Moving expenses deduction for job change

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

Dear Tax Talk,

I relocated and started a job in February 2014. I incurred all moving expenses twice. I moved to Orlando, Florida, from Weatherford, Texas, by myself on Valentine’s Day. I lodged in extended stays until we purchased a home in late June. I flew back to Texas and moved my family in late July. We used a moving company to haul our personal effects to our new home.

I have several questions:

- Can I deduct for my vehicle mileage on my initial trip to Orlando?

- Can I deduct for four months of extended lodging prior to purchasing a house, or is this considered rent?

- On the second trip to Florida, I drove a second car and my spouse drove a truck to our new home. Do I have to itemize the separate mileage?

- Will I have to wait to claim all moving expenses on my 2015 tax return? Or can I submit separate claims for each move?

Let me know about the moving expenses deduction for a job change. I have begun to gather all documentation since the April 15 tax deadline is approaching.

— Jody

Dear Jody,

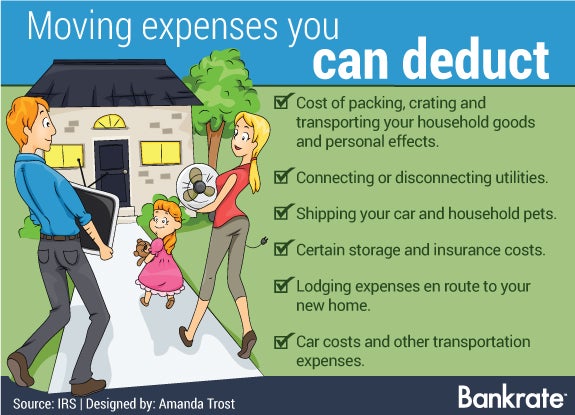

If you meet the time and distance test requirements of the IRS, you can deduct your moving expenses. That includes transportation and storage of household goods and personal effects, and travel from your old home to your new home, including your lodging along the way. The expenses are deductible on your 2014 Form 1040.

Since you are an employee, the time test is met if you work full time for at least 39 weeks during the first 12 months after you arrive where your new job is located. Additionally, your move meets the distance test, as your new job location is at least 50 miles farther from your former home than your prior job was from your former home.

Generally, within the first year of starting work at your new location, you can include expenses that are incurred for the cost of moving your household goods and personal effects and traveling to your new home. This does not include your four months of extended lodging. However, you can include the cost of disconnecting and reconnecting utilities, packing supplies, and up to 30 consecutive days of storage and insurance expenses after your belongings are moved from your old home and before they are delivered to your new home.

Yes, you can deduct your initial trip either using actual costs or the 2014 mileage rate of 23.5 cents per mile. However, you can deduct only one trip per person, including yourself, so keep that in mind.

I am glad to hear you are gathering your documentation because it is important if the IRS has any questions when you submit your return. Make sure you have your receipts, invoices, credit card statements and a mileage log, since you were driving your vehicles to your new home. You will deduct the expenses on Form 3903, Moving Expenses, on your 2014 Form 1040, as it seems that is when they were all incurred.

Thanks for the great questions and all the best to you in 2015.

Ask the adviser

To ask a question on Tax Talk, go to the “Ask the Experts” page and select “Taxes” as the topic. Read more Tax Talk columns.

To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. Taxpayers should seek professional advice based on their particular circumstances.

Bankrate’s content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. The content is broad in scope and does not consider your personal financial situation. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Please remember that your use of this website is governed by Bankrate’s Terms of Use.

Related Articles

Cryptocurrency taxes: A guide to tax rules for Bitcoin, Ethereum and more

Need to report cryptocurrency on your taxes? Here’s how to use Form 8949 to do it

Donor-advised funds: A popular tax-advantaged way to give to charity