The Fed’s crisis playbook: 7 ways America’s recession fighters can battle a floundering economy

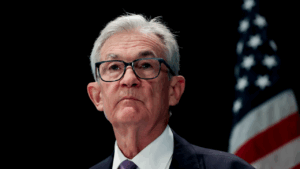

The Federal Reserve is a key first responder when the U.S. economy faces a crisis, as has been illustrated by the ongoing coronavirus pandemic and its devastating effects on Americans’ health and financial wellbeing.

Recessions call the Fed to action; they’re the key threat against the Fed’s two goals of maximum employment and stable prices. In the Fed’s arsenal, it has a broad array of tools to prop up the financial system and stabilize market functioning — steps that include the traditional response of cutting interest rates but also some unconventional steps, such as buying government-backed debt in a program now known as “quantitative easing.”

“The Fed’s toolbox is more like a tool ‘shed’ these days,” says Collin Martin, managing director and fixed income strategist at Schwab Center for Financial Research. “While the tools used during the financial crisis generally focused on zero interest rates and bond buying targeted at Treasurys and agency mortgage-backed securities, the Fed introduced tools to help corporations, municipalities and even small businesses.”

Here’s everything you need to know about the Fed’s crisis playbook, including what’s in it and how it impacts the economy.

The main policy tools in the Fed’s crisis playbook

1. Slash interest rates to as low as near-zero

When the U.S. economy enters a downturn, the Fed’s first response will most likely be cutting its benchmark interest rate known as “the federal funds rate.” Fed officials can either walk down those rates gradually or take them down all the way to zero in one big, dramatic cut when it finds that a more severe crisis is on its hands, such as what happened at the start of the coronavirus pandemic.

When the Fed cuts that target rate, it means most borrowing costs for things like home equity lines of credit (HELOCs), credit cards and auto loans will fall, as will the income that most savers get on products including savings accounts and certificates of deposit (CDs).

The idea is, a lower federal funds rate will prompt consumers and businesses to perhaps make those borrowing decisions that they’ve been putting off, providing a booster shot to growth. In times of severe strain, cheaper borrowing rates may also help keep businesses afloat, guaranteeing them the cheap loans that they may need to take out to survive a crisis that’s no fault of their own.

The Federal Open Market Committee (FOMC) is the sole arbiter over whether to raise or lower interest rates in the U.S.

2. Purchase Treasury and government-backed mortgage securities, sometimes called “quantitative easing”

What was once considered unconventional, asset purchases have now become a mainstay for the Fed’s past two recession responses, starting first with the Great Recession of 2007-2009 and then continuing with the coronavirus pandemic in 2020. In fact, the same day the Fed last cut interest rates to zero on March 15, it also announced a massive bond-buying program.

The Fed most often purchases Treasury securities and mortgage-backed securities but can also include commercial mortgage-backed securities in the mix. As directed by the FOMC, the New York Fed purchases those assets on the open market from the primary dealers with which it’s authorized to make transactions. The Fed then credits banks’ accounts with cash in an equivalent value to the asset that it purchased, while the securities then go on its balance sheet.

Asset purchases serve two main goals: Restoring market functioning and putting downward pressure on the longer-term rates not directly linked to the federal funds rate, such as mortgages. Those purchases also increase the money supply, effectively making the cost of money even cheaper.

The more securities the Fed purchases, the larger an effect it will have. And typically, the further out the maturity, the more of a stimulative effect on the economy purchasing it will have. When the Fed wants its asset purchases to have a stimulative effect, you’ll likely hear central bankers and other experts call it “quantitative easing.”

By law, the Fed is limited to purchasing assets that are government-backed, though it can take special steps to get around those measures.

3. Create emergency lending programs with congressional approval

One of the ways to get around those purchasing limits is granted by Congress, through Section 13(3) of the Federal Reserve Act. With permission from the U.S. Treasury and a layer of start-up funds that act as security, the Fed can create a special purchase vehicle (or SPV) that it pours money into. Those SPVs, in turn, are used to purchase the assets that aren’t government-backed, such as municipal or corporate debt. In a sense, it’s like the U.S. central bank is opening up a new credit card.

So far with the coronavirus crisis, the Fed has created 13 different programs. A few were revived from the 2008 era, such as the U.S. central bank’s efforts to help backstop money market funds with the Money Market Mutual Fund Liquidity Facility (MMLF), which loans money to banks in exchange for assets that they purchased from prime money market funds as collateral.

Others are entirely new endeavors, such as the five different Main Street Lending program options for nonprofits and firms with up to 15,000 employees or no more than $5 billion in annual revenue. In these instances, banks underwrite the loans and then sell a 95 percent stake back to the Fed.

“Early on in the crisis the central bank stepped in to support the flow of credit to businesses and state and local governments, ensuring that an inability to access funds did not cripple the economy,” says Gus Faucher, chief economist at PNC Financial Services Group.

4. Roll back regulations: Bank reserve requirements, dividend payments, stock buybacks and ending some regulations that limit depositors

The Fed can also temporarily revoke some key banking regulations, some of which indirectly and directly impact depositors. They appear simple, but they can still be powerful.

The Fed in April, for example, lifted “Regulation D,” a rule that prevents consumers from making more than six withdrawals or deposits from certain savings accounts. That was to give depositors more direct access to the cash they have lying around in their financial portfolio.

That also looks like eliminating banks’ reserve requirements — the cash that banks are normally required to keep in accounts at the Fed — and prohibiting stock buybacks and dividend payments for the nation’s largest banks. All of that is simply designed to make sure that a bank has more money to lend out, thus increasing the available supply of credit in the economy.

5. Adjust interest rates and loan terms for “discount window” borrowing

Normally, banks in need of more cash to underwrite new loans while still covering their consumers’ deposits will choose to lend back and forth to other financial institutions on the market. But in some times of economic distress, when banks are hesitant about letting go of their funds, the Fed will step in through a program called the discount window. That’s where the Fed lends directly to financial institutions experiencing a cash crunch.

The discount window is always open, though banks are typically charged a heftier fee when they borrow directly from the Fed (the primary rate is typically 50 basis points higher than the fed funds rate, while the secondary rate is 1 percentage point higher). That’s to incentivize intermediation between banks.

But in times of distress, the Fed will choose to reduce that interest rate to be in line with the federal funds rate. U.S. central bankers may give firms a longer time period to pay those funds back — what’s currently 90 days, as it was during the 2008 financial crisis, rather than overnight.

6. Ramp up involvement in the repurchase (repo) market

Another corner of the financial system, the repurchase agreement (repo) market is where firms trade trillions of dollars worth of debt for cash each day, typically in the form of overnight loans. When this market faces turmoil, it can pose grave consequences for the fed funds rate, causing that benchmark rate to trade higher than the Fed’s desired target range, illustrating why the Fed wants to get involved in times of crisis.

During a crisis, the Fed can make cash available to the primary dealers in the repo market in exchange for Treasurys and other securities, which are used as collateral to help finance the loan. It’s just another way of ensuring the credit keeps flowing throughout the economy — and they have to be paid back, fast.

7. Forward guidance and other public comments

Last but not least, U.S. central bankers can turn to its communication strategy as a way of pushing down interest rates — and by some measures, it might be one of the most powerful tools of all. These steps are often called “forward guidance.”

When the Fed is vocal about not raising interest rates, that can often influence what households, businesses and investors alike decide to do with their money. Baked into the 10-year Treasury rate, for example, is an expectation about where inflation and other borrowing rates may be over a certain period of time. If market participants don’t see rates rising, those new investing decisions that they make will often help to keep borrowing low.

Another common tool is known as the Fed’s “dot plot” chart, which is a graphical representation of where officials expect interest rates to be over a three-year period. Other forms of forward guidance appear in Fed officials’ public speeches, post-FOMC meeting statements, records of previous meetings and press conferences.

How the Fed’s toolkit stimulates the economy

With the exception of cutting interest rates (which is mainly only used to stimulate growth), most of the Fed’s crisis toolkit is multi-faceted, meaning it serves multiple objectives: spurring business activity, stabilizing market functioning and increasing the availability of credit in the economy.

Asset purchases, for example, do all three, as was illustrated by the coronavirus pandemic. Investors in March were flooding en masse to safe-haven assets, dumping Treasury securities in the quest for cash. But they were having a hard time finding other investors who were willing to pay for those securities, even at low prices. That not only made it harder for market participants to offload debt, but it also complicated the picture for the banks and financial firms using the 10-year Treasury yield as a benchmark for other loan products. The disruption pushed interest rates on those loans higher than where the Fed wanted it to be and also made it harder for firms to underwrite new loans.

The Fed then stepped in to start purchasing those assets. The main goal was to restore market functioning, but it also helped ensure that interest rates were in the target range where U.S. central bankers wanted them to be while also helping banks feel more confident about lending out cash.

When it comes to creating the 13(3) emergency lending facilities, many companies were also able to secure funding without the Fed even spending a cent, simply because investors saw the Fed as providing a backstop to financial markets.

All of those steps highlight the dual nature of the Fed’s recession-fighting playbook. Ensuring that interest rates are low and borrowing is cheap is only half of the problem. The Fed also wants to make sure that credit is widely available and that hard-hit firms and consumers have access to cheap loans.

Limits of the Fed’s crisis toolkit

But that’s not to say the Fed’s toolkit is limitless. Low interest rates and credit helps a sputtering economy, but it’s not a panacea.

Take the pandemic, for example: The Fed may be able to guarantee cheap loans, but it doesn’t have the power to stop the virus from spreading, nor can it manufacture demand so firms will hire more workers or consumers will spend more money.

Most say that’s where fiscal policy comes in, complementing the Fed’s traditionally “blunt” instrument by directing aid money directly where it’s needed.

What are the possible consequences of the Fed’s actions?

Experts have long speculated that increasing the money supply by way of asset purchases could lead to inflation down the road. The Fed’s balance sheet increased more than 700 percent since the global financial crisis more than a decade ago, rising to $7.18 trillion as of Nov. 12 from $870 billion in July 2007. So far, however, inflation has registered lower than where officials want it to be.

Others criticize the Fed for favoring Wall Street over Main Street, with loans inherently easier and more attractive for the financial system’s largest firms and banks rather than mom-and-pop shops. Experts also spell concerns about intervening too much and allowing even the riskiest of companies to survive.

“For better or for worse, the Fed’s facilities allowed risky companies to issue debt,” Martin says. “While it likely kept many companies from defaulting, these facilities risk giving investors a false sense of security — that during times of distress, the Fed might always be there to help backstop certain parts of the market. That can make it difficult to effectively price risk and can negatively impact investors if the tide turns but the Fed is no longer available to help.”

Bottom line

The Fed’s toolkit is expansive. While the Fed isn’t capable of solving every problem, it illustrates that the U.S. central bank has a lot more in its back pocket than just the ability to reduce interest rates.

But just as the Fed tiptoed into uncommon territory with quantitative easing in 2008, and returning to it again in 2020, there’s also a risk that the Fed might find it challenging to walk back its accommodative support measures.

“Now that the Fed’s toolbox includes risk assets, there is a new precedent for managing economic shocks going forward,” says Adam Coons, CFA, portfolio manager at Winthrop Capital Management. “This new regime has opened the door for further intervention into our capital markets, blurring the lines of what capitalism is.”

Learn more:

- Negative interest rates, explained — and how they work

- What is economic stimulus and how does it work?

- The Federal Reserve’s board of governors, explained — who’s on it and what they do

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.