Will stubborn inflation force the Fed to raise interest rates again?

Federal Reserve officials have watched inflation rise faster than expected for three straight months, leading some investors and economists to start whispering about a rising downside risk: the U.S. central bank being forced to pick back up on raising interest rates.

To be sure, it’s not the baseline consensus that the Fed will reverse course and raise interest rates again after maintaining its key benchmark rate at a 23-year high since July. Fed officials themselves even acknowledged that they still retain a bias to cut interest rates.

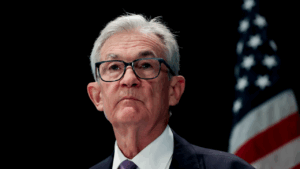

“I think it’s unlikely that the next policy rate move will be a hike,” said Fed Chair Jerome Powell after the Fed’s post-meeting press conference in May, much to the relief of Wall Street investors. The key S&P 500 index is still off its recent record highs but has risen more than 3 percent since officials announced that they’d leave interest rates alone for their sixth consecutive meeting.

Yet, Powell & Co. appear to be pushing back against reducing interest rates anytime soon. Rather than raising interest rates again, Fed officials may think the secret to bringing inflation back to their ultimate goal post of 2 percent requires keeping borrowing costs at their historically high level for even longer.

The timing of when the Federal Reserve begins to cut interest rates is up in the air – and in an indefinite holding pattern. Until we see renewed evidence that inflation is consistently easing, we’re no closer to the Fed cutting rates.— Greg McBride, CFA , chief financial analyst for Bankrate

The bar for another rate hike may be even higher than a rate cut, economists say

At the Fed’s May meeting, Powell still took the time to stress that the Fed’s future moves haven’t been determined yet. Just as officials would be prepared to reduce rates faster if the economy took a turn, policymakers would also re-evaluate their rate path if inflation proved more challenging to defeat.

“We’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2 percent over time,” Powell said. “That’s not what we think we’re seeing, but that is what it would take.”

Even though the topline consumer price inflation rate has barely budged for 10 straight months, Fed officials are still taking into account the rapid improvement they’ve already witnessed. Almost two years ago, price pressures topped a fresh high that hadn’t been seen for generations: 9.1 percent. As of the latest data from March 2024, inflation has been hovering at 3.5 percent, the Bureau of Labor Statistics’ (BLS) latest report shows.

Powell also pointed to signs that monetary policy is already starting to impact the economy. Housing activity has plummeted as high rates crush would-be borrowers. Meanwhile, the U.S. economy in the first quarter of 2024 grew slower than expected.

Fed officials wouldn’t be inclined to wait for inflation to officially hit 2 percent to cut interest rates, for fear that they might keep rates restrictive for too long, Powell has said. In the Fed’s latest economic projections from March, the median forecast for 2024 assumed three rate cuts, even as the Fed’s preferred inflation gauge retreated to 2.4 percent before excluding food and energy prices. That measure of inflation — the personal consumption expenditures (PCE) index — isn’t quite there yet, but the latest figures show a 2.7 percent inflation rate.

Signaling that rate hikes are over, however, is a hard statement to take back. At one point, investors were pricing in above-trend growth and seven rate cuts — which was most likely always “fantasy land,” as McBride puts it.

Knowing that markets hear “rate cuts” when the Fed says “no more rate hikes” is partially what surprised economists so much about the Fed’s conviction to signal that it’s most likely done raising borrowing costs.

“Unless we see a meaningful back-up in inflation — not just a lack of improvement — the Fed is indefinitely on the sidelines,” says Lindsey Piegza, chief economist at Stifel Financial. “The committee has clearly capitulated. They would lose a lot of credibility, on top of the mistakes that they made at the front end of the cycle by holding onto transitory and crisis-level accommodation well beyond what was appropriate.”

The Fed is juggling sticky inflation with a slowing labor market

A slowdown in services and shelter inflation could be the medicine Fed officials need. Those prices have driven almost three-fourths of inflation over the past 12 months, BLS data shows. Services are up a hotter 5.3 percent over the past 12 months, while rents have climbed 5.7 percent. That might be why so-called core inflation — prices excluding food and energy, a metric long considered to be an indicator of underlying inflation — has been hovering at a stickier 3.8 percent since February.

An “experimental” rent index from BLS showed that rent prices rose the slowest since 2010, indicating that a cooldown not yet reflected in the data could be afoot. Services costs, meanwhile, are closely linked with robust consumer spending. Consumption remained robust in the first three months of the year, even as the economy slowed. Those gains, however, could diminish, especially as consumers’ spending habits catch up to higher rates and ballooning credit card debt.

Oxford’s Chief Economist Ryan Sweet says the unexpectedly hot inflation of the next three months is unlikely to be the norm.

“Housing inflation remains a thorn in the Fed’s side, as it has remained stubbornly high,” he says. “Based on market rents, it will take longer for housing inflation to roll over, but it is coming.”

Officials are also now acknowledging the other side of their dual mandate: maximum employment. The job market is clearly showing signs of a slowdown, even if it is still historically healthy. Unemployment has been holding below 4 percent for the longest stretch of time since the 1960s but has recently started creeping up, returning to a two-year high of 3.9 percent in April. Employers in April added the fewest number of positions in seven months, missing economists’ forecasts. The share of workers who are voluntarily quitting their positions has rebounded back to pre-pandemic levels, a sign of a rebalancing labor market.

After spending the past two years hyper-focused on inflation, slowing price pressures help give the Fed room to minimize harm to the job market. Not to mention, slower spending and a weaker labor market would also weigh on inflation.

But a nightmare scenario for the Fed — and consumers — might be an environment where unemployment edges up, while inflation stays sticky, giving Fed officials a reason not to move in either direction.

“Inflation may be sticky, but labor market and consumer indicators point to a slowdown in growth already occurring,” says Lauren Goodwin, economist and chief market strategist at New York Life Investments. “The ‘goldilocks’ mix of stable growth and disinflation is moving past us.”

What Fed officials are currently saying about the economy

It's much more likely we would just sit here for longer than we expect or the public expects right now until we see what effect our monetary policy is having.— Neel Kashkari, Minneapolis Fed President

I am optimistic that today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target.— Thomas Barkin, Richmond Fed President:

The current policy stance, which I view as being moderately restrictive, may be appropriate for balancing risks that are two-sided.— Susan Collins, Boston Fed President

If the Fed is done raising interest rates, these are the most important steps to take with your money

The Fed’s decisions impact almost every financial decision you make. Consumers see higher rates reflected on their credit card statements, personal loan financing costs, auto loan rates and more. And even if the Fed is done raising borrowing costs, it does little to erase the pain of higher interest rates, which are unlikely to be as cheap as they were during the pandemic-era anytime soon.

1. Eliminate high-cost, variable-rate debt

Americans are more vulnerable to higher interest rates if they have a variable-rate loan, especially if it’s debt on a high-interest credit card. The average credit card rate is hovering at the highest levels ever recorded, most recently 20.66 percent, thanks to the Fed’s inflation fight, according to Bankrate data.

Calculate whether transferring that debt to a balance-transfer card can help you save money in the long run. Often, it involves paying a fee, but you may end up saving money on interest and speeding up your repayment if you can take advantage of a 0 percent introductory annual percentage rate (APR). Currently, offers on Bankrate last for as long as 18-21 months.

2. Boost your emergency savings

Uncertainty underscores the importance of finding ways to boost your emergency savings. Financial experts’ typical rule of thumb recommends that Americans have anywhere between six to nine months’ worth of expenses stashed away.

The one silver-lining to rising rates: The best yields in over a decade can even help savers grow their rainy-day fund even quicker — and also grow their purchasing power. All 10 banks ranked for Bankrate’s best high-yield savings accounts for May are offering yields higher than headline inflation.

3. Lock in a long-term CD

If you already have an emergency fund, consider locking in those elevated yields by opening a 2-year or 5-year certificate of deposit (CD). Savings account yields are variable, and banks can trim those offers long before the Fed reduces its own benchmark.

4. Keep the course with your retirement contributions

Hawkish Fed surprises could lead to more market volatility, but it shouldn’t matter to the long-term investor with a diversified portfolio. Stay the course with your retirement contributions and see any downdraft in the market as an important buying opportunity.

“At some point, the market is going to have to come to the Fed, or the Fed is going to come to the market,” says Mark Fleming, chief economist at First American Financial Corporation. “The forecast is one thing. The reality is another.”

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Fed remains on hold, keeps forecast for three rate cuts in 2024