Coronavirus: Three budget friendly ways to improve your financial hygiene

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

As COVID-19 sweeps across the United States, social distancing measures and rigorous personal hygiene are helping to flatten the curve. But, just as frequent hand washing and standing six feet apart from others is critical to personal hygiene, diligent maintenance of your financial hygiene is important in times of uncertainty. Keeping your financial accounts organized, securing your digital accounts with strong passwords, and assigning someone to manage your finances if you’re unable, promotes overall financial health and preparedness for any scenario.

What is financial hygiene and why is it important?

Financial hygiene is a broad term that refers to your overall financial viability and security. This can include everything from maintaining a good credit score to organizing and updating all financial asset information regularly.

The continual practice of organizing financial assets is important for everyone, regardless of age or circumstance. While the outbreak of COVID-19 may have brought this issue to the forefront, organizing your digital assets is crucial for maintaining your financial hygiene. There are many instances in life where a loved one or trusted executor may need access to your financial and personal accounts.

The first reason individuals may assume they would need an executor to manage their finances is in the case of death. But, in actuality, this is far from the only instance that would require someone to access your varying accounts and assets. If you’re incapacitated for any reason, such as extreme illness or injury, having your finances in order provides clarity to the people you’ve appointed to help. This includes having a list of assets and login information at the ready.

It’s important to understand that digital assets often fall into a legal gray area that traditional assets don’t. Unlike physical assets, the ownership and privacy rights of digital assets are often determined by the Terms of Service Agreement of the asset or account in question. But let’s face the facts, no one really reads these agreements. In fact, a 2017 Deloitte survey found that over 90 percent of consumers accept legal terms and conditions without reading them.

Frequently, the Terms of Service Agreement will state that your online accounts can’t be transferred in the case of death or incapacitation. This can create a very difficult situation if the worst happens and your loved ones are left trying to organize and manage your digital assets. Moreover, even if the digital financial assets in question are transferable, they are notoriously difficult to include in a traditional will because the nature of online accounts is fluid with passwords and security information updating regularly to keep accounts safe.

Three steps you can take to improve your financial hygiene:

Step 1. Assess your current financial health, then make a plan to improve it.

Consider auditing your own finances as a “financial check-up”. You may not be financially unhealthy now, but a check-up is key to diagnosing and treating problems that may have gone unnoticed.

Perhaps the best indicator of your financial health is your credit score, which acts as a metric for lenders to see how creditworthy you are. Reviewing your credit report allows you to see any outstanding debts or loans that are hurting you financially. Currently, the three major credit bureaus — Experian, Equifax and TransUnion — are offering free weekly reports until April 2021.

Once you have a good understanding of your credit history and current score, you can work on ways to improve areas that you may have missed in the past. If you have high interest credit card debt in multiple accounts, consider using a balance transfer card to consolidate some of that debt. Creating an organized plan for paying down your debts can help you save money in interest down the road.

Taking the time to go over your financial health as it stands today is also a good way to spot any potential fraud that could hurt you.

Step 2: Organize your digital assets

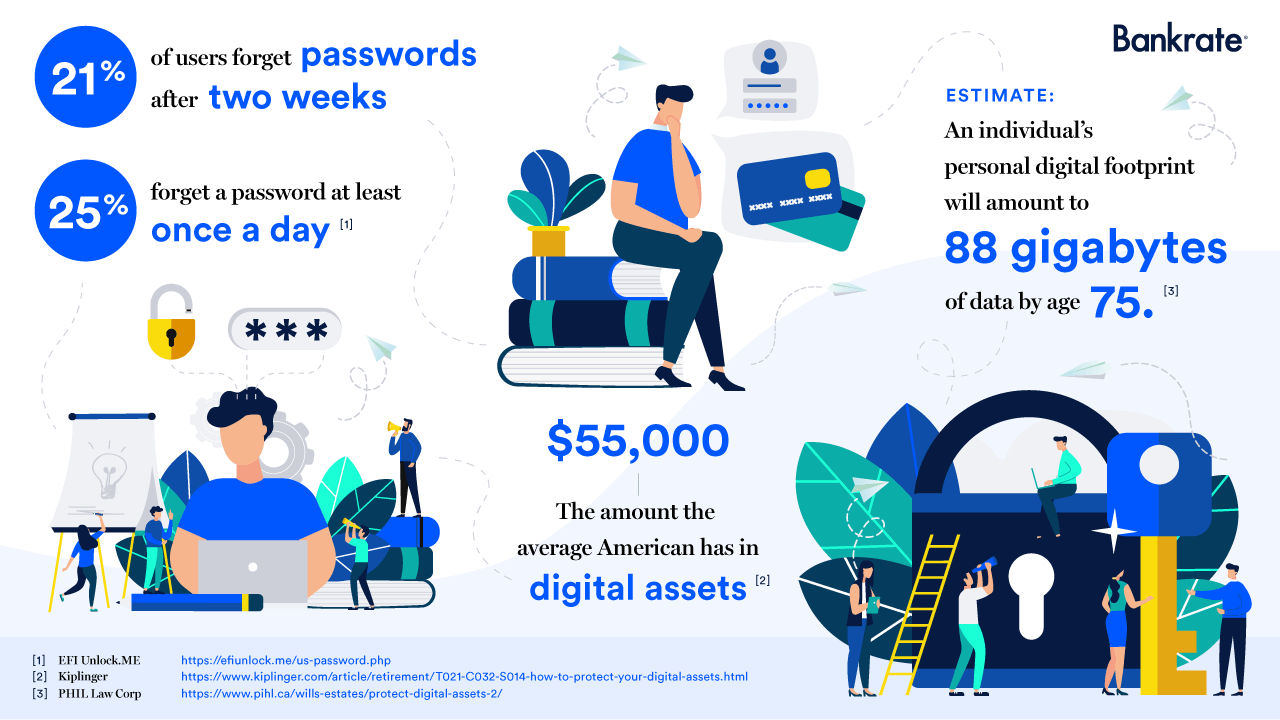

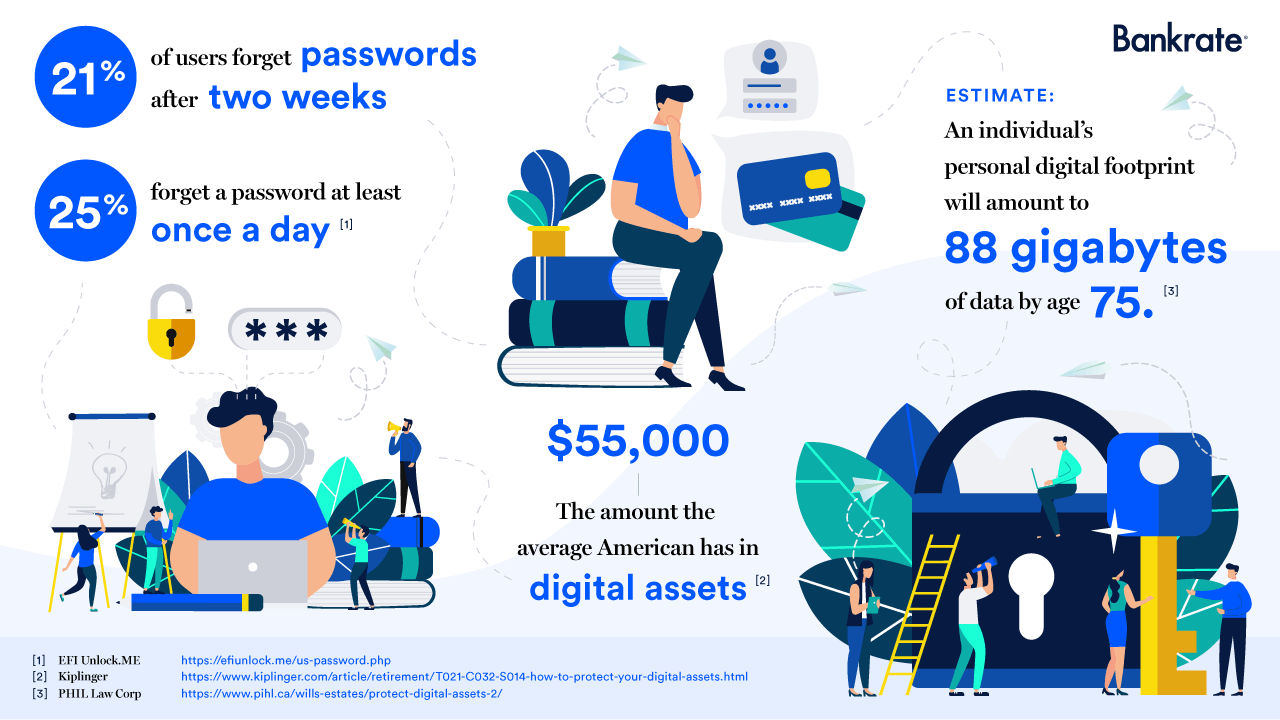

By age 75, the average American will have amassed an estimated 88 gigabytes of data from their digital footprint alone. To put that number into perspective, one gigabyte is “equivalent to 10 yards of books standing side by side or 200 MP3 songs running at 5 minutes each.” Digital assets make up a large portion of this data and include everything from financial accounts, social media, online marketplace accounts and login information.

These asset categories include (but are not limited to) the following:

| Asset | Relevant Accounts |

|---|---|

| Financial Accounts |

|

| Online Marketplace |

|

| Login Information |

|

A good place to start when organizing your digital assets is to make a “just in case” folder with all of your relevant account information.

A “just in case” folder is a comprehensive and up-to-date list of all login and account information for all your digital assets. If security is a concern when making a “just in case” assets folder, consider making the file password protected and only giving the password to one trusted individual in your life.

It is important to note that laws regarding digital asset ownership after death vary by state. Before compiling your “just in case folder” and appointing a financial executor, review the guidelines and restrictions of your state.

While nobody likes to think of a future where they need a “just in case” folder, being prepared does not mean that you are throwing in the proverbial towel. Good financial hygiene is not just for the fatalistically inclined, but rather, it’s a mark of solid organization and planning that’s beneficial for all people regardless of what stage of life they are in.

Step 3. Designate a financial executor

Once you have organized your financial assets, you’ll need to designate a financial executor. An executor is an individual you trust to oversee your finances in the event that you’re unable.

It is important to give this individual directions for how to access your “just in case” folder when needed. Choosing a person in your life who you trust to be your financial executor cuts through much of the red tape surrounding Terms of Service Agreements and allows your loved ones quick access to your digital assets. This is critically important in cases of emergency or death because it can prevent accidental delinquency on bills and loan payments, and is also a good form of protection against identity theft.

In fact, the risk of identity theft after death is so pervasive that it has garnered a nickname: ghosting. If you or a loved one dies unexpectedly, family members could have difficulty identifying and closing all digital assets associated with the deceased. When this happens, it opens the door for fraudsters to “ghost” your identity to open new accounts in your name. Roughly 2.5 million people a year fall victim to ghosting, and without a comprehensive list of all your accounts, it could be hard for your executor to pinpoint fraud until it has already occurred.

Final Thoughts

You can think about the practice of maintaining your financial hygiene the same way you look at saving for retirement. Sure, it’s not fun to put money away every month when you (probably) won’t touch it for years, but it’s the responsible way to ensure that your future is secure. By taking the time to understand your current financial standing, organizing your digital assets in a “just in case” file, and designating a financial executor, you improve your financial hygiene and decrease your risk of falling prey to fraud in an emergency situation.

Related Articles