Super Bowl pool anyone? Sports betting illegal in most places, but widely practiced

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

Taxes on gambling winnings

Have you placed your Super Bowl bets in the office pool? Don’t feel guilty. Gambling is inevitable.

That was the determination in 1976 of the Commission on the Review of the National Policy Toward Gambling, which spent three years studying gambling in the United States.

“No matter what is said or done by advocates or opponents of gambling in all its various forms, it is an activity that is practiced, or tacitly endorsed, by a substantial majority of Americans,” the report noted 41 years ago.

A new landscape

Judging by the continually expanding gambling options across the country, the report was prescient. Almost every state and the District of Columbia sanction some sort of gambling.

The reason for the governmental imprimatur is the same one that tempts bettors: money. The gambling industry is an important part of many states’ economies. Gambling proceeds also help fund education programs or special state projects.

Then there are the taxes. In most states, tax collectors get a portion of residents’ winnings. So does the IRS, which collects taxes on gambling winnings since they are considered income.

Here’s a look at some betting that could boost state coffers and the U.S. Treasury if all the winners pay their taxes.

RATE SEARCH: Compare mortgage rates today at Bankrate.com!

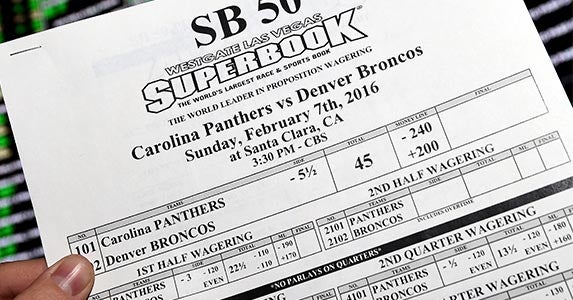

Super Bowl-sized betting

Ethan Miller/Getty Images

For fans of the Atlanta Falcons and New England Patriots, Super Bowl LI is the culmination of their die-hard support. For the rest of the world, it is a chance to cash in on myriad wagers.

Each year, when the top two NFL teams meet for the season’s final contest, around $10 billion is bet worldwide.

2016 Super Bowl bets were record-breaking

In the United States, legal sports books in Nevada account for part of that money. The Nevada Gaming Control Board reported that a record $132.5 million was bet on the 2016 Super Bowl at Nevada casinos.

Legal sports betting in Nevada, however, is just a fraction of the domestic wagering picture. The Silver State’s legal sports wagering represents less than 1 percent of all sports betting nationwide, according to the American Gaming Association, which estimates $88 billion in illegal bets will have been placed on NFL and college football games this season.

But all bets — legal, illegal or even among co-workers dropping a few bucks in the office pool — share one thing: Winning bets are taxable income.

Lucrative March Madness

Ethan Miller/Getty Images

In the spring, the U.S. sports gambling spotlight focuses on March Madness, when men’s college basketball teams compete for the national championship.

Although the Super Bowl is the single biggest one-day sports betting event, the expanded basketball playoffs make this tournament the biggest draw for gamblers in sheer dollars wagered.

March frenzy eludes IRS

The college hoopsters battle on the court for a month, going from 68 teams to 64 to 32; then the Sweet 16 and Elite Eight elimination rounds. By the time the teams reach the Final Four, and then the ultimate championship game, thousands of bets have been placed.

Nevada’s sports book operators estimate they take in $80 million to $90 million in wagers on the annual tournament. That, however, is less than 4 percent of the illegal take, according to the American Gaming Association.

The FBI estimates that more than $2.5 billion is illegally wagered on March Madness each year. That’s $2.5 billion from which the IRS will never see a penny.

RATE SEARCH: Compare CD rates today.

Racetrack bets and more

Horsephotos/Getty Images

Although horse racing is not as popular as it once was, the “sport of kings” still draws its share of bettors.

That was apparent in 2015 when American Pharoah became the 12th Triple Crown winner. Racing fans had been waiting since 1978, when Affirmed won the Kentucky Derby, the Preakness Stakes and the Belmont Stakes, collectively known as the Triple Crown. The horse racing industry is hopeful that the thrill of having another Triple Crown winner will carry into future races as bettors try to pick the 13th horse to take that title.

Not just fun and games

Part of the allure of gambling on the horses is that it demands some study. Fans pore over the Daily Racing Form and track programs, comparing not only the animals’ lineages, but jockeys’ and trainers’ records.

Racing also offers a variety of ways to bet. In addition to the standard win, place and show, a bettor can choose to bet a quinella, exacta, trifecta, superfecta, daily double or picks 3, 4 or 6.

Such a plethora of ways to wager is probably the basis for the old saying that the sport of kings has impoverished a lot of commoners.

That’s even truer now that many tracks also have casinos, known as racinos, on the premises. According to the Rockefeller Institute, racinos are found in 14 states: Delaware, Florida, Indiana, Iowa, Louisiana, Maine, Maryland, New Mexico, New York, Ohio, Oklahoma, Pennsylvania, Rhode Island and West Virginia.

When your horse does make it across the line first or your slot machine pull hits all sevens, remember to let Uncle Sam know of your good luck when you file your return.

Betting in Nevada, Delaware, New Jersey

Ethan Miller /Getty Images

While full-scale sports betting is legal only in Nevada, the opportunity has opened up on the East Coast.

The Professional and Amateur Sports Protection Act, or PASPA, enacted in 1992, outlaws sports gambling everywhere except in states that had previously legalized sports wagering. This covers Delaware, Montana, Oregon and Nevada.

Delaware took advantage of its exemption and in 2009 authorized betting only on NFL games using parlay, or combined, betting cards. Legislation that would have allowed online sports betting in that state was introduced in early 2016, but didn’t gain traction.

Most online betting happens in New Jersey

In November 2013, neighboring New Jersey began offering online poker and other gambling options. According to a University of Las Vegas Center for Gaming Research study, New Jersey online betting accounts for more than 90 percent of the legal U.S. online gambling revenue.

New Jersey also wants to offer legalized sports betting, but on Aug. 9 the state suffered a setback when a federal appeals court struck down a 2014 state law that would have allowed sports betting at casinos and racetracks. Garden State officials are challenging the federal law, taking it all the way to the U.S. Supreme Court.

RATE SEARCH: Find and apply for credit cards from Bankrate.com’s partners today!

Poker and online gambling

PATRICK KOVARIK/Getty Images

Poker is viewed by many as a game rather than a sport, although poker tournaments have shown up on sports cable channels. However you characterize it, poker’s popularity is growing. It’s a particular favorite of online players.

For many years, online gambling, including poker, was the target of federal prosecutors. Under the Unlawful Internet Gambling Enforcement Act, Internet gambling sites were effectively shut down. The biggest strike against poker came in 2011 when an FBI sting operation closed the three largest online poker sites for violating internet gambling prohibitions.

Online gambling still not legal nationwide

While some states have introduced legislation to allow online gambling on their soil, others have voiced strong opposition to it. Attorneys general from 10 states have asked Trump administration officials to push for a federal prohibition of all forms of online gambling, not just sports betting. Meanwhile, supporters to legalize gambling nationwide continue to lobby Congress.

Three states still set their own online gambling laws. So far Nevada, New Jersey and Delaware have officially legalized online gambling, including poker playing.

The reason for this tug of war at state and federal levels? Money plays a big role. Dr. Kahlil Philander of the University of Nevada Las Vegas has researched the U.S. online poker market and says it could be worth more than $2 billion a year, while another trade organization expects revenues from all forms of online gambling to hit $4 billion by 2020.

Fantasy sports: Game of chance or skill?

Tom Pennington/Getty Images

Fantasy sports has been around for a decade, attracting a following of millions of people each year. Last year, the two biggest industry players, FanDuel and DraftKings, spent so much money lobbying states to legalize fantasy games that it impacted their profits. In November, they announced they would join forces and merge, pending approval by regulators.

While football is the predominant focus of fantasy sports, other popular North American team sports in this arena include basketball, baseball, hockey and golf.

However, fantasy sports’ legality has been unclear, due to a growing controversy over whether it’s a game of skill or a form of gambling. Many states consider it the latter, including Arizona, Iowa, Louisiana, Montana and Washington. Last year, eight states passed bills to legalize and regulate fantasy sports, including New York. More than a dozen other states introduced legislation in 2016 to legalize fantasy sports but failed to score.

Fantasy sports has grown annually by 12 percent on average since 2007, according to Forbes. Legal Sports Report said the industry took in $3 billion in 2015, but predicts slowing growth moving forward.

Whether you believe fantasy sports is a game of skill or chance, if you win, you do have to pay taxes.

RATE SEARCH: Compare money market accounts today.

How to file wins, losses on your return

Sebastian Gauert/Shutterstock.com

Regardless of how much you win on bets, sports and otherwise, you’re supposed to pay taxes on the winnings.

Casual gamblers, those folks who visit casinos a few times a year or buy lottery tickets when the jackpot hits a record amount, are required to report gambling winnings as “other income” on line 21, Form 1040.

Sometimes the amounts won trigger withholding at 25 percent when the lucky gambler is paid. In other instances, a gambling establishment simply will ask winners for a tax ID (the individual’s Social Security number) for tax-reporting purposes.

Form W-2G detailing the winnings and any withholding then is sent to the bettor, as well as the IRS. But even without official documentation, you are legally required to report all your winnings.

Good and bad news

The good news is that gambling losses are deductible. You tally all those bad bets in the “other miscellaneous deductions” section of Schedule A.

Remember, however, that you can only deduct losses to the extent of your gambling winnings. You might be able to zero out your winnings, but if you have more losses than payouts, too bad.

You cannot use your bad betting luck to claim a tax loss on your return.

Related Articles