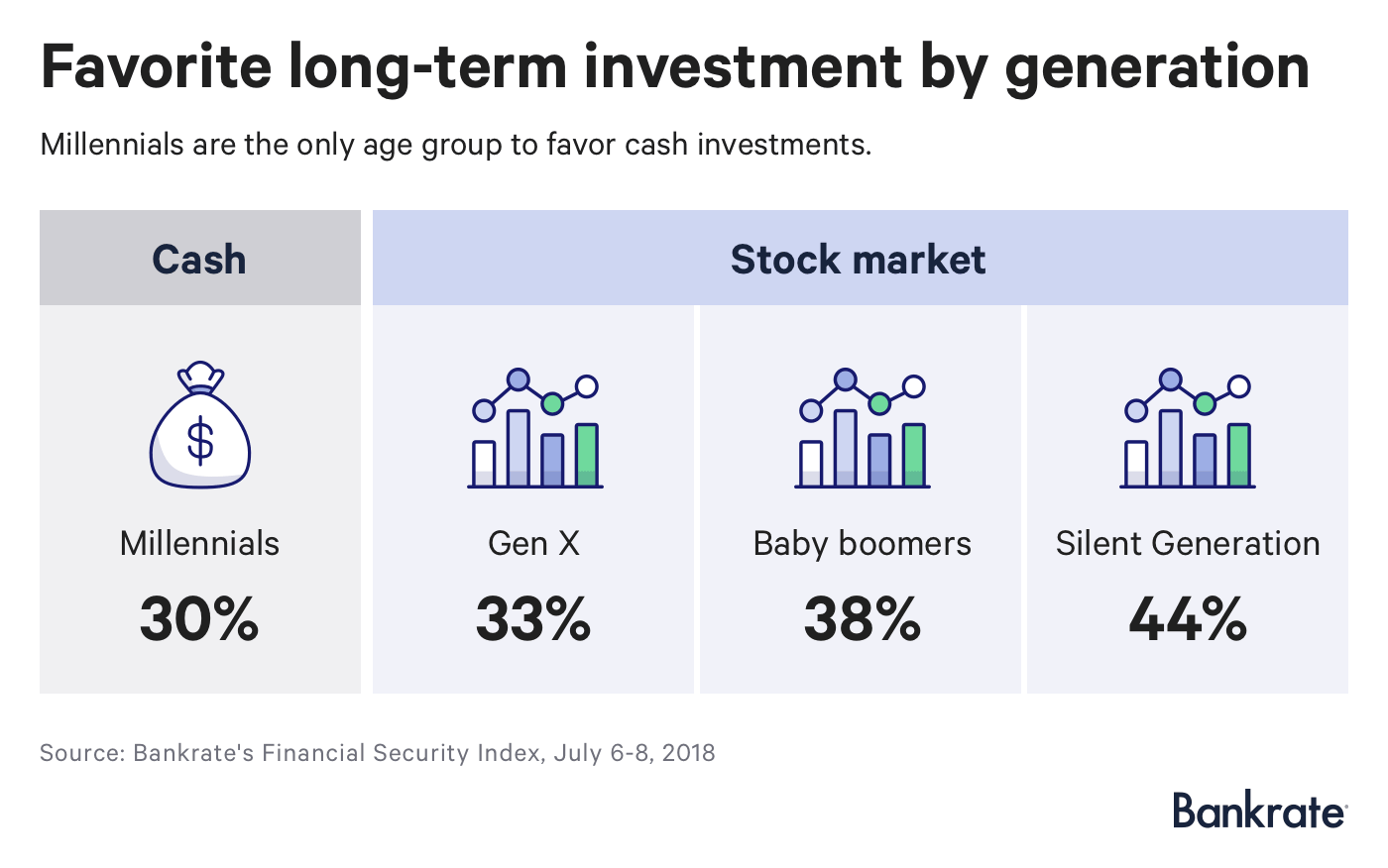

Millennials love cash, everyone else prefers stocks

Three in 10 millennials say cash is their favorite long-term investment, while each successive generation lays claims to stocks – a third of Gen Xers, 38 percent of baby boomers and 44 percent of the Silent Generation.

Millennials’ second-most desired investment, though, is the stock market, while about a fifth of everyone else selected cash.

Millennials would lose out in a spectacular fashion if they acted on this bias. For the sake of simplicity, let’s assume you’re a 22-year-old worker planning to retire at 67 and you save 10 percent of your $50,000 salary in your 401(k).

If you invested in a money market fund yielding 2 percent, you’d end up with about $359,000 by the time you retire. If instead you contribute to a balanced fund of stocks and bonds which yielded 8 percent annually (similar to Vanguard Wellington’s performance over the past 15 years), you’d have $1.9 million.

Do millennials really hate stocks?

While millennials may assert their stock aversion, reality says something else.

Thanks to the introduction of auto-enrollment into target-date funds — which are mutual funds made up almost entirely of stocks when you’re young and then slowly shifting to bonds as you get older – millennials have a ton of exposure to the stock market.

Three-quarters of the retirement portfolios for those in their 20s comprised stock funds or target-date funds, according to an Employment Benefit Research Institute report. Meanwhile, those in their 30s owned more stock than those in their 40s, who owned more stock than those in their 50s, and so on.

Cash investments made up just 1 percent of the portfolio for younger millennials and 2 percent for those in their 30s.

So, what’s going on?

Millennials may avow a love for cash because they are in such desperate need for it.

Half of those aged 18 to 29 say they are better off financially than their parents at the same age, according to the Federal Reserve, compared with 56 percent of those over the age of 60.

Households helmed by those under the age of 35, according to the Fed, owned $2,600 in median savings in 2016, or about a quarter of the total compiled by the Silent Generation.

Millennials are putting off starting a family due to record levels of student loan debt and the high housing costs, leaving them less margin for error.

With little hope for a pension that half of those over 60 enjoy, 41 percent of millennials have no retirement savings, and just a quarter feel as if their savings are on track for a secure retirement.

Given that anxiety, millennials may say they prefer cash because it’s hard to imagine owning funds you won’t need in a decade.

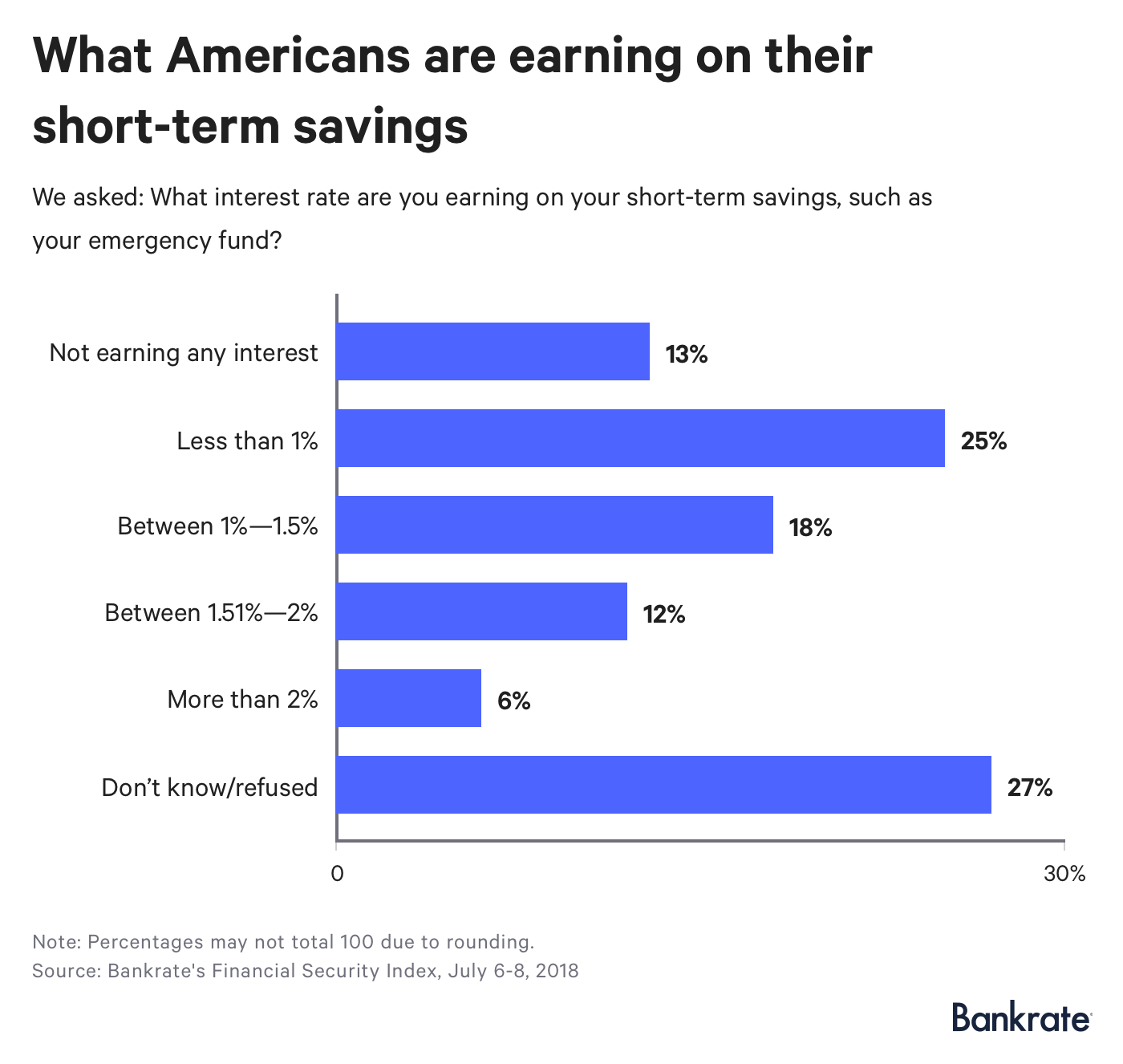

What Americans are earning on short-term savings

Millennials, and Americans by and large, aren’t earning that much with what savings they do own.

Just 6 percent of respondents said they’re earning more than 2 percent on their cash, equivalent to the upper limit of the Fed’s short-term interest rate target. More than a quarter did not know what their receiving, while another 13 percent aren’t getting any interest at all.

Millennials were the least likely to receive more than 1.5 percent, thanks to their paltry holdings, while boomers were the most likely.

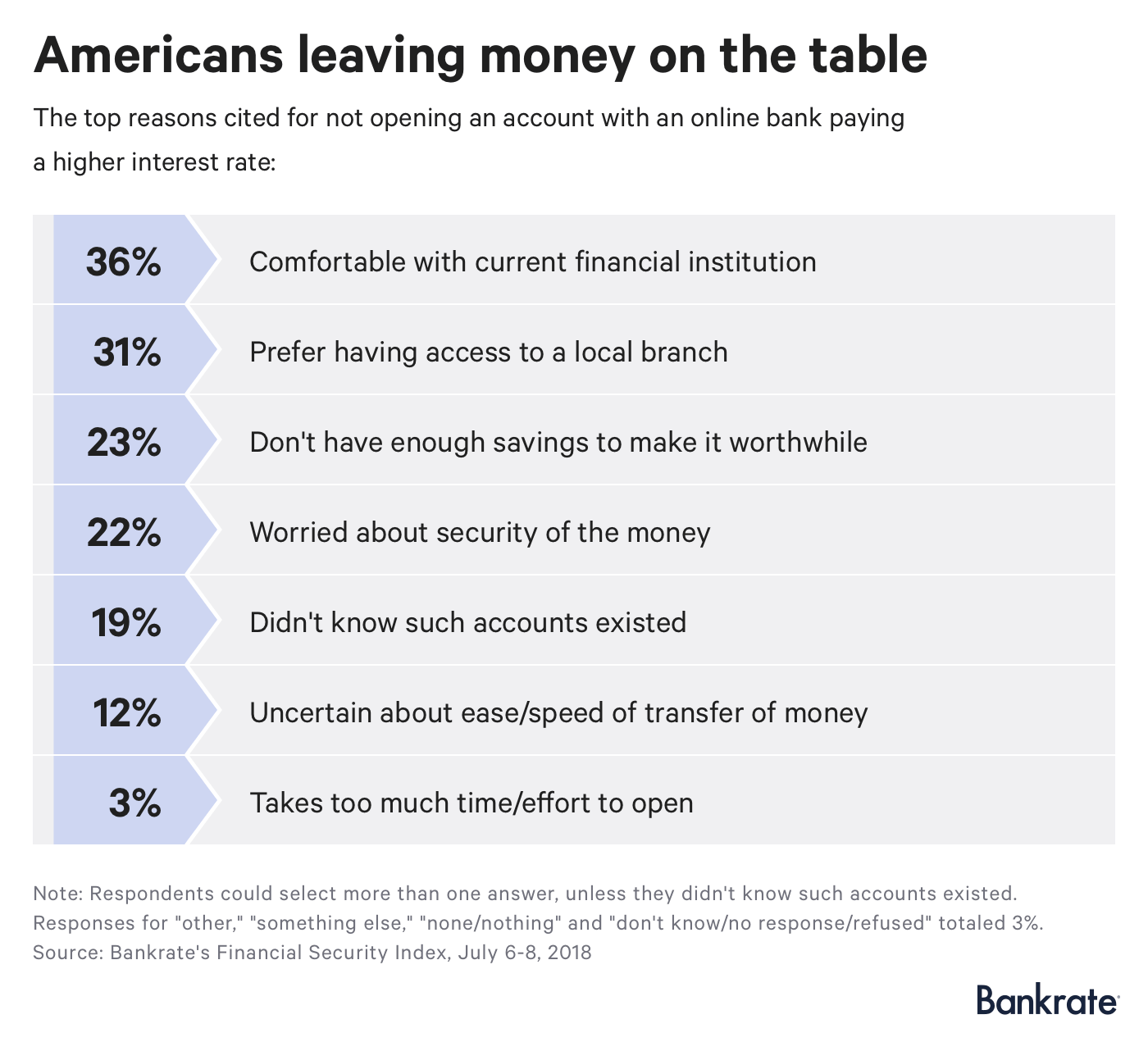

Why Americans aren’t chasing higher yields at online banks

Americans in search of higher yields on savings and other accounts need only consult their internet browser. Online banks, per Bankrate data, are much quicker to pass along higher yields to consumers after the Fed raises interest rates than traditional brick-and-mortar outfits.

Most view a change as not worth their time, with 36 percent comfortable with their current bank and another 31 percent desiring access to a local branch.

Nearly a fifth of Americans, though, didn’t know such accounts existed.

“Top-yielding, nationally available bank savings accounts and money market deposit accounts can be found with very low minimum deposits, and in some cases no minimum deposit at all – making these accounts literally available to every American household,” McBride says.

This study was conducted for Bankrate.com by GfK Custom Research North America on its OmniWeb online omnibus. The sample consists of 1,000 completed interviews, weighted to ensure accurate and reliable representation of the total population, 18 years and older. Fieldwork was undertaken July 6-8, 2018. The margin of error for total respondents is +/- 3%.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Survey: Nearly 3 in 4 Americans have a financial regret