Which credit cards earn rewards for Airbnb and VRBO stays?

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

This piece was last updated on Oct. 25, 2023, to reflect current credit card details.

The pandemic has changed so much about the way Americans and others around the world travel, including an unprecedented reduction in work-related trips. A December 2020 study from IdeaWorks even shows that business travel may stay depressed indefinitely, with a loss to airlines in the 19 percent to 36 percent range overall. Further, intracompany meetings, which make up 20 percent of business air trips, could decrease as much as 60 percent.

And, what about hotel stays? Obviously, fewer air trips for business travelers could easily result in fewer hotel stays and a declining focus on hotel loyalty. And with an extended focus on social distancing, the hotel industry, which caters to large crowds, is primed to struggle anyway.

With all this in mind, you may be wondering how you can earn rewards for Airbnb and VRBO stays. Doing so could make it easier for you to book more pandemic-friendly options, as well as larger properties that can work better for families.

How to earn points and miles on vacation rentals

Earning points and miles on vacation rentals requires you to sign up for a rewards credit card. However, there may be situations where you can earn rewards in a related program you belong to regardless of how you pay for your vacation rental booking.

Airbnb

Rumors of an Airbnb loyalty program abound, but Airbnb loyalists haven’t seen anything come together so far. Either way, earning rewards for Airbnb stays is easy with the right credit card, and you can even “double-dip” on your rewards.

For example, both Delta and British Airways have portals that let you earn miles when you book with Airbnb. The Delta Airbnb portal lets you rack up 1 mile for each dollar you spend on Airbnbs worldwide, and the British Airways Airbnb portal lets you earn 2 Avios for each dollar you spend. However, if you’re brand-new to the Airbnb program, you can earn 6 Avios per dollar spent on your first booking.

Many Airbnb enthusiasts also strategically buy gift cards in order to boost rewards on Airbnb stays. This can make sense if you have a credit card that earns bonus rewards at grocery stores and drugstores where Airbnb gift cards can be found or if you buy gift cards through the United MileagePlus app. Either option can let you earn more points on your Airbnb stay than you would if you booked it directly and paid with a rewards card.

VRBO

With VRBO.com, you can book private homes, luxurious villas, condominiums and more, and you have a few different ways to earn more points. For starters, you’ll want to make sure you pay with a rewards credit card and maybe even a travel credit card that offers bonus points on travel bookings. Just keep in mind that, based on many reports, VRBO bookings do not always code as travel on your credit card statement. In some cases, your purchase may code as “property management” or “real estate” instead, in which case it wouldn’t qualify for bonus points if your card offers them.

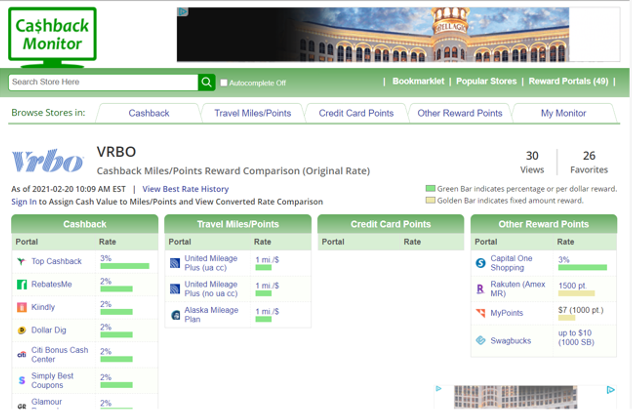

You may also be able to earn some extra cash back if you click through a portal like Cashback Monitor or TopCashback before you make your VRBO booking. Both offer 3 percent in cash back at the time of this writing, although their promotions are always subject to change.

Redeeming credit card points for vacation rental stays

When it comes to redeeming rewards for vacation rental stays, the strategies to consider and the value of your points can vary widely. The best way to move forward will depend on the type of rewards you have taken the time to earn, and they can vary even more depending on the exact rewards credit card you have.

For example, if you have the Chase Sapphire Preferred® Card, your points are worth 1.25 cents each when you book vacation rentals through Chase Ultimate Rewards. Yet, points accrued with Chase Sapphire Reserve® are worth 1.5 cents each when used to book vacation rentals through the same process. You could also use either of these cards to make vacation rental bookings directly with VRBO.com or Airbnb then redeem your points for statement credits at a rate of 1 cent each.

Another solid travel credit card for Airbnb and VRBO bookings is the new Capital One Venture X Rewards Credit Card. This card lets you earn 10X miles on hotel and rental car Capital One Travel bookings and 5X miles on flights through Capital One Travel, plus 2X miles on all other purchases. Also, you can redeem your miles for any travel you want at a rate of 1 cent per mile. This means you can use this card to pay for your Airbnb or VRBO booking directly, then use your miles to make up for all or part of the charge.

Also, note that Wyndham Rewards stands out among other hotel loyalty programs due to its many vacation rental options. In fact, you can use points in this program to book Wyndham vacation rental properties, private homes or even vacation cottages on Cottages.com.

Best credit cards for earning rewards on Airbnb and VRBO stays

While an Airbnb rewards credit card is only a pipe dream, for now, there are plenty of rewards credit cards that can help you rack up points when you book a vacation rental. Here are Bankrate’s top credit cards for earning rewards on Airbnb and VRBO stays, as well as your other travel expenses.

Capital One Venture X Rewards Credit Card: Best for credits and bonuses

- Welcome bonus of 75,000 miles after spending $4,000 on purchases within the first three months of opening your account

- Earn 10X miles on hotel and rental car Capital One Travel bookings and 5X miles on flights through Capital One Travel, plus 2X miles on all other purchases

- Up to $300 in annual Capital One Travel booking credit

- Get a 10,000-mile account anniversary bonus

- Receive up to $100 in credit toward your Global Entry or TSA Precheck application fee (every four years)

- $395 annual fee

The Capital One Venture X Rewards Credit Card is the issuer’s first premium travel credit card, and it created quite the stir in the travel credit card world with its debut. You can use your rewards as statement credit to cover travel-related expenses you charge on your card, like vacation rentals. We should also note that Wyndham Rewards is one of Capital One’s transfer partners, which means you can transfer your points and use your rewards to book Wyndham vacation rentals or cottages, as well.

If you decide not to use your rewards for vacation rental bookings, you can transfer them to airline or hotel partners or use them to cover purchases made on Amazon.com or PayPal.com. Although this card comes with a hefty annual fee, the $300 in annual Capital One Travel credit and 10,000-mile anniversary bonus (worth $100) help justify that fee.

Capital One Venture Rewards Credit Card: Best for flat-rate rewards

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel, 2X miles for each dollar you spend

- Receive up to $100 in credits toward Global Entry or TSA Precheck membership (every four years)

- $95 annual fee

The Capital One Venture Rewards Credit Card is a more basic version of the Venture X card but offers many of the same features including the option to redeem rewards for statement credit to cover travel purcahses as well as the ability to book travel in Capital One’s travel portal. For a $95 annual fee, this Capital One credit card earns you 5X miles on hotels and rental cards purchased through the Capital One portal, 2X miles on every purchase you make and up to $100 in credits toward Global Entry or TSA Precheck membership every four years.

Chase Sapphire Preferred® Card: Best for flexibility

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem for travel through Chase Ultimate Rewards.

- Enjoy benefits such as a $50 annual hotel credit for a stay booked through the Ultimate Rewards portal, 5X points on travel purchased through Chase Ultimate Rewards, 3X points on dining and 2X points on all other travel purchases.

- $95 annual fee

If you want to earn generous rewards on vacation rental stays, but you also want some flexibility in your rewards program, the Chase Sapphire Preferred Card could be a good fit. This card lets you earn 2X points on travel purchases, including on Airbnb and VRBO stays, and you can also earn a generous welcome bonus. Note that you can redeem your rewards for vacation rentals through Chase Ultimate Rewards, but you can also transfer points to Chase airline and hotel partners. Other redemption options include gift cards, merchandise, cash back and statement credits. A $95 annual fee applies.

Chase Sapphire Reserve®: Best for luxury travel perks

- Earn 60,000 points after spending $4,000 on purchases within your first three months

- Earn 5X total points on air travel and 10X total points on hotels and car rentals (after earning your $300 annual travel credit) when you purchase travel through Chase Ultimate Rewards.

- Earn 3X points on other travel and dining, and 1 point per dollar spent on all other purchases.

- Major benefits include a $300 annual travel credit, Priority Pass Select airport lounge membership, DashPass Subscription ($0 delivery fee and reduced service fees on orders over $12 for a minimum of one year on qualifying food purchases with DashPass, DoorDash’s subscription service. (Activate by December 12, 2024)

- $550 annual fee

If you want to earn rewards on Airbnb stays but also want access to luxury travel benefits, the Chase Sapphire Reserve could be the way to go. You’ll have to pay a $550 annual fee, but you’ll get benefits like a Priority Pass Select airport lounge membership, an up to $300 annual travel credit, a free DashPass membership (activation required) and more.

Citi Double Cash® Card: Best for earning cash back

- Earn 2 percent cash back on all your purchases — 1 percent when you make a purchase and another 1 percent when you pay it off

- No annual fee

- Rewards can be used for statement credits, a check or a credit to a linked account once you have a cash rewards balance of $25 or more

The Citi Double Cash® Card is an excellent choice if you prefer to earn cash back when you book Airbnb and VRBO stays. This card lets you earn a total of 2 percent back on everything you buy — 1 percent when you make a purchase and another 1 percent when you pay it off. There’s no annual fee, and you can even redeem your rewards as cash back to cover your vacation rental stays. This card can also be good for balance transfers since you get an introductory 0 percent APR on balance transfers for 18 months, followed by a variable APR of 19.24 percent to 29.24 percent (transfers must be made in the first four months to qualify).

Additional options for booking Airbnb and VRBO stays (and other vacation rentals) with credit card rewards

There are many different ways to book a vacation rental for leisure or business travel, just as there are many ways to use rewards to cover the cost. The following strategies might help you get more bang for your buck the next time to use credit card rewards for vacation rental stays:

- Buy gift cards with premium rewards credit cards. Grocery stores can be an excellent place to pick up gift cards for Airbnb or even VRBO, and the same is true for drugstores. If you use a credit card that offers more points on these purchases, you can boost your rewards haul compared to if you had booked the rental with your credit card directly. As an example, the Chase Freedom Unlimited® offers 1.5 percent cash back on regular purchases and 3 percent cash back on dining at restaurants and drugstore purchases. Meanwhile, the Blue Cash Preferred® Card from American Express lets you earn 6 percent back on up to $6,000 spent at U.S. supermarkets each year (then 1 percent back).

- Book through the Chase portal. While the Chase Ultimate Rewards portal lets you book vacation rentals with points, you can also book with a mix of points and cash or cash only. Fortunately, both Chase Freedom cards (the Chase Freedom Unlimited® and the Chase Freedom Flex℠*) offer 5 percent back on travel bookings made through Chase Ultimate Rewards.

- Consider hotel programs with vacation rental options. Also, be sure to look at hotel programs that offer vacation rental options, including Wyndham Rewards. You could even look at Marriott Rewards, which offers bookable units with kitchens and living areas with some of their brands, like Residence Inn.

- Redeem for statement credits. Remember that, in some cases, it makes sense to redeem your rewards for statement credits. This option makes it possible to use cash back rewards for Airbnb or VRBO rentals or to use rewards to cover any other purchases made to your card.

The bottom line

Vacation rentals can be more convenient for large families and those who want to cook or have more space while on vacation. However, you shouldn’t just pay with any credit card. Do some research to find the best credit cards with Airbnb rewards or VRBO potential based on your needs and spending style, and you’ll be on your way to more free travel in no time.

The information about the Chase Freedom FlexSM has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles