Mutual bank conversions: How to use your savings to access thrift stocks before they IPO

The last decade has not been kind to bank depositors, with low rates on savings accounts and CDs, even if many banks have recently been pushing rates higher. But savers do have a class of oddball banks that may be able to add some extra spice to their returns if they bank there.

This unusual kind of bank is called a mutual bank, and it offers the potential to get you in on a lucrative IPO and participate along with the insiders, all with no obligation to participate.

What’s a mutual bank conversion?

A mutual bank is a bank that’s owned by the depositors of the bank, its members. This ownership structure is in stark contrast to publicly traded banks, where shareholders own the bank. Rather than being focused on generating the most profit for investors, mutual banks are often community banks that are dedicated to serving a local area with good customer service.

But mutual banks can convert to publicly traded banks, and the process – called a mutual bank conversion – gives the bank’s depositors a chance to participate in an initial public offering (IPO). Sometimes mutual banks are also referred to as thrifts and the process as a thrift conversion.

A bank might convert for a variety of reasons, including the following:

- The bank wants more capital to expand its operations.

- The bank needs new capital to keep it running smoothly.

- An investor-owned bank can more easily expand because it has a stock that can be used like a currency in takeovers.

- It can issue stock as a further incentive to employees.

- Insiders themselves want to participate in a lucrative IPO.

If you’re a depositor in the bank, you’ll be able to participate in the IPO and get shares before they’re traded on the stock exchange and available to the broader investing public.

You won’t be forced to participate in the IPO, but you do have the option, and that has been an attractive investment opportunity for many investors in prior thrift conversions. By their very nature, they’re usually underpriced and you’re effectively buying a bank for less than its net asset value, building in a substantial margin of safety for you as an investor.

The upshot is that you have low downside risk, and most thrifts end up being acquired a few years later at a premium to their net asset value.

Unlike traditional IPOs, where new shares are typically allocated to the underwriting bank’s best customers or other insiders, in a mutual conversion it’s the depositors and the bank’s managers who have the first crack at shares in the offering. So depositors really have a shot at a good thing.

In addition, the interests of depositors and insiders are aligned. Depositors get to invest on the same terms as insiders, and insiders have plenty of incentive to make sure the valuation of the bank is attractive – in other words, low – when it prices the IPO.

Mutual conversions are considered low risk

If you’re a depositor in the bank, you have little downside. You’ll enjoy a safe, FDIC-protected account that earns you interest and you’ll have the option to participate in an IPO, which typically jumps substantially on its first day of trading. And because thrift conversions are usually priced below their net asset value, they’re often a low-risk proposition for investors.

While nothing’s guaranteed, getting in on the ground floor of a mutual-to-stock conversion typically is pretty lucrative, says Scott Hein, emeritus professor of finance at Texas Tech University.

“On the initial public offering, it’s frequently the case that stock appreciates markedly on the first day of trading,” Hein says. “I think we see something similar on mutual conversions as well, so those people that are original investors do get a pop in their return immediately.

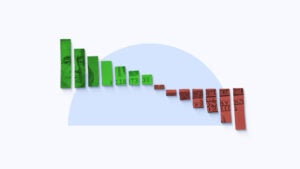

A jump of 20 percent on the first day is very common, but some years are better than others. In 2018, thrift IPOs jumped 26 percent on average on their first day, while they did even better in 2017 – up 36 percent.

But the real returns come over time, since these banks are typically attractive buyout targets for larger, more efficient banks, and they’ll often be acquired at much higher prices.

How to invest in a thrift conversion

The combination of relatively high returns and low risk in mutual bank conversions has proven so attractive that some investors are willing to do the legwork involved in seeking out mutual banks that may soon convert in hopes of getting in on the action. Some investors open dozens or even hundreds of accounts in the hopes of participating in an IPO.

Once they locate a suitable target, investors open an account and stash their cash. However, to participate fully in the IPO, investors may need $10,000 or more in the bank. Those with more in the bank will get a larger helping of shares, up to the maximum allocation for any single investor.

Perhaps in order to discourage this type of profiteering, mutual banks typically impose rules on which depositors are eligible to participate. For instance, thrifts require depositors to have been with the bank for as much as a year before the bank announces its intent to go public. And often banks limit accounts to depositors living in the specific geographic area served by the bank.

Another snag: Typically just 2 to 4 percent of banks convert in any given year. And with just over 400 such mutual institutions remaining in the U.S., depositors have a relatively small number of opportunities in a given year. That means you may end up waiting quite a while for your mutual to convert.

Thrift conversions were much more popular in the 1990s when more of these institutions existed. Now you generally have only a handful converting in any year.

So the number of conversions continues to dwindle as the number of mutual banks declines. However, from time to time, credit unions may convert to a mutual form of ownership, but that’s infrequent and onerous for the credit union.

Regulations could be changed to make it easier for credit unions to convert to mutual banks, but it’s not clear that any rule changes are imminent.

(For a full rundown on mutual conversions and how they work, see my book “The Zen of Thrift Conversions.” Those looking for a mutual bank in their state should consult the companion website The Zen of Thrift Conversions, which also details the status of thrift IPOs.)

Bottom line

A mutual bank conversion can be a lucrative “no-cost” option for depositors, while they enjoy the safety of a bank account. Those looking to take advantage of this extra “juice” will want to understand how the process works and what the potential upsides and downsides are, however.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.