How to write a check: A step-by-step guide

Key takeaways

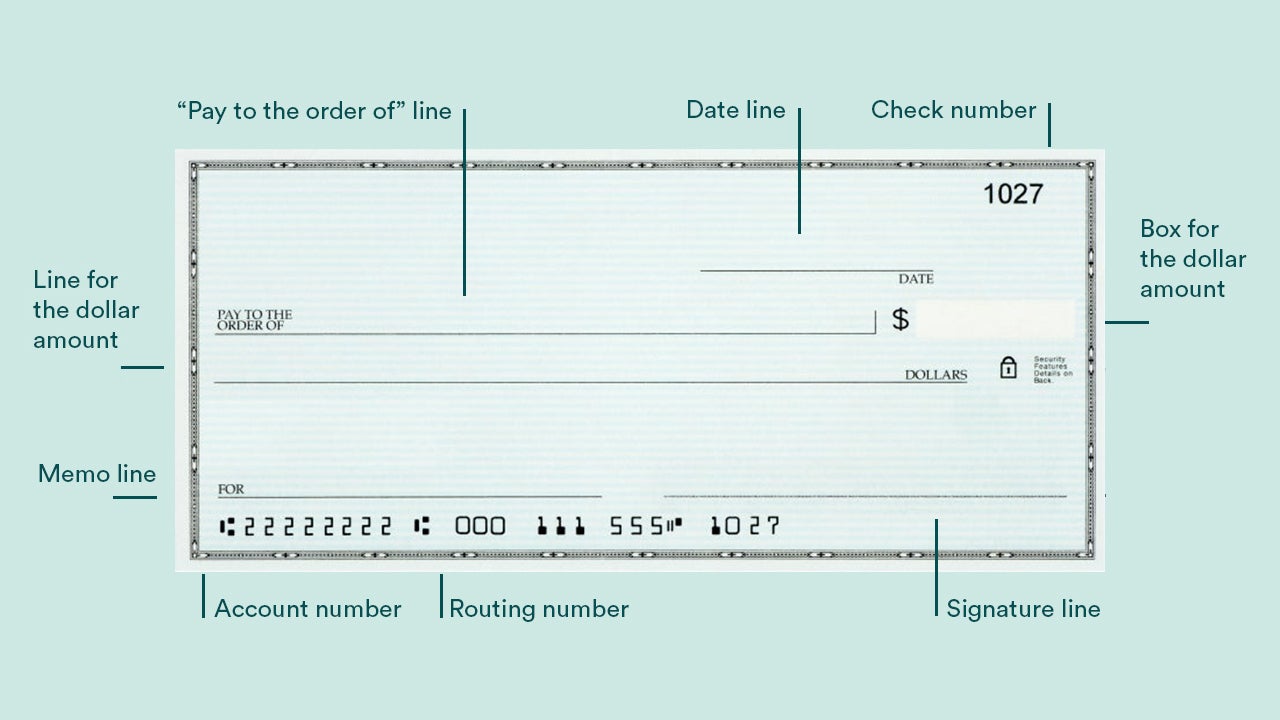

- Writing a check requires six simple steps: date, payee name, amount in numbers, amount in words, memo (optional) and your signature.

- Always use blue or black pen — never pencil — to prevent alterations and fraud.

- The number amount and written amount must match exactly, or banks may reject your check.

These days, it’s easy to swipe a card or send money electronically. But checks remain essential in many situations. Whether you’re paying rent, sending a gift or handling a bill, knowing how to write a check properly can save you from headaches down the road. Make a mistake, and you might face delays, late fees or even bounced check charges.

Before you fill out your next check, use this simple step-by-step guide to ensure you get it right the first time.

What you need to write a check

- A checking account with enough money to cover the check amount

- A pen with blue or black ink

- The payee’s full, correct name

- The exact dollar amount you’re paying

Oddphoto/Getty Images; illustration by Bankrate

Oddphoto/Getty Images; illustration by Bankrate

How to fill out a check in 6 simple steps

Before writing a check, you’ll need to have a checking account with sufficient funds to cover the amount of the check. Then, follow these steps to fill one out.

1. Write the date

Write the current date on the line at the top right-hand corner. This tells the financial institution and recipient when you wrote the check. You can write the date in long form or use numbers — either “1/11/2025” or “Jan. 11, 2025” works fine.

Important note about future dates

2. Write the name of who’s getting the money

On the line that says “Pay to the order of,” write the full name of the individual or company you’re paying. This person or entity is called the payee. Use their complete, legal name rather than a nickname to avoid confusion.

You can write “Cash” if you don’t know the payee’s name, but this is risky — anyone can cash or deposit a check made out to cash. It’s much safer to write a specific name.

3. Write the check amount in numbers

In the small box to the right of the payee line, write the numerical dollar amount clearly. For example, if you’re writing a check for one hundred dollars and thirty cents, write “$100.30.”

Make sure your handwriting is legible — unclear numbers can cause your bank to reject the payment or process the wrong amount.

4. Write the amount in words

On the line below “Pay to the order of,” spell out the dollar amount in words. This amount must match the numerical amount exactly. Write the cents as a fraction over 100.

Examples:

- $100.30 becomes “One hundred and 30/100”

- $50.00 becomes “Fifty and 00/100”

- $1,250.75 becomes “One thousand two hundred fifty and 75/100”

Even if you’re writing a check for a round dollar amount, include “00/100” for the cents portion. This prevents someone from adding cents to your check. Draw a line through any remaining blank space on the line.

5. Write a memo

The memo line is optional, but it’s smart to use it. This section serves as a reminder of the check’s purpose and can help with your recordkeeping. For example, you could write “Rent – January 2025” or “Wedding Gift”.

Some companies request specific information in the memo line, such as your account number or invoice number. This helps ensure your payment gets applied correctly.

6. Sign your name

Sign your name clearly on the line at the bottom right corner of the check. Use the same signature that’s on file with your bank — mismatched signatures can cause processing delays.

Your signature authorizes the bank to pay the stated amount to the payee. Without it, the check is invalid.

Essential tips for writing checks safely

Following these best practices helps prevent fraud, processing errors, and payment delays.

- Always use pen, never pencil: Write with blue or black ink only. Pencil marks can be erased and changed, making your check vulnerable to fraud. Other ink colors (like red or green) can cause problems with check-scanning equipment.

-

Write clearly: Make your handwriting easy to read. If you have messy handwriting, print in block letters. Unclear writing is one of the main reasons banks reject checks.

-

Check everything twice: Before you sign, review all the information. Make sure the number amount matches the written amount, the payee’s name is spelled correctly, and you’ve filled in all required fields.

-

Fill empty spaces: Draw a line through any blank space after the written amount to prevent someone from adding words or numbers. For example, after writing “Fifty and 00/100,” draw a line to fill the rest of the line.

-

Keep records: Write down each check number, amount, payee, and date in your check register or a budgeting app. This helps you track spending and catch errors. You can also take a photo of the check before mailing it.

-

Store checks safely: Keep unused checks in a secure place at home. Never leave them in your car, purse, or other easy-to-access locations. If checks are stolen, contact your bank immediately to close the account.

Where to get checks for your account

You have several options for getting checks:

Your bank: Most banks provide checks, but they’re often more expensive than other options. Some checking accounts include free checks as a benefit, so check your account details first.

Third-party check printers: Companies that specialize in printing checks typically charge less than banks. You’ll need your account and routing numbers to order. For comparisons and recommendations on where to buy checks and save money, see Bankrate’s guide.

Online ordering: Many services let you order checks online and have them delivered to your home. This is convenient and often less expensive than ordering through your bank.

Different types of checks and when to use them

Personal checks aren’t your only option. Understanding different check types helps you choose the right payment method for different situations.

Personal checks: The standard checks from your checking account, used for everyday payments. They’re drawn directly from your account balance.

Cashier’s checks: Issued and guaranteed by your bank, making them more secure for large purchases. You pay the bank upfront, and they issue a check from the bank’s own funds. These cost $10-$15 typically.

Certified checks: Your personal check that the bank verifies and guarantees. The bank confirms you have the funds and sets that money aside. To understand the difference between cashier’s checks and certified checks, see our detailed comparison.

Money orders: Similar to cashier’s checks but available at more locations (post offices, grocery stores) and typically cheaper ($1-$5). They’re good for smaller amounts. Learn about cashier’s checks vs. money orders to choose the right option.

Finding a checking account that fits your needs

If you write checks regularly, choosing the right checking account matters. When comparing checking accounts, look beyond just whether they provide checks. Consider factors like:

- Monthly fees and how to avoid them

- Minimum balance requirements

- Cost of checks (some accounts include them free)

- Mobile banking features and check deposit

- ATM network and fees

- Overdraft protection options

To compare features, fees, and benefits across different banks and credit unions, explore Bankrate’s best checking accounts.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.