Schedule D: How to report your capital gains (or losses) to the IRS

So you’ve realized a profit on your investments? Buckle up and get ready to report your transactions to the IRS on Schedule D and see how much tax you owe.

But it’s not all bad news. If you lost money, this form helps you use those losses to offset any gains or a portion of your ordinary income, reducing the taxes you owe. And if you profited from your transactions, Schedule D helps ensure you don’t overpay Uncle Sam for your gains.

What is Schedule D?

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets, that is, investments and other business interests. It includes relevant information such as the total purchase price of assets, the total price those assets were sold for and whether those assets were held for the long term (more than a year) or short term (less than a year).

Learn more: Short-term vs. long-term capital gains: How to trim your tax bill

Who has to file Schedule D?

You’ll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you’ll need to file this form. (Most brokerage or investment accounts are taxable accounts. But most retirement accounts, such as traditional and Roth IRAs, even if held at a brokerage, are not taxable accounts.)

Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more. Those who have capital losses that they’re carrying over from previous tax years will want to file Schedule D so that they can take advantage of the tax benefit.

There are other reasons you may need to file Schedule D as well. If you have realized capital gains or losses from a partnership, estate, trust or S corporation you’ll need to report those to the IRS on this form. Those with gains or losses not reported on another form can report them on Schedule D, as can filers with nonbusiness bad debts. Those with like-kind exchanges and installment sales may need to answer questions about their transactions on Schedule D.

How you report a gain or loss and how you’re taxed

The two-page Schedule D, with all its sections, columns and special computations, looks daunting and it certainly can be.

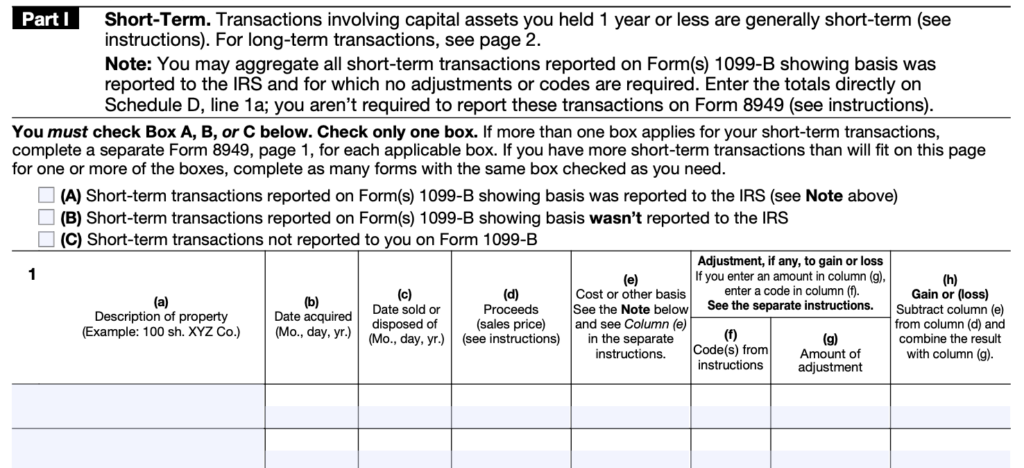

To start, you must report any transactions first on Form 8949 and then transfer the info to Schedule D. On Form 8949 you’ll note when you bought the asset and when you sold it, as well as what it cost and what you sold it for. Your purchase and sales dates are critical because how long you hold the property determines its tax rate.

If you owned the asset for a year or less, any gain would typically cost you more in taxes. These short-term sales are taxed at the same rate as your regular income — your marginal income tax rate (and, thus, your short-term capital gains tax rate) could be as high as 37 percent on your 2024 and 2025 tax returns.

Short-term sales are reported on Part 1 of the form.

However, if you held the property for more than a year, it’s considered a long-term asset and is eligible for a lower capital gains tax rate — 0 percent, 15 percent or 20 percent, depending upon your income level. Sales of long-term assets are reported on Part 2 of the form, which looks nearly identical to Part 1 above.

Detail your transactions

Once you determine whether your gain or loss is short-term or long-term, it’s time to enter the transaction specifics in the appropriate section of Form 8949. All transactions require the same information, entered in either Part 1 (short term) or Part 2 (long term), in the appropriate alphabetically designated column. For most transactions, you’ll complete:

(a) The name or description of the asset you sold

(b) When you acquired it

(c) When you sold it

(d) What price you sold it for

(e) The asset’s cost or other basis

(h) The gain or loss

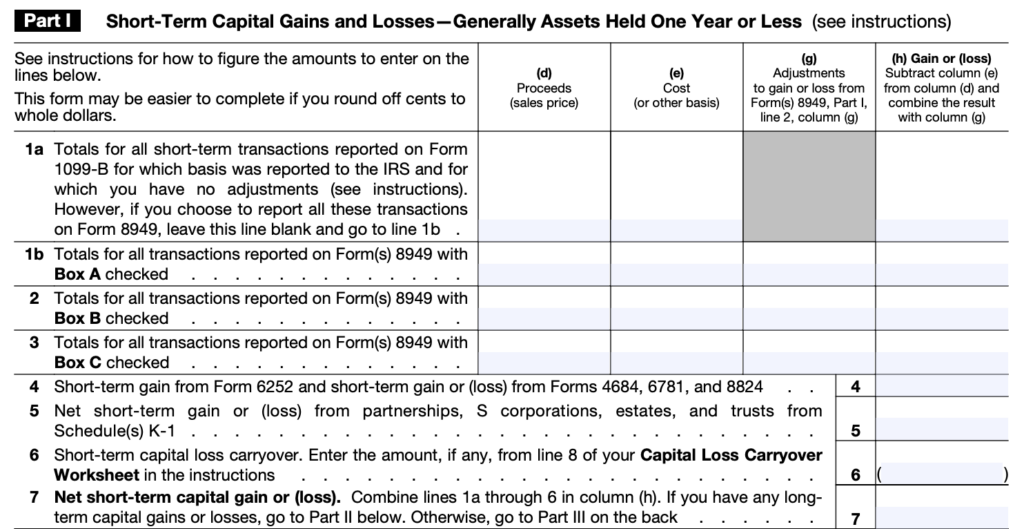

Total your entries on Form 8949 and then transfer the information to the appropriate short-term or long-term sections of Schedule D. On that tax schedule you’ll subtract your basis from the sales price to arrive at your total capital gain or loss, as in the sample below.

Schedule D also asks for information on some specific transactions that do not apply to all taxpayers, such as installment sales, like-kind exchanges, commodity straddles, sales of business property and gains or losses reported to you on Schedule K-1.

Check out the complete list and if any of these apply to your tax situation, it probably would be wise to turn Schedule D and the rest of your tax paperwork over to a professional. These are complicated matters, and it can be easy to make a mistake even with the best intentions.

Learn more: 5 tips to find the best tax preparer for you

Schedule D also requires information on any capital loss carryover you have from earlier tax years on line 14, as well as the amount of capital gains distributions you earned on your investments.

You may be able to avoid filing Schedule D, if one of the two situations below applies to your return:

-

If distributions, line 13, are your only investment items to report, you don’t have to fill out Schedule D; they go directly on your Form 1040.

-

Generally, you also can escape Schedule D if your only capital gain is from the sale of your home. As long as you meet some basic residency requirements and your home-sale profit is $250,000 or less ($500,000 if married-filing-jointly), it’s not taxable and often you don’t have to tell the IRS about it here or on any other form. That said, if you receive a 1099-S form, you should report the income on Schedule D, even if you qualify for the exclusion, because the IRS expects 1099-S income to show up on your tax return.

Total your transactions

Once you’ve filled in all the short-term and long-term transaction information in Parts 1 and 2, it’s time to turn over Schedule D and combine your asset-sale details in Part 3. This section essentially consolidates the work you did earlier, but it’s not as easy as simply transferring numbers from the front of the schedule to the back.

Lines 16 through 22 direct you to other lines and forms depending on whether your calculations result in an overall gain or loss. A couple of lines in Part 3 also deal with special rates for collectibles and depreciated real estate. Again, in these situations, expert tax advice might be warranted.

Use Schedule D to total up your gains and losses. If you total up a net capital loss, it’s not good investing news, but it is good tax news. Your loss can offset your regular income, reducing the taxes you owe – up to a net $3,000 loss limit.

If you reported a net loss greater than the annual limit, it can be carried forward to use against gains in future tax years until it’s exhausted.

As a bonus, your capital loss means you’re through with Schedule D. You simply transfer your loss amount to your 1040 and continue your filing work there.

Figure the tax on your gains

When you come up with a gain, the tax paperwork continues. And this is where the math really begins, especially if you’re doing your taxes by hand instead of using software.

Depending on your answers to the various Schedule D questions, you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in the Form 1040 instructions booklet. These worksheets take you through calculations of your various types of income and figure the appropriate taxation level for each.

Before you begin either of these worksheets, be sure you’ve completed your Form 1040 through line 15 (on the 2024 version of the form) — that’s your taxable income amount — because that’s the starting point of both worksheets. From there you’ll have lots of addition, subtraction, multiplication and transferring of numbers from various forms.

But if you sold stock or other property, don’t be tempted to ignore Form 8949, Schedule D, the associated tax worksheets and all the extra calculations. Remember, the IRS received a copy of any tax statement your broker sent you, so the agency is expecting you to detail the sale, and gain or loss, with your tax filing.

Bottom line

The extra work needed in figuring your capital gains taxes is generally to your advantage. Regular income tax rates can be more than twice what’s levied on some long-term capital gains. So when you’re finally through with the calculations, your tax bill should be lower than it would have been if you had simply used the standard tax table to find your tax due.

Note: Kay Bell contributed to a previous version of this story.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.