Bankrate’s Be My Valentine Index finds the high cost of love

Nothing says love like a giant wad of cash, right?

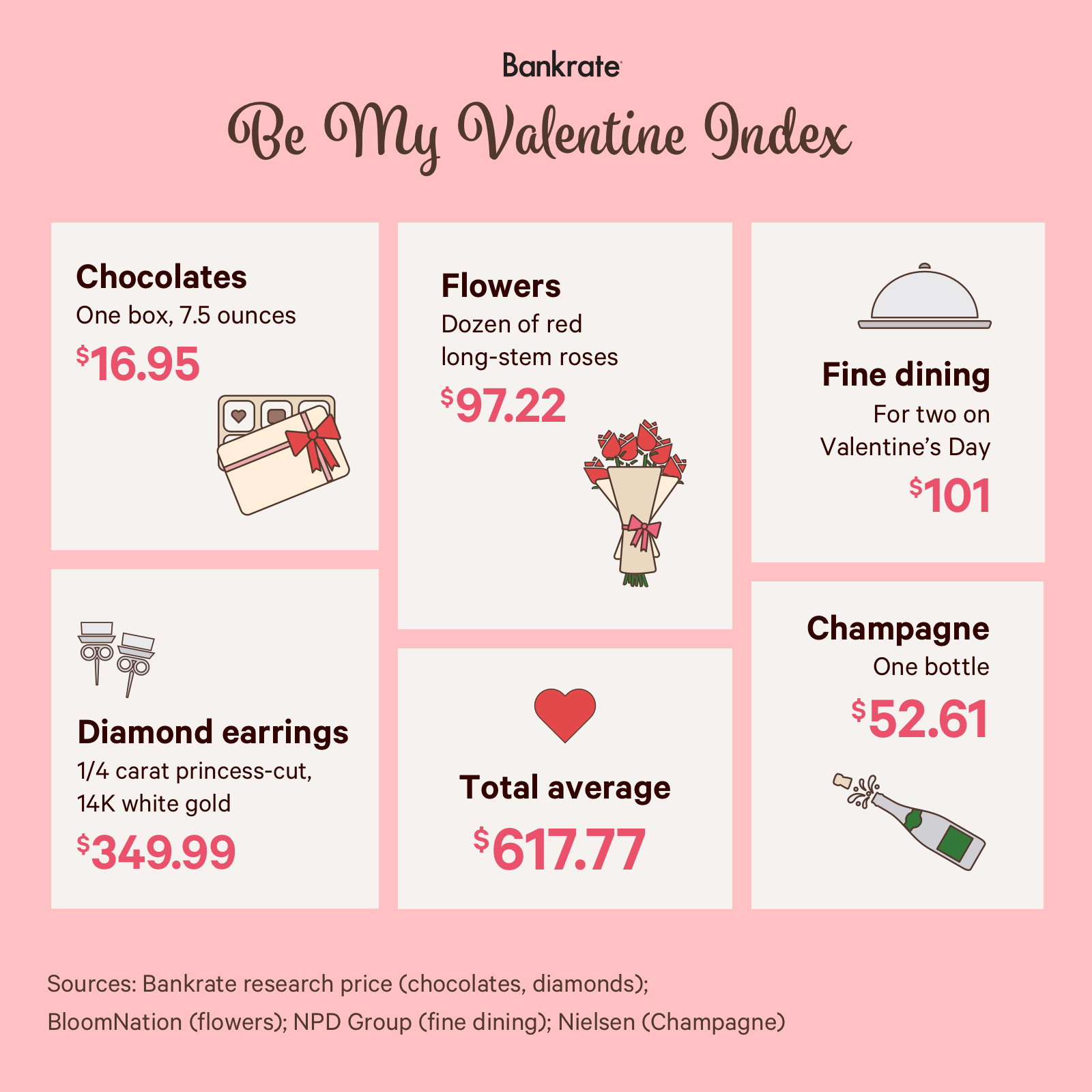

This year, Valentine’s Day could run the wallets of consumers dry. In total, an all-out celebration including chocolate, diamonds, roses, fine-dining and Champagne will cost consumers an average of $617.77, according to Bankrate’s 2019 Be My Valentine Index.

Prices tend to spike on a national holiday, including Valentine’s Day. Consumers are expected to spend $20.7 billion on Valentine’s Day this year, according to the National Retail Federation. That’s a 6 percent increase from last year’s projected $19.6 billion and breaks the previous record of $19.7 billion in 2016.

While expectations of Valentine’s Day vary by age, gender and location, one thing is for certain: Celebrating the holiday can become a pricy endeavor.

Prices have increased since 2017

To come up with the Be My Valentine Index, Bankrate collected data from NPD group, BloomNation and Nielsen to create a basket of popular gifts given on Valentine’s Day. Bankrate also conducted independent research to create the average.

Those with a sweet tooth will have to shell out big to satisfy their cravings: A box of chocolate will run consumers about $17. Much of the price increase can be attributed to an increase in the cost of cocoa. The Intercontinental Exchange reports cocoa prices are approximately 9 percent higher than last year, and while there are other costs that go into retail chocolate, consumers can still expect higher prices on Valentine’s Day.

A dozen long-stem roses saw a modest price increase of almost $3 since 2017, according to BloomNation. The price jump of roses around Valentine’s Day can be attributed to the high volume of demand and shorter daylight hours of winter given to produce the plants, according to Teleflora. Plus, transportation costs jump with demand, as do the demand for florists to fulfill orders.

To spend, or not to spend?

Consumers looking to spend more than $600 celebrating Valentine’s Day might want to evaluate their priorities.

A recent Bankrate survey found that most Americans wouldn’t cover an unexpected $1,000 expense with their savings. More than a third would need to borrow the money in some way, either with a credit card, personal loan or from family or friends.

“Spending anything close to $620 on Valentine’s Day further inhibits the ability to build an adequate emergency cushion,” says Greg McBride, CFA, chief financial analyst at Bankrate.

Let’s say you put $600 each month into a savings account earning 2 percent APY. You would have nearly $80,000 saved in 10 years, according to Bankrate’s simple savings calculator and based on an initial amount of 1 dollar.

Frugal gift alternatives

Considering how costly Valentine’s Day can become, opting for frugal alternatives will give your wallet some relief.

Instead of giving gifts, consider sharing an experience. Last year, the NRF found 41 percent of consumers ages 25-34 are giving experiences, rather than gifts, to their partners. These include tickets to a concert or sporting event.

Scour places like StubHub to find last-minute deals on event tickets. Or, if you’re looking for something more low-key, put together a cheap basket and enjoy some time together outside.

Sara Skirboll, shopping and trends expert at RetailMeNot, says skipping a gift basket in lieu of an activity may be cheaper, but it could also be a more meaningful move.

“I love the idea of a fun experience like an unexpected day trip or going to a comedy show or concert,” Skirboll says. “This can be more personal and a more unique experience to really show your love and create a special memory with that person.”

Other ways to stay frugal on Valentine’s Day can include celebrating after the official holiday has passed. You’ll be able to find typical gifts, like flowers or candy, on deep discount.

As prices continue to increase, consumers might want to reconsider splurging on cupid’s big day — because what’s more romantic than a stable financial future?

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.