Parents have trouble saving because of mortgage payments, Bankrate survey finds

More than 1 in 3 mortgages has a “major impact” on the borrower’s ability to save. That number jumps to 51 percent for parents who have mortgages.

That’s according to Bankrate’s Money Pulse survey for February.

SEARCH RATES: Know how much you can comfortably borrow? Now find a great mortgage deal.

Mortgages affect savings

Asked, “How much of an impact does the size of your mortgage have on your ability to save money for the future?” 37 percent of respondents said their mortgage has a major impact. Another 46 percent said it has a minor impact on savings.

There was a big split between parents of children under 18 and everyone else: 51 percent of the parents with children said their mortgage has a major impact on savings, and 27 percent of everyone else said their mortgage has a major impact on savings.

“It’s probably not as much about the mortgage as it is that stage of life,” says Jonathan Smoke, chief economist for Realtor.com.

Homeowners with children are likely to be in their early 30s to their mid-50s, with competing financial goals: Keeping the kids clothed and fed and educated, saving for college, saving for retirement, paying the mortgage, maintaining the home.

Jim Sahnger, mortgage planner for Schaffer Mortgage in Palm Beach Gardens, Florida, recommends thinking of a mortgage payment as a form of savings.

“If you look at it from the aspect of you’re building equity, that’s obviously important,” he says.

Homeownership also shelters you from rent hikes and it might convey tax benefits, he says.

Figure out how much you can afford to buy using Bankrate’s mortgage calculator, and read how to buy a home while paying off student loans.

The homebuying age

Other results from the survey:

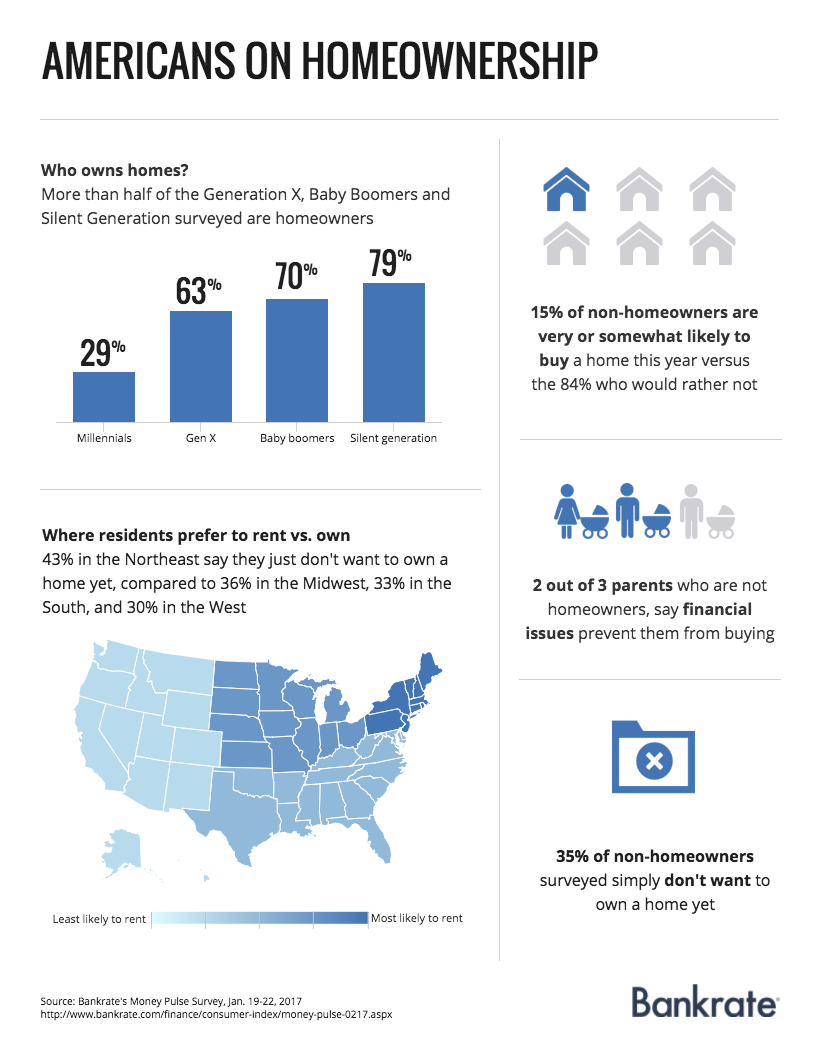

- 15 percent of Americans say they’re very or somewhat likely to buy a home this year.

- Older millennials and Gen Xers are the most likely to be in the market for a home.

- Among parents who don’t own homes, 2 in 3 say financial issues prevent them from buying.

Who is very or somewhat likely to buy a home this year? Here’s the age breakdown:

- Younger millennials (ages 18-26): 15 percent

- Older millennials (ages 27-36): 20 percent

- Gen Xers (ages 37-52): 20 percent

- Baby boomers (ages 53-71): 11 percent

- Silent Generation (72 and older): 4 percent

This doesn’t surprise Smoke at all. The dominant homebuying segment is people ages 25 to 34.

Regardless of generational labels, “if you had history going back 50 years, you would see this pattern is true in both good times and bad,” Smoke says.

People often buy their first homes shortly before or after children are born.

Kevin Hartman fits the pattern.

When he and his wife bought their first house, “I was 29 when we closed and not even a year back from my first deployment to Iraq. I was married to Andrea and we were pregnant with our first baby girl at the time. All three of our kids were born while we lived in that home since we lived there for six years.”

They sold that house in Salem, Oregon, a couple of years ago, and just bought a town house in Portland, Oregon.

SEARCH RATES: Found a home, even in a seller’s market? Comparison-shop mortgage rates today.

Reasons for not owning

In Bankrate’s survey, 56 percent of parents were homeowners and 41 percent were renters. Among those parents who are renters, just 18 percent said they don’t want to own a home yet. About one-third said they don’t own because their credit isn’t good enough, and another third said they don’t own a home because they can’t afford a down payment.

But you don’t have to have a big down payment. In fact, when Hartman closed on his Portland town house in late January, it was with a Veterans Affairs-guaranteed loan in which he didn’t make a down payment. (They had made a down payment on their first home — the one in Salem — for which they also got a federal VA loan.)

“The cost of living in Portland is such that saving for a down payment is challenging,” Hartman says.

And they wanted to keep their savings for emergencies.

Hartman says four sellers rejected his offers because the sellers didn’t want to endure the perceived hassle of a VA loan. It turned out that the deal went smoothly.

“I wish there was a way to make, without pulling on heartstrings, how to help sellers and Realtors understand the VA process. There’s nothing to be scared of,” he says. “If you can add the value of helping a vet, at least consider that.”

Perception vs. reality

Zero-down VA loans are one of the perks of being in the armed forces. In qualified rural areas, buyers can get zero-down loans guaranteed by the U.S. Department of Agriculture. Loans insured by the Federal Housing Administration are available with as little as 3.5 percent down, and some lenders offer mortgages with as little as 3 percent down for buyers with low to moderate incomes.

Read about five mortgages that require no down payment or a small down payment.

Smoke, the economist for Realtor.com, says people “are likely to tell you it takes 20 percent down to buy a home, when in reality it averaged 11 percent last year.”

It was even less for FHA and VA borrowers. In 2016, the average FHA buyer made a 4 percent down payment, and the average VA buyer put down 2 percent, according to Ellie Mae.

You don’t need perfect credit

Sahnger, the mortgage planner in Florida, says a lot of people with “credit events” turn out to have better credit scores than they expected. And he says there are ways to boost your credit score.

While it helps to have excellent credit when buying a home, it’s not necessary. In December, the average VA buyer had a 707 credit score, while the average FHA buyer had a 686 credit score, according to Ellie Mae. That FHA average score is mediocre. In contrast, the average credit score was 753 for buyers getting conventional loans.

SEARCH RATES: Shop for a mortgage to buy your dream home.

Methodology: Bankrate’s Money Pulse survey was conducted Jan. 19-22, 2017, by Princeton Survey Research Associates International with a nationally representative sample of 1,003 adults living in the continental United States. Telephone interviews were conducted in English and Spanish by landline (502) and cellphone (501, including 312 without a landline phone). Statistical results are weighted to correct known demographic discrepancies. The margin of sampling error is plus or minus 3.7 percentage points for the complete set of data.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.