9 common credit card fees and how to avoid them

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Credit cards can be a great way to save using cash back and rewards over time, but if you’re not careful, the fees involved could limit your earnings.

Luckily, there are ways to avoid costly fees, and the law even requires that fees and terms be communicated to you by your issuer upfront. Credit card companies are prohibited from charging hidden fees or obfuscating long-term costs thanks to the Credit CARD Act of 2009. This consumer protection measure helped increase transparency within credit card terms and conditions while limiting fees and interest rates.

That said, it’s important to review these rates and fees on any credit card you own so you can stay prepared. While you probably already know the dangers of carrying long-term debt on a credit card with high interest, there are more fees that you should know about — and know how to avoid:

How to know which credit card fees you’re paying

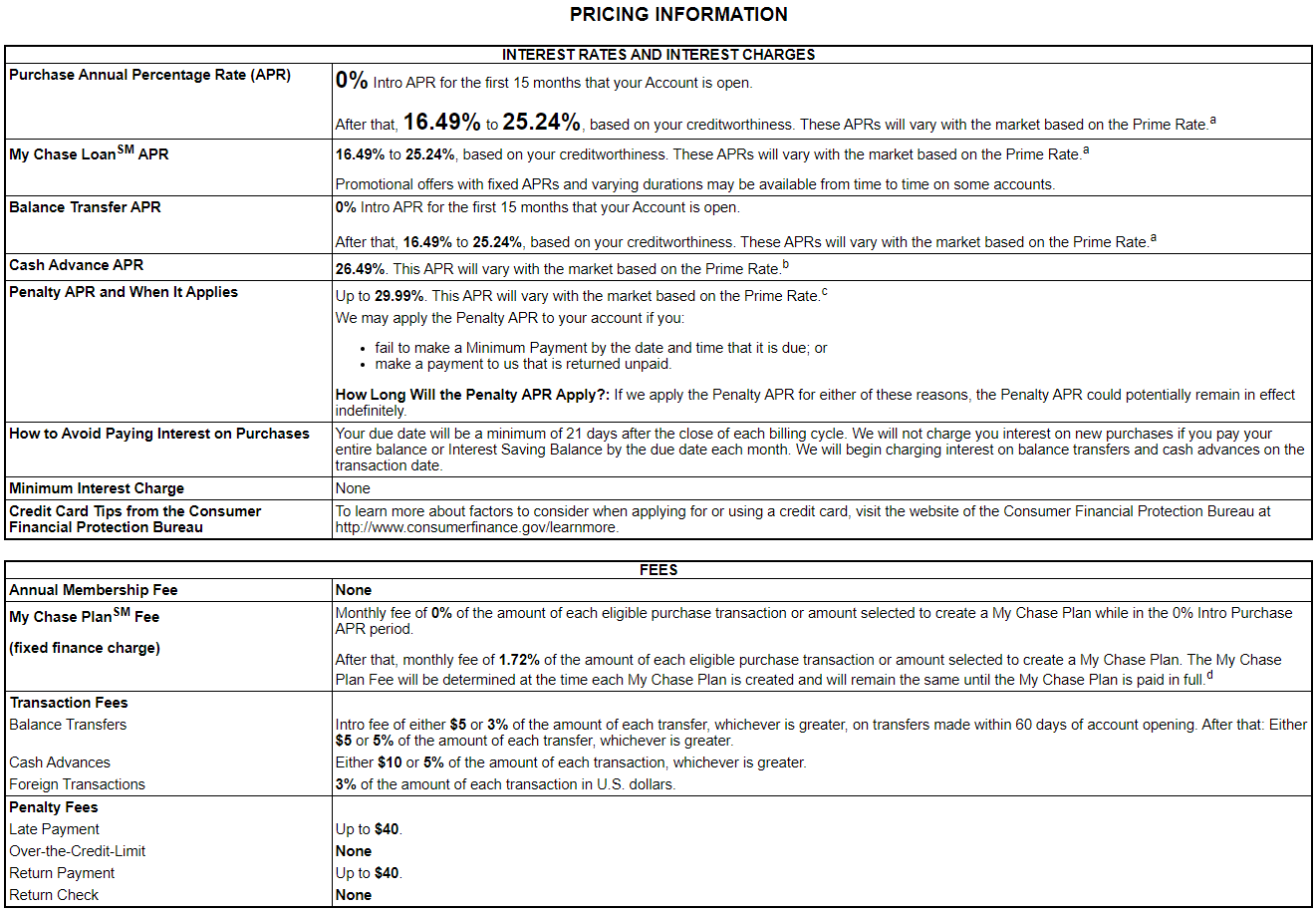

To find any fees or charges that apply to your credit card or one you’re considering, look for the Schumer Box. Credit card issuers are legally required to provide this easy-to-read table for every credit card. In the Schumer Box, you’ll find the card’s terms and conditions, interest rates and fees.

Here’s an example of what the Schumer Box looks like. This is for the Chase Freedom Unlimited® card:

If you’re comparing credit card offers, you can easily find the fee information and Schumer Box online by looking for a button with words like “pricing and terms” or “important rates and disclosures.” When you’re approved for a credit card, you’ll typically receive information about your card by mail, including a pamphlet with a Schumer Box.

If you don’t hang onto the physical card agreement you receive in the mail, you should be able to find the same information in your online account. You can also call customer service and ask them to email you the fee information associated with your card. Lastly, you can look at the card’s application page online — but the fees listed there may have changed since you were approved for your card.

9 credit card fees you don’t have to pay

If you want to use credit to your advantage, try to avoid unnecessary credit card fees and charges. Below, you’ll find nine common credit card fees, what triggers them and how you can skip them altogether.

Annual fee

Credit card annual fees work similarly to membership fees for other products and services. When you open a card with an annual fee, you’ll see the charge added to your credit card bill once per year.

Credit card annual fees are typically somewhat commensurate with the value of the benefits you receive with any given card. For example, you can pay up to $695 per year for a premium travel credit card, yet cards with fees in this range often offer $1,000 or more in statement credits and cardholder perks.

While paying the annual fee on a credit card can absolutely make sense, you should make sure the perks you’re receiving are worth it to you. If you choose a high-priced travel card, for example, you should make sure you travel often enough to get value from perks like airport lounge access, TSA PreCheck credits and annual travel credits.

How to avoid paying it

The good news about yearly fees is that there are myriad credit cards with no annual fee — rewards cards included.

As an example, the Chase Freedom Flex℠* comes with no annual fee but offers cash back rewards along with cellphone insurance, trip cancellation and interruption insurance, purchase protection, extended warranties and more.

Finance charge

Credit cards add finance charges to your bill when you carry a revolving balance beyond your credit card’s grace period and due date. This charge is the interest you accrue on your balances. Finance charges are assessed based on your credit card’s annual percentage rate, or APR.

How to avoid paying it

You can avoid paying interest by paying your credit card balance in full each month. Of course, this is easiest to accomplish when you only use plastic to pay for purchases you can afford, in conjunction with a monthly budget or spending plan.

You can avoid finance charges in the short term by choosing a credit card that offers 0 percent APR on purchases, balance transfers or both for a limited time. Many 0 percent interest cards are also no annual fee cards.

Foreign transaction fee

Some credit cards charge a separate fee, called a foreign transaction fee, when you use them for purchases outside the U.S. This fee is typically around 3 percent of your purchase. It can also be charged if you make online purchases with a company based abroad.

How to avoid paying it

The best way to avoid this fee is by using a credit card with no foreign transaction fees. Fortunately, most travel credit cards don’t charge foreign transaction fees at all. This is often listed within the card’s benefits section, in addition to your rates and fees pamphlet. All credit cards issued by Capital One and Discover are free of foreign transaction fees, to boot.

Balance transfer fee

Balance transfer fees come into play when you transfer your balance from one credit card to another, usually to consolidate debt or secure a lower interest rate.

While these fees vary, most balance transfer credit cards charge balance transfer fees between 3 and 5 percent of your transferred debt amount. In some cases, the fee may go up if you don’t transfer you balance within a certain timeframe after account opening.

How to avoid paying it

You can look for credit cards that don’t charge a balance transfer fee, although the tradeoff for no balance transfer fee is usually less favorable terms. Your best bet is taking steps to minimize how much you pay in balance transfer fees by securing a card that charges a fee equal to 3 percent instead of 5 percent.

Cash advance fee

Cash advance fees come into play when you use your credit card to get cash at an ATM. This fee can also apply when you use the credit card convenience checks your issuer may send you by mail.

Either way, cash advances typically carry a higher interest rate than the standard APR for purchases. Cash advances are also charged interest from day one; they don’t allow for a grace period like regular credit card purchases do.

How to avoid paying it

To avoid cash advance fees, you should skip using your credit card to get cash out of an ATM. When you get credit card convenience checks in the mail, go ahead and shred them if you feel tempted to use them.

Late payment fee

Late payment fees show up when you pay your credit card bill past its due date. While these fees can vary, they usually fall between $25 and $41.

How to avoid paying it

To avoid credit card late fees, make sure you always pay your credit card bill early or on time. Set up automatic payments or add your due date on your calendar as a reminder. If you forget and end up with a late fee charge on your account, it never hurts to call your issuer and ask if they’ll waive it — especially if you’ve never paid late before.

A handful of credit cards don’t charge any late fees at all, if you want an option to avoid them altogether. For example, the Citi Simplicity® Card is a popular balance transfer credit card which carries no annual fee and no late fees.

Card replacement fee

Card replacement fees can apply when your credit card is lost, stolen or misplaced, and you need to order a new one. However, most credit card companies will send you a replacement card for no charge at least once, as a courtesy.

If your issuer does charge a fee to replace your card, it will typically fall between $5 and $15.

How to avoid paying it

If your credit card is lost or stolen, call your credit card company to see if they’ll send you a replacement card for free. If they refuse to replace your card without charging you a fee, you may want to consider taking the opportunity to look for a new credit card from a different card issuer altogether.

Returned payment fee

When the payment you send to your card issuer isn’t accepted, you could take on a returned payment fee, which usually ranges from $15 to $41. For example, a returned payment fee could apply if you pay your credit card bill with a check that bounces due to insufficient funds.

How to avoid paying it

To avoid returned payment fees, make sure you always have enough cash in your account to cover your credit card payment — even if that means adjusting your payment amount to what you can afford instead of the full balance.

Some issuers also let you determine your own payment due date. If you know that you get paid on a certain date each month, you may want to consider making your card payment due when you know you’ll have the funds.

Over limit fee

Finally, some credit cards charge fees if you go over your credit limit. If your credit limit is $5,000 and you make a purchase that pushes your credit card balance to $5,050, for example, your credit card company may approve this purchase and add an over-limit charge to your account.

How to avoid paying it

Make sure you keep a close eye on your credit card limit and how close you are to it during any given month. If you need more available credit than you have right now, consider applying for a new credit card or asking your issuer to raise your limit.

On the other hand, you can request over the limit purchases be denied at the point of sale instead. Credit card companies generally ask you if you want them to allow charges that surpass your credit limit.

If you know you have a large purchase to make that might put you over your limit, you can also pay down your existing balance before the due date, freeing up your available credit for the upcoming purchase.

The bottom line

Most credit card fees are unnecessary and easy to avoid — if you understand all the fees your card could potentially charge ahead of time.

By arming yourself with information and using credit wisely (spending what you can afford and paying down balances), you can maximize the benefits of plastic without paying for the privilege of having a credit card.

*The information about the Chase Freedom Flex℠ has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles