A beginner’s guide to digital wallets

Key takeaways

- Digital wallets allow you to make payments without a physical debit or credit card.

- Apple Pay, Google Pay and Samsung Pay are examples of popular digital wallets.

- You can store credit cards, debit cards, boarding passes, gift cards and more in your digital wallet.

- Digital wallets use encryption and tokenization to protect your data.

Digital wallets have become increasingly popular over the years — Apple released a digital-first credit card, “just Venmo me” has become a common phrase and you can even ride mass transit by simply holding your watch or phone up to the turnstile.

As of 2022, 89 percent of Americans have used at least one form of digital payment, and over two-thirds expect to have a digital wallet within two years, according to a study by McKinsey & Company.

For those still uncertain about using digital wallets for payments, here’s everything you need to know about what they are, how they work and why they’re a safe option.

What is a digital wallet?

Digital wallets are a way to pay from financial accounts via computer, smartphone or a smart device. They ultimately eliminate much of the need to carry around an actual wallet.

Apple Pay, Google Pay and Samsung Pay are probably three of the most popular digital wallets, but there are quite a few others. Some other popular digital wallets include PayPal and Venmo, both of which are uniquely social by allowing you to easily send money to retailers and friends.

Zelle is another popular option for digital payments that automatically comes with many bank accounts.

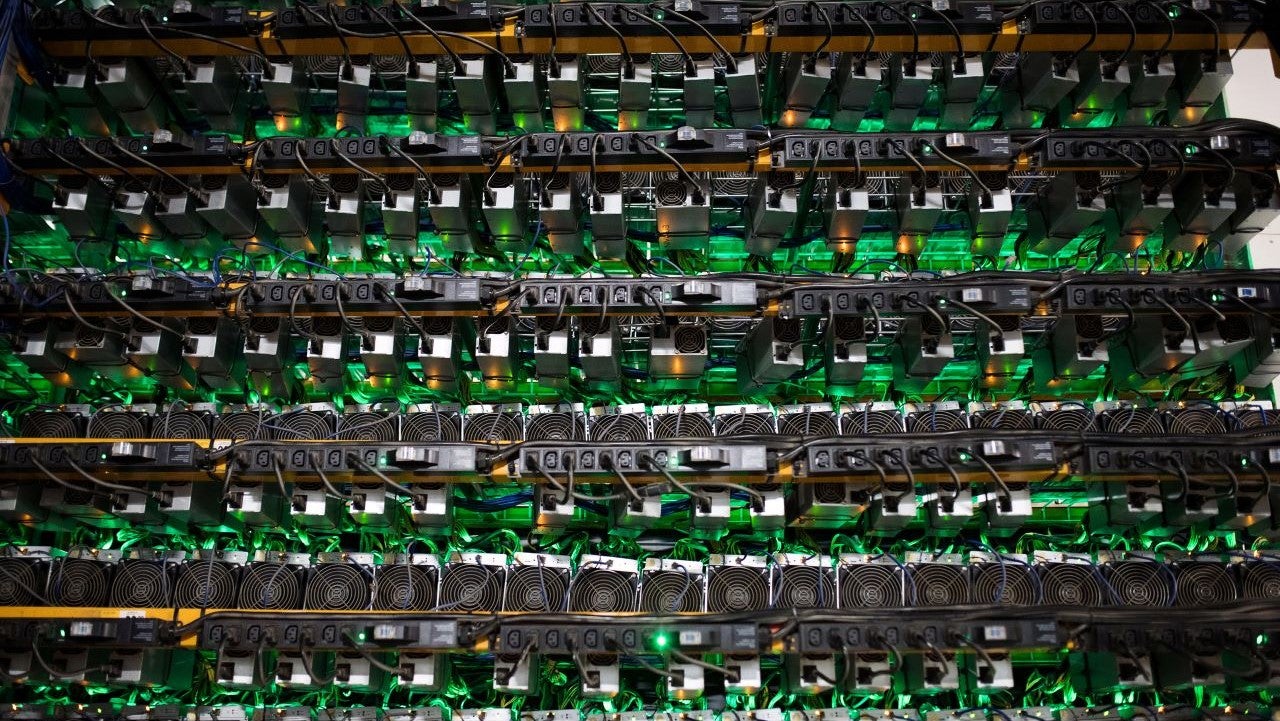

Note that digital wallets and crypto wallets aren’t the same thing. Whereas you’d generally use a digital wallet to make everyday purchases, a crypto wallet is often used to buy cryptocurrency.

How digital wallets work

Before using a digital wallet, you’ll need to enter your card information into the app or site of your choice. Your information will then be encrypted, and you will only be able to use the wallet when you unlock your device and authorize the wallet’s use.

Digital wallets use several different technologies to enable payments, including the following:

- Quick response (QR) codes: QR codes are unique codes, similar to barcodes, that some apps use to initiate payments. With this technology, you scan the code with your smartphone’s camera, and then authorize the payment using your digital wallet.

- Near field communication (NFC): This technology allows two devices to “speak” to each other, or transfer data, when they’re in close proximity.

- Magnetic secure transmission (MST): This technology uses magnetic waves to transmit data, similar to swiping a credit card’s magnetic stripe.

When using mobile wallets that use NFC and MST technologies, you generally need to hold your device within close range of the payment terminal. Look for the contactless payment indicator on the retailer’s point-of-sale system or card reader. The symbol looks like a sideways Wi-Fi icon.

When it comes to certain peer-to-peer payment apps, like Venmo or Zelle, you often can only send money to those with accounts with the same app. Not all retailers accept mobile payments. So while they can be convenient, digital wallets aren’t yet a complete replacement for physical payment methods.

What else can digital wallets do?

Not only are digital wallets great for simplifying payments, they are also a great place to keep other important documents organized and easily accessible.

Here’s what you can store in a digital wallet:

- Credit or debit cards

- Boarding passes

- Hotel reservations

- Concert tickets

- Gift cards

- Coupons

- Loyalty rewards cards

Many apps also offer their own digital wallets — particularly fast-food chains that also offer loyalty programs. Starbucks, for example, incentivizes customers to use the app by rewarding them with “stars” that can be redeemed for free drinks and other rewards. Starbuck gift cards can be uploaded and also reloaded with a debit or credit card.

Types of digital wallets

There’s a wide variety of digital wallets on the market. Here are some examples of popular digital wallets:

- CashApp

- Apple Wallet

- Samsung Wallet

- Google Wallet

- PayPal

- Venmo

- Zelle

Some of these digital wallets have unique features that set them apart. For example, Venmo acts like a social media network in that you can view and comment on friends’ transactions in addition to making or requesting payment. And Apple developed a credit card designed to be stored in and used with your Apple Wallet.

There’s also something called a closed digital wallet, which only supports payment to the wallet issuer. Walmart Pay is an example of a closed wallet since you can only use this digital wallet for purchases at Walmart.

Because different types of digital wallets offer different features and uses, you may use more than one.

Are digital wallets safe?

A common hesitation with digital wallets is the concern over safety and security. What happens if your phone gets stolen? Can hackers easily steal your information? Will you be putting your finances at risk?

The answer is no. Digital wallets are actually more secure than physical cards, because mobile payments are heavily encrypted and tokenized, meaning that none of your actual card or account numbers are stored within the digital wallet.

But how does that work?

When you add your personal information into a digital wallet, that data is then converted into a unique code via encryption that can only be accessed by authorized entities.

Digital wallets go a step further by also adding in tokenization, which takes that sensitive encrypted data and replaces it with a non-sensitive digital equivalent known as a token. These unique tokens are randomly generated every time a user makes a payment and only the merchant’s payment gateway can match this token to accept the payment.

Ultimately, your information is useless and unreadable to fraudsters when encryption and tokenization are used together. Even if a particular retailer you shopped at is hacked, your personal payment information is still protected, due to the multiple layers of protection.

Contactless, digital payments are generally safer than paying using a physical card’s chip or magnetic stripe, not only because of the tokenization technology, but also because of the requirement for authentication. If someone steals your card, it’s much easier for them to use it — but with a digital wallet, there are often added layers of security, whether it’s a fingerprint scan, facial recognition or password protection.

Pros and cons of digital wallets

Pros:

- Convenience: It’s more convenient to carry around and frees up pocket space, since it’s accessible from your device. Plus, you can store multiple types of cards in the digital wallet.

- Extra backup: You can still make payments at most retailers if you forget your wallet.

- Safety: Digital payments have the added protection of data encryption and tokenization, making them safer in many ways than traditional debit or credit card transactions.

Cons:

- Some limits on where you can use it: Not every retailer or person you want to send money to accepts payments from digital wallets, or may not have the technology in place yet to do so.

- It relies on your device: If the device your digital wallet is stored on runs out of battery, or you lose access to it for whatever reason, that means also losing access to the digital wallet.

Bottom line

Digital wallets offer consumers a convenient, efficient and secure method for virtual payments, tickets, gift cards and more. While it may not be time to ditch your physical wallet just yet, we will likely continue to see an increase in adoption by U.S. consumers and merchants as consumers become more comfortable with contactless and digital financial services.

–Freelance writer Emily Batdorf contributed to updating this article.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.