6 investment formulas for financial success

Important financial formulas for investors

The financial world can seem complex, but many of the concepts are more simple than they first appear. Understanding your income and expenses, and figuring your investment returns can help you get control of your financial life. These six formulas can help you better understand your financial life and lead to better decision-making.

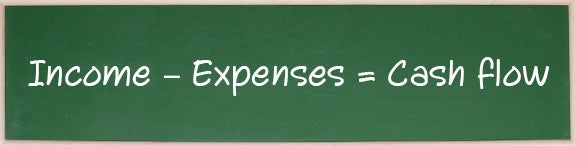

1. Cash flow

It’s hard to understand how much you’re saving until you know what cash is coming in and going out. This straightforward cash flow formula is key to your success.

Cash flow = Income – Expenses

A negative cash flow means you’re spending more than you bring in. This may deplete your savings or increase your debt. A positive cash flow indicates that you’re living within your means. If the result is a negative cash flow, you can take steps to reduce your expenses or seek additional sources of income.

“Knowing if there is potential leftover income could be helpful in terms of thinking about extra savings you can make to grow a nest egg,” says Jeffrey Golden, a financial planner with Circle Advisers in New York. “What I’ve come to discover is that people who do not have a good sense of their cash flow underestimate their ability to save.”

To get the most accurate picture of your expenses, calculate your cash flow over a number of months and don’t forget to include occasional expenses such as property taxes, auto insurance and vacations, as well as unscheduled (but not unexpected) expenses like that co-pay for the doctor or birthday presents for your family.

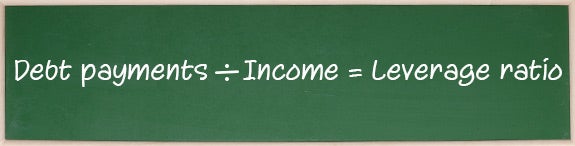

2. Leverage ratio (2 formulas)

The term “leverage” means the use of borrowed capital — debt. Most people use leverage to buy a house — that’s why you have a mortgage. So, leverage in and of itself isn’t a bad thing. It’s when your debt is too great in proportion to your income where you can get into trouble.

Here you need to compare similar time frames, so if you’re looking at your monthly debt payments, you need to use your monthly income as the divisor. A common rule of thumb says that your leverage ratio (including mortgage, car loans, etc.) should be no more than 33 percent of your income.

Stephen Lovell, president of Lovell Wealth Management, a registered investment advisor, says the leverage ratio is also useful in determining your coverage ratio. That is to say, how many times can you cover your debt per month? For example, if your total debt payment per month is $1,000 and your monthly income is $4,000, then that’s a good ratio — you have 4 times the coverage.

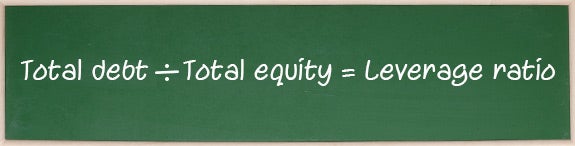

You can also find the leverage ratio for your liabilities compared to your equity (rather than income). Equity, simply put, is your ownership interest. For example, if your house is worth $200,000 and you owe $50,000, then you have equity of $150,000 in the house.

Using this leverage ratio “lets you know how much risk you currently have,” says Lovell. It’s a quick way to see how at risk your debt is, a calculation you may want to make before you take other financial risks, such as changing jobs or going back to school.

The lower the ratio, the better your overall financial health. Lovell points out that if you have fewer assets, you need to make sure your leverage ratio is lower. Someone with more assets can have a higher ratio, because they have more ability to pay down that leverage with the extra assets.

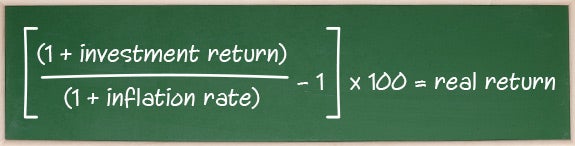

3. Inflation-adjusted return

You know that investments have to do more than keep pace with inflation for you to build wealth. As Golden says, “A dollar today is not worth a dollar in the future.” But how do you determine what your investment return is after inflation?

This equation helps you compute your real return, or your return adjusted for inflation. For example, if an investment returns 8 percent, and inflation is 3 percent, this is how you’d set up the problem:

[ ( 1.08 ÷ 1.03 ) – 1 ] x 100 = 4.85 percent real return

“You’re losing to inflation every year,” says Charles Sachs, a wealth manager at Kaufman Rossin Wealth in Miami. “Long term, inflation runs about 3 percent. So your money buys half as much in 20 years.”

In other words, leaving your money stuffed under your mattress creates a real risk that you’ll have significantly less purchasing power than if you had invested it. Calculating your real return helps you figure out what your future purchasing power is likely to be.

4. Calculate gains or losses

Say you’re invested in a blue-chip stock such as Walmart or Microsoft, and you’d like to know how much, in percentage terms, your investment has increased.

Using the formula, say you bought the stock at $60, and now it’s trading for $100:

( $100 – $60 ) ÷ $60 = 67 percent gain

If, on the other hand, you purchased a popular cryptocurrency such as Bitcoin near the peak, you’ve experienced a decline in value. Figuring out exactly how much you’ve lost requires a slight change to the formula:

( Purchase price – Market price ) ÷ Purchase price = Percentage decrease

Suppose you bought Bitcoin at $60,000 and it’s now selling for $30,000:

( $60,000 – $30,000 ) ÷ $60,000 = 50.0 percent loss

5. Rule of 72

The “Rule of 72” helps you quickly compare the returns from different interest rates, taking into account the effect of compounding. You’ll be able to quickly see how long it will take your money to double at any given level of return.

For example, if you take $10,000 and invest it at 5 percent, then this rule of thumb tells you it will take about 14.4 years to double your money.

“That helps people think about how long they’ll need to work. It makes a good starting point for evaluating your current situation,” says Golden.

Sachs cautions that there’s a drawback to focusing on return: “What if you met your target return but not your financial goals?” He suggests deciding on your goals first and then building a portfolio that can meet those goals with the least amount of risk.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

7 ways to manage financial stress and anxiety this holiday season

6 ways to avoid going broke in retirement

7 strategies to build wealth no matter your income