Bitcoin: A beginner’s guide to the world’s largest cryptocurrency

Bitcoin is one kind of digital currency or cryptocurrency, a medium of exchange that exists exclusively online. The currency broke into mainstream consciousness in 2017 — as its price ran up thousands of dollars over the course of the year — and it now sports a market cap of more than $2.1 trillion, making it the most valuable and popular cryptocurrency by a huge margin. Bitcoin was created to act as a digital form of payment that eliminates the financial middleman (for instance, a bank).

More recently, after plummeting massively in 2022, the crypto soared in late 2023 and 2024 with the approval of Bitcoin ETFs and the reelection of crypto-friendly former President Donald Trump. Prices surged again in late 2024 before eventually hitting all-time highs in May 2025.

Bitcoin has created much controversy, from proponents who say it’s the future of currency to those who decry it as a speculative bubble. Here’s what you need to know about Bitcoin, how it works and some of its drawbacks.

The basics of Bitcoin: What it is and how it works

Bitcoin debuted in 2009, when the software underpinning the currency was released. Its origins are a bit mysterious, however, and a person (or perhaps group) known as Satoshi Nakamoto claims the credit for unveiling the cryptocurrency.

The price of Bitcoin has been on a roller coaster since the digital asset’s debut, rising and falling throughout the 2010s before soaring during the COVID-19 pandemic. Bitcoin fell sharply during 2022 as the Federal Reserve hiked interest rates, but it has since recovered and reached new highs in 2025.

Bitcoin operates on a decentralized computer network or distributed ledger using blockchain technology, which manages and tracks the currency. Think of the distributed ledger like a huge public record of transactions taking place in the currency. The networked computers verify the transactions, ensuring the integrity of the data and the ownership of bitcoins, and they’re rewarded with bitcoins for doing so, though the rewards decline over time.

This decentralized network is a huge part of the appeal of Bitcoin and other cryptocurrencies. Users can transfer money to each other, and the lack of a central bank to manage the currency makes the currency almost autonomous. This autonomy means that the currency, at least theoretically, can avoid the interference of governments and central banks.

Bitcoin can operate mostly anonymously. While transactions might be traceable to certain users, the person’s name is not immediately tied to the transaction, even if the transaction is processed publicly. However, authorities have become better at tracking the movements of bitcoins, because the ledger of bitcoin transactions is publicly available.

How bitcoins are created

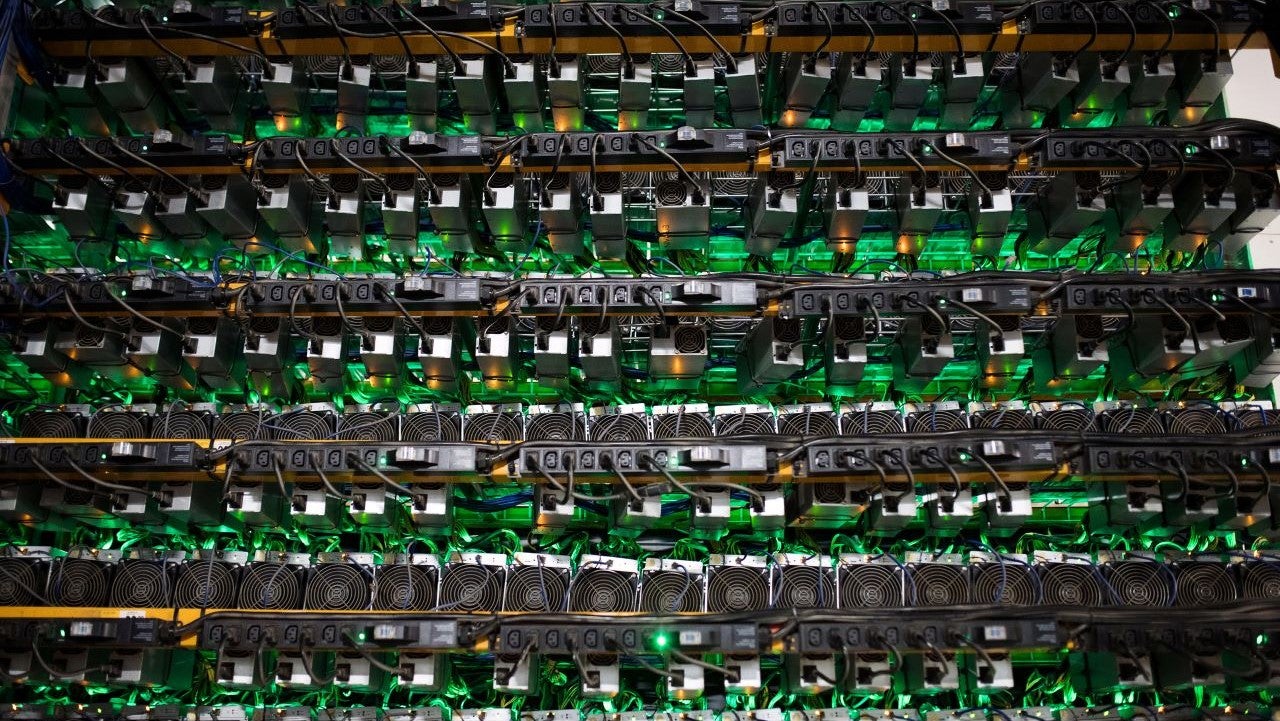

Bitcoins are created, or “mined,” when computers on the network verify and process transactions in the currency. Some computers called miners are specially outfitted with high-powered processors that can chew through transactions and earn a part of a bitcoin. So Bitcoin requires a lot of processing power to maintain the network and a lot of electricity to run those computers.

Bitcoins aren’t created infinitely, however, and the currency is limited to 21 million whole units. Experts expect the remaining number of bitcoins to be mined out around the year 2140. When this occurs, miners will be rewarded solely with a fee for processing transactions.

While the number of bitcoins may be limited, each whole bitcoin can be split into much smaller units. In practice, bitcoins are divided into fractions of a coin to facilitate payments of very small amounts of real currency. A bitcoin can be officially divided into as many as one hundred million parts, which are called satoshi in honor of the mysterious founder.

Bitcoin is just one type of cryptocurrency, and literally thousands more have been created. Some of the most popular include Ethereum, Solana and XRP.

How to use Bitcoin

Bitcoin’s original purpose was to function as a decentralized digital currency. While it’s arguable whether the cryptocurrency has actually achieved that aim, some still use it to make payments. On the other hand, there are traders who view Bitcoin as more of an investment opportunity, sometimes even making speculative bets on where its price will head.

Here’s a closer look at some of the most common ways Bitcoin is used:

- Investing

-

Some investors use crypto to enhance their portfolio’s value by buying and holding individual coins, buying shares of a Bitcoin ETF or buying shares of companies that are involved with Bitcoin in some way, like mining.

- Payments

-

Users can hold and spend bitcoins via a cryptocurrency wallet. A wallet is like a personalized location on a distributed ledger that refers to only your currency holdings. If you receive Bitcoins, your wallet will give a cryptographic address to the sender. To spend a bitcoin — say, at a store — you would scan the store’s QR code or send the funds to its public address.

- Speculating

-

Rather than focusing on long-term portfolio growth over time, some investors (and even some companies) will use short-term price movements to place bets on where Bitcoin’s price is headed. Examples of this include short-term, high-risk trading strategies like options on Bitcoin ETFs or Bitcoin futures, which magnify exposure to Bitcoin’s price movements.

Advantages of Bitcoin

Bitcoin has some advantages as a currency and is popular for many reasons, ranging from the utopian to the capitalistic.

1. Decentralized currency management

Through its decentralized network and limited number of coins, Bitcoin promises a kind of utopian version of currency. Proponents say that by getting central banks and governments out of the currency game, the currency will maintain its value better over time. By extricating these entities, some say that Bitcoin returns power to the people.

2. Anonymous or semi-anonymous transactions

The relative anonymity of Bitcoin is also a huge feature for many. Some proponents (such as certain libertarians) like that the government or other authorities cannot easily track who uses the currency. However, such anonymity means that the currency can also be used for criminal activities.

It’s worth noting that every transaction is tracked and can be used to reconstruct a given wallet’s spending. It’s all public, allowing any entity to track spending, creating further privacy concerns, even if it’s finally unclear who owns a given wallet.

3. Hard or impossible to counterfeit

Bitcoin’s popularity is also due to an entirely practical matter, though: It’s tough to counterfeit due to the blockchain ledger system that verifies transactions over and over.

4. Surging popularity

Bitcoin is also popular because the hype surrounding the cryptocurrency has made it a trendy trading vehicle. Because the value of the currency fluctuates so much, traders can jump in and make (or lose) money and can now do so even more easily using exchange-traded funds. This hype and the limited nature of coins has driven the price of bitcoins much higher over the last decade, though it continues to fluctuate significantly.

More recently, Bitcoin IRAs have also become popular, and have even been introduced by huge brokerage companies like Fidelity.

Disadvantages of Bitcoin

Bitcoin suffers from some significant drawbacks that are intrinsic to its design, notably its limit on the number of coins in circulation and its general volatility.

1. Bitcoin is an energy hog

Big computer miners require a lot of energy to operate. Producing the electricity is expensive and pollutes the environment, for what some detractors say is a currency project with little feasibility.

Just how much electricity does Bitcoin use and how much greenhouse gas does it emit? According to the Cambridge Bitcoin Electricity Consumption Index, if Bitcoin were a country, it would rank as the 24th highest user of electricity as of June 2025. It would rank 61st in terms of its greenhouse gas emissions. Those are huge numbers for a rarely used digital currency.

2. The number of coins is limited

By its very nature, the number of coins is limited, and that poses a serious problem for using Bitcoin as a currency. In effect, this limit does not allow the money supply to be increased, which is valuable when an economy experiences a recession. If used throughout an economy, Bitcoin could create destructive deflationary spirals, which were more common when economies ran on the gold standard. In fact, this concern is a key reason why the gold standard was eliminated.

A challenging situation arises when consumers and others hoard currency during tough economic times. When money doesn’t flow, it slows the economy. Without a central authority such as a bank to stoke the economy or offer credit, the economy could move into a deflationary spiral. So consumers don’t spend because goods will be cheaper tomorrow, creating a destructive situation.

With a fixed number of units, Bitcoin doesn’t provide the flexibility needed to manage a systemwide currency.

3. A volatile currency is useless

Imagine going to a restaurant where the prices moved up or down every day, sometimes by 10 percent or more. If this sounds like an unattractive prospect, then it’s exactly what makes Bitcoin virtually useless as a currency. While volatility makes Bitcoin attractive for traders, it renders it all but worthless as a medium of exchange.

Consumers need to know what a currency can buy when they make spending decisions. If they expect the currency to rise — or even skyrocket — there’s little incentive for them to use it as currency.

4. Government regulations and policies

Crypto regulation varies from country to country, and even from state to state in the U.S. States like Wyoming are leading the way with crypto-friendly policies. Federal regulation also varies between agencies. For example, the IRS defines crypto as property; the SEC defines it as a security.

Under the current Trump administration, the crypto industry has experienced a burst of optimism, partially propelled by the announcement of a national strategic Bitcoin reserve. Meanwhile, there are discussions surrounding how to include crypto across broader financial systems, like tokenized Treasury bonds, which may end up signaling a shift toward broader adoption of digital assets.

The need for regulation, however, remains important, especially after high-profile blow-ups in recent years, like TerraUSD, a stablecoin that was meant to hold a fixed value. The 2022 collapse of crypto exchange FTX also sent shockwaves through the crypto industry.

5. Any transaction is reportable to the IRS

The laws surrounding cryptocurrency are onerous for consumers, making it tough to use.

The IRS now requires you to declare on your annual tax return if you’ve had transactions in a cryptocurrency in the current tax year. And if you sell crypto assets or buy something with one, you could create a tax liability. So you’ll need to keep clear records of your buy and sell prices if you’re using the digital currency, lest you run afoul of the law and run up a tax bill.

Here’s the full rundown on what you need to know about cryptocurrency taxes.

Bottom line

While Bitcoin has captured the public’s attention, it has serious drawbacks that make it difficult to achieve the stated mission of being a medium of exchange or even a store of value. In fact, one of the world’s greatest investors, Warren Buffett, called the currency “probably rat poison squared” in 2018. Buffett has said that it’s not the kind of thing he considers an investment. Add on the fact that governments could potentially shut down the currency, and it’s a risky investment at best. Still, if you’re looking to get started trading cryptocurrency, here are the key things you need to know.

—Bankrate’s Brian Baker, CFA, and Logan Jacoby contributed to an update of this article.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

Up next

We appreciate your feedback

Thank you for taking the time to share your experience.