Economists survey: Experts wary ‘leaner economic times’ lie ahead

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

The economy can’t get much better than this. That seems to be the takeaway from Bankrate’s latest survey of top economists.

Just three of the 21 experts surveyed for Bankrate’s Third-Quarter Economic Indicator see positive signs on the horizon for the U.S. economy. Most (52 percent) believe the tight labor market, rising interest rates and tariff fights could hurt people’s ability to earn wealth during the next 12 to 18 months.

The chief economist for the National Federation of Independent Business, William C. Dunkelberg, put it bluntly.

“We are at a peak,” Dunkelberg says. “‘Good’ things can’t help, but problems will slow the economy.”

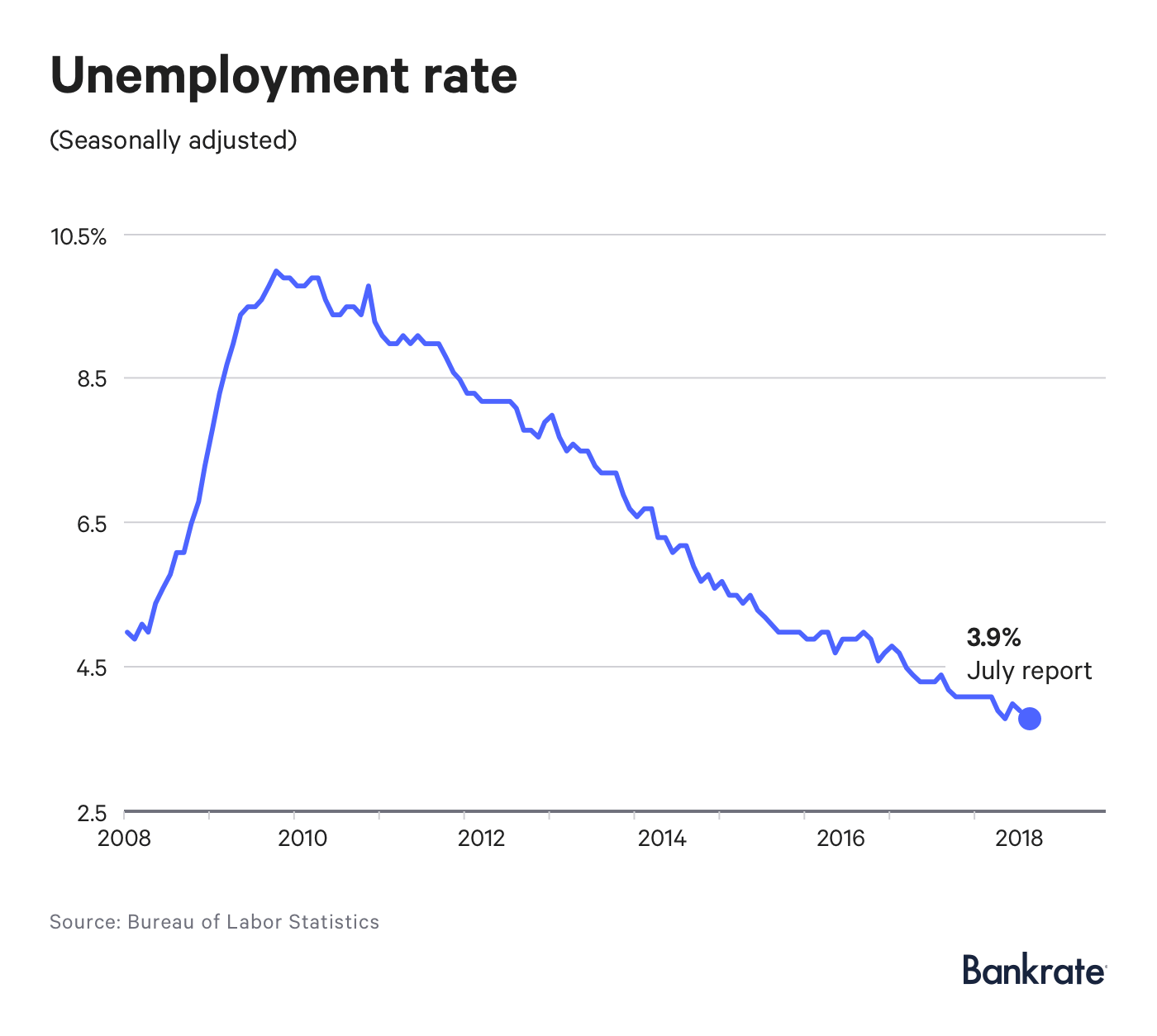

Peak for the job market means businesses could find it even more difficult to take down their “help wanted” signs. The unemployment rate was 3.9 percent in July — the lowest rate for the month of July in nearly 50 years, according to the Bureau of Labor Statistics.

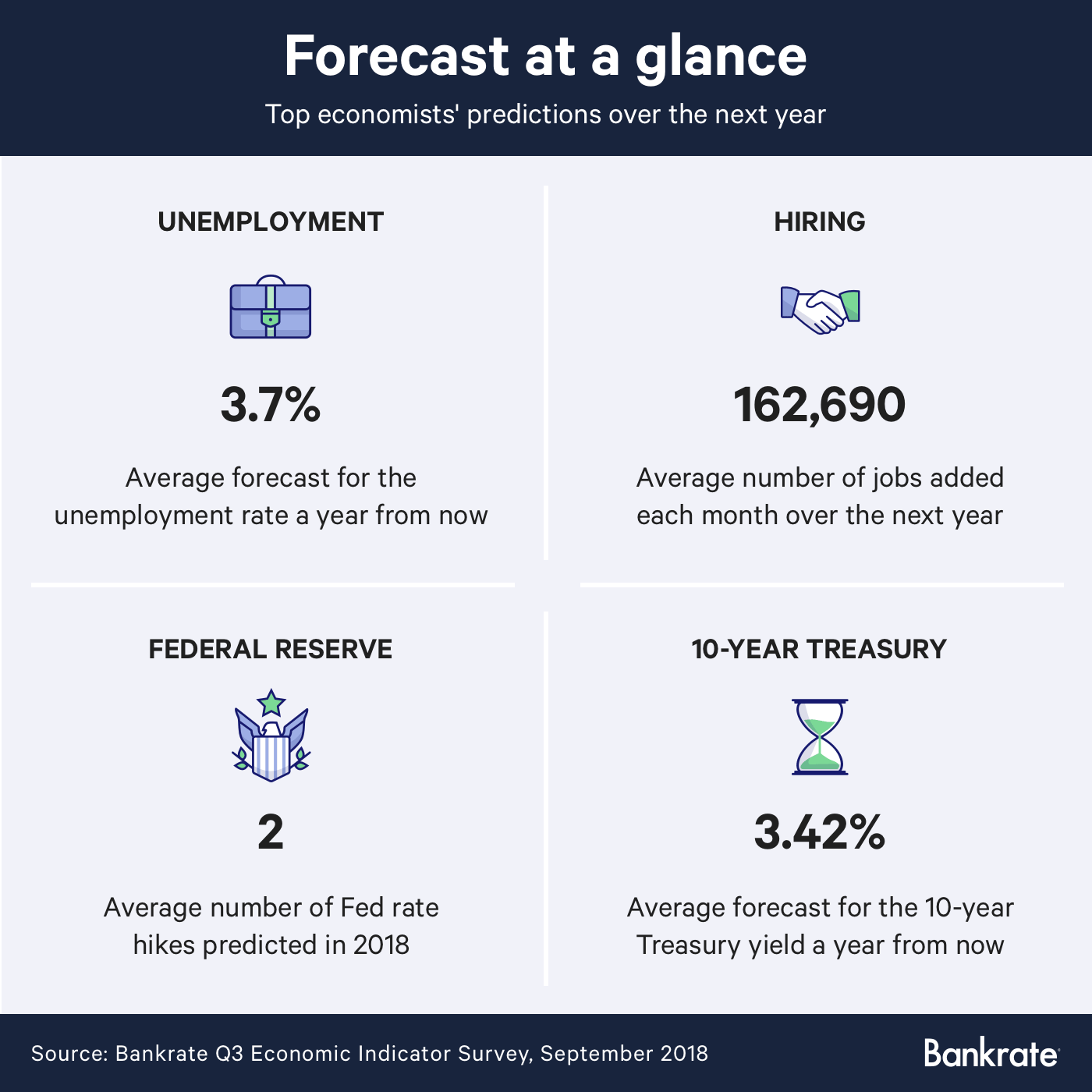

On average, economists expected the unemployment rate to shed two-tenths of a percentage point, finishing August 2019 at 3.7 percent, according to the survey. By next summer, we should see more evidence that the economic expansion is coming to an end, says Bernard Baumohl, chief global economist at The Economic Outlook Group.

“The benefits of the tax cuts will have faded by then, and both consumers and businesses will feel the full effects of tariffs, higher energy prices and rising interest rates,” Baumohl says. “As the clouds of recession converge, employers will pull back on hiring.”

There is no longer the widely held belief that unemployment will just keep going lower and lower, says Greg McBride, CFA, chief financial analyst for Bankrate.com.

“The pace of improvement seems destined to slow, and there is a belief that downside risks to the economy will emerge over the next 12 to18 months, so make hay while the sun shines,” McBride says.

He adds that consumers would benefit from giving their piggy banks a little extra going forward.

“Fortunately, savings rates will continue to rise with more Fed hikes in the offing. But so will variable-rate debt, such as credit cards and home equity lines of credit, so paying down and paying off debt is a necessary element of preparing for leaner economic times,” McBride says.

How many more Fed hikes?

The majority (95 percent) of economists say they believe the Federal Reserve will raise interest rates two more times before 2018 comes to a close. One economist predicts a single rate hike before the end of the year.

The Fed raised rates to the 1.75 percent to 2 percent range in June. Rate hikes are typically thought to be good for the savings account and bad for the for the credit card bill. In general, economists worry raising rates too slowly could lead to a rapid inflation from consumer being able to spend more and thus pushing up prices. Others are wary that moving the federal funds rate up too quickly could hurt borrowers and weaken the economy.

Experts see a rising 10-year Treasury

Don’t be surprised to see mortgage rates rise, particularly as the Fed unwinds its trillion-dollar balance sheet. The forecast for the 10-year Treasury note — the benchmark for 30-year fixed mortgage rates — is slightly higher than it was in the second and first quarters. On average the economists predict a yield of 3.42, according to the survey.

As always, the Fed will be data-driven as it struggles to balance its actions to hold down inflationary pressures while promoting maximum growth with low unemployment, says Bernard Markstein, president and chief economist at Markstein Advisors.

“The Fed is trying to stay ahead of inflationary pressures from a tight labor market, which is at or near full employment, without tipping the economy into recession,” Markstein says. “It will continue to raise the federal funds rate a quarter-percent at a time with enough space between increases to judge how the economy is doing, how serious inflationary pressures appear to be, and if there is any evidence that higher interest rates are slowing the economy too much.”

The Third-Quarter 2018 Bankrate Economic Indicator survey of economists was conducted Aug. 1-8. Survey requests were emailed to economists nationwide, and responses were submitted voluntarily online. Responding were: Scott Anderson, chief economist, Bank of the West; Bernard Baumohl, chief global economist, The Economic Outlook Group LLC; Robert A. Brusca, chief economist, FAO Economics; Joseph Brusuelas, chief economist, RSM US; Bill Dunkelberg, chief economist, NFIB; Robert Frick, corporate economist, Navy Federal Credit Union; Timothy Hopper, managing director, Macro Fund Advisors; Robert Hughes Sr., research fellow, American Institute for Economic Research; Sam Khater, chief economist, Freddie Mac; Jack Kleinhenz, Ph.D., CBE, chief economist, National Retail Federation; Bernard Markstein, president and chief economist, Markstein Advisors; Joel L. Naroff, president, Naroff Economic Advisors; Brian Nick, Chief Investment Strategist Nuveen; Jim O’Sullivan, chief economist, High Frequency Economics; Satyam Panday, senior economist, S&P Global; Lindsey Piegza, Ph.D., chief economist and managing director, Stifel Nicolaus & Co.; Lynn Reaser, chief economist, Point Loma Nazarene University; Ryan Sweet, director, Real Time Economics; Diane Swonk, chief economist, Grant Thornton; Ariana Vaisey, economic analyst, Wells Fargo Securities; Lawrence Yun, chief economist, National Association of Realtors.

Related Articles

Survey: Economists see unemployment holding above pre-pandemic levels a year from now

Survey: Top economists see elevated COVID-19 joblessness for at least another year

Economists survey: Future looks good for saving, bad for growth

Top economists: Expect the economy to heat up further this year