How does the prime interest rate affect you?

Key takeaways

Key takeaways

- Credit card lenders add a margin to the prime rate to arrive at your card’s variable APR.

- The prime rate impacts the cost of credit on consumer loans, including credit card accounts, with the rates on consumer loans moving up or down with the prime rate.

- The prime rate is tied to the Federal Reserve’s target interest rate and is typically three percentage points above it

If you read your credit card’s fine print, you may have noticed something along the following lines: “This APR will vary with the market based on the prime rate.” What does that mean? And how does the prime interest rate affect you?

Most credit cards offer what is called a variable APR — that is, an annual rate of interest that varies over time as the prime rate changes. If the prime rate goes up, your credit card interest might increase by fractions of a percentage point. Likewise, if the prime rate goes down, it might drop a little.

What is the prime rate?

The prime interest rate, also known as the “U.S. prime rate” or “Wall Street Journal prime rate,” is determined by individual banks and it helps them decide how much interest to charge for consumer credit products like mortgages, personal loans and credit cards. In some cases, the prime rate is the actual interest rate offered to the most creditworthy applicants.

However, banks and credit issuers will often charge the prime interest rate plus a certain markup percentage based on the customer’s credit score and the type of product they are borrowing. The extra interest helps cover the cost of lending money and it also protects the bank or lender from consumers who default on their loans.

The current prime rate is 7.5 percent, but that doesn’t mean that people with prime credit should expect to only pay 7.5 percent APR on their credit cards. Credit card issuers determine interest rates using the prime rate as a baseline. Current credit card interest rates average around 20.09 percent. Even people with perfect credit scores will pay quite a bit more than the prime rate on their credit cards.

How does the prime rate affect your interest rate?

Most credit cards offer a variable interest rate (often called a “variable APR”) based on the prime interest rate. Credit card issuers will tack on a margin to the prime rate to determine your specific variable interest rate.

This means that your credit card APR can go up or down depending on the prime rate. Credit card issuers are not required to notify you when your variable interest rate changes due to a change in the prime interest rate, but don’t worry — in most cases, any adjustment to your interest rate will be minor. If your bank or lender wants to raise your credit card interest rate for other reasons, such as to issue a penalty APR after a late payment, they are required to give you 45 days’ notice.

Some mortgages and personal loans may also offer variable interest rates. If you don’t want the interest rate you pay on your mortgage or loan to change over time, you can shop around for a fixed-rate mortgage or loan. Fixed interest rates remain constant throughout the life of your loan, which means you’ll always know how much interest will be charged on your balance.

How the prime rate affects your credit card bills

The prime rate ultimately affects the base interest rate that the issuer will use to determine your final interest rate based on your credit score. So if you have poor credit and carry a balance from month to month, you can expect to pay more in interest compared to if you had a good or excellent credit score. A higher prime rate may tweak the amount you pay slightly up and a lower prime rate may tweak the amount down.

Of course, the prime rate has no effect on your credit card bills at all if you pay your balance in full each month. Since the prime rate only affects a card’s interest rate, it won’t make a difference to how much you pay provided you’re not accruing interest.

If you want to keep track of the way your variable APR fluctuates over time, pay attention to your monthly credit card statements and see if you notice any changes. You might see your interest rate go up or down by fractions of a percentage point, which represents the effect of the prime rate on your variable APR.

How is the prime rate determined?

The prime rate is generally three percentage points higher than the federal funds rate, which is a target interest rate range set by the Federal Reserve Board. This rate is used to determine how much interest banks charge each other when making overnight loans to fulfill reserve requirements.

All banks are required to have a certain amount of cash in reserve at the end of each business day to ensure that consumers can withdraw money from their accounts as needed. If banks need a little extra cash to fill out their reserves, they can borrow it from the Federal Reserve (or from another bank) at the federal funds interest rate.

When the Federal Reserve raises or lowers the federal funds rate, the prime rate usually responds accordingly.

The prime rate and the economy

As we’ve discussed, the U.S. prime rate is based on the federal funds rate, which is a target interest rate that the Federal Reserve aims for based on economic conditions. When the Fed wants to stimulate the economy, it lowers its target interest rate so that it’s easier for banks to borrow money. In turn, banks can make loans at lower interest rates, creating consumer and business demand for these loans and thereby stimulating the economy. For example, during the COVID-19 pandemic, the central bank took its target interest rate to a very low 0 percent to 0.25 percent range. This resulted in 30-year historic low mortgage rates below 3 percent for consumers.

Similarly, when the Federal Reserve aims to slow down the economy, it raises its target interest rate. This makes it more expensive to borrow money, thereby cutting down on demand and slowing down the economy.

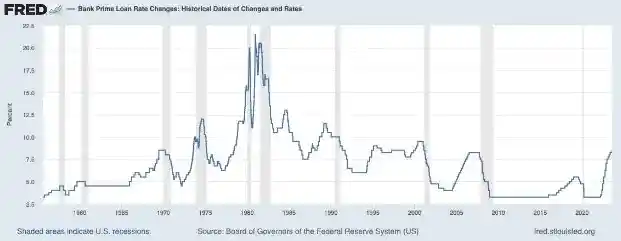

For instance, the Federal Reserve raised its target interest rate multiple times starting in March 2022, attempting to battle inflation and slow down the economy. That’s why the prime rate tends to move with economic conditions as the Federal Reserve adjusts its target interest rate.

The bottom line

The prime rate is the benchmark used to determine the interest rates you’ll pay on loans, credit cards and other lines of credit. When the prime rate changes, you might see a small increase or decrease in your variable interest rates. In most cases, however, you won’t even notice the change unless you read your credit card statements every month and compare your interest rates over time.

Your creditworthiness plays a more critical role in determining the interest rates lenders offer you. If you want to pay the lowest interest rates possible on your credit cards and loans, focus on building your credit score — not on what the prime rate is doing.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.